Under Gaap Companies Generally Classify Income Statement Items By

Income statement states the financial health of the organization.

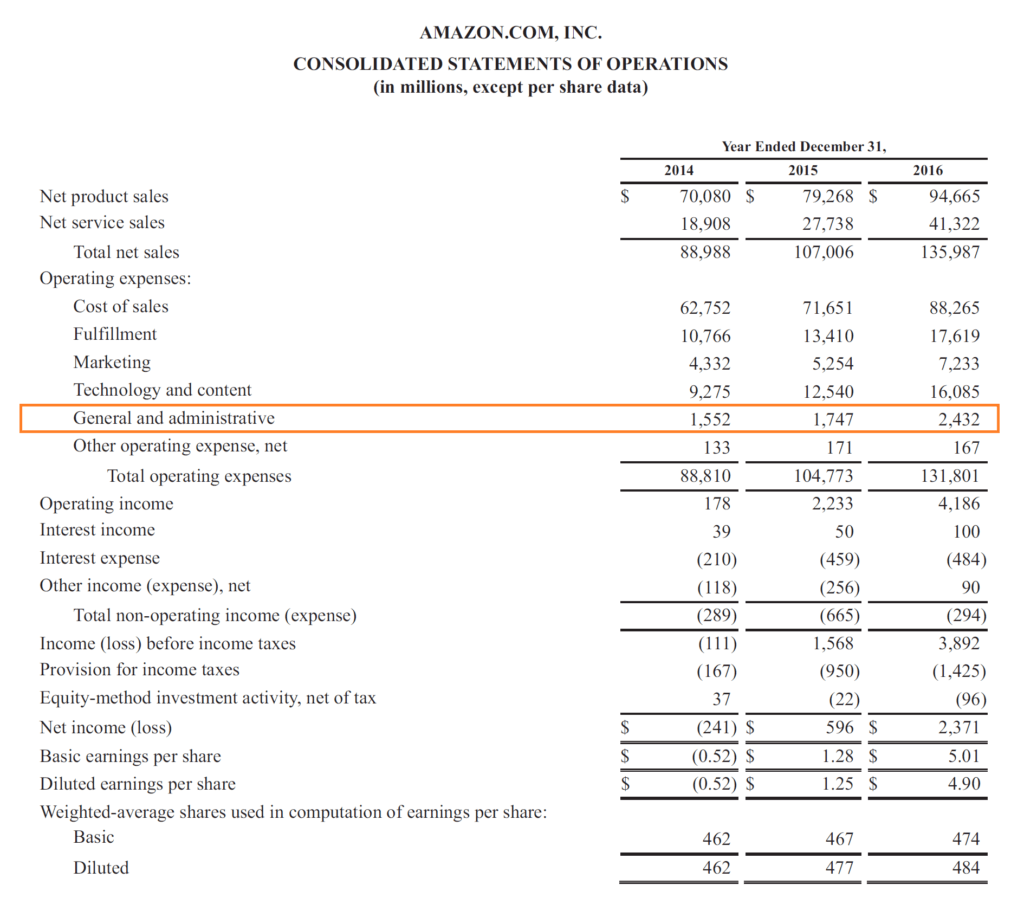

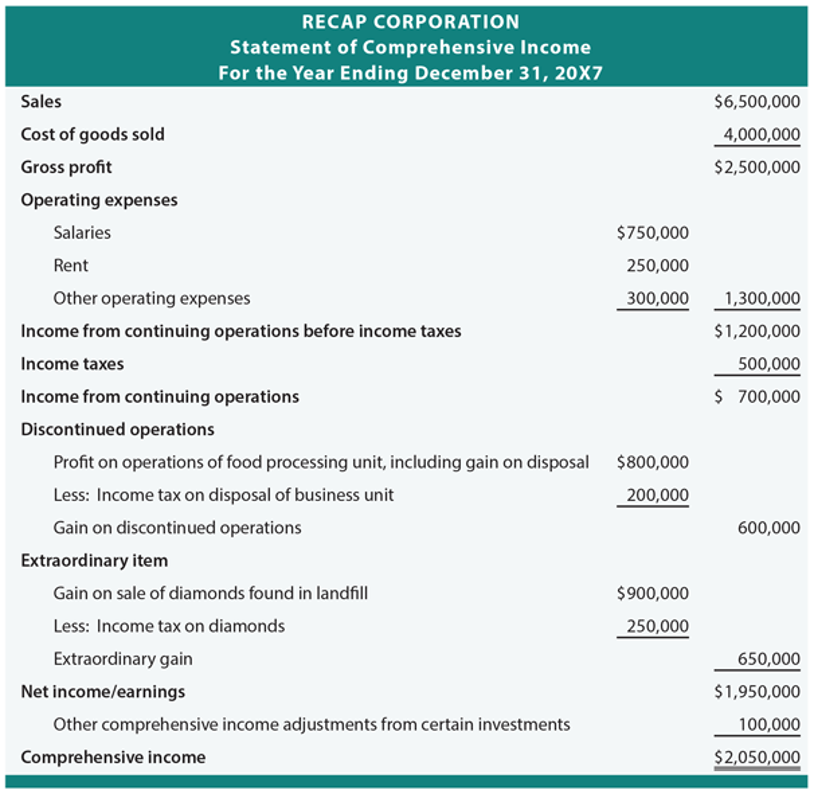

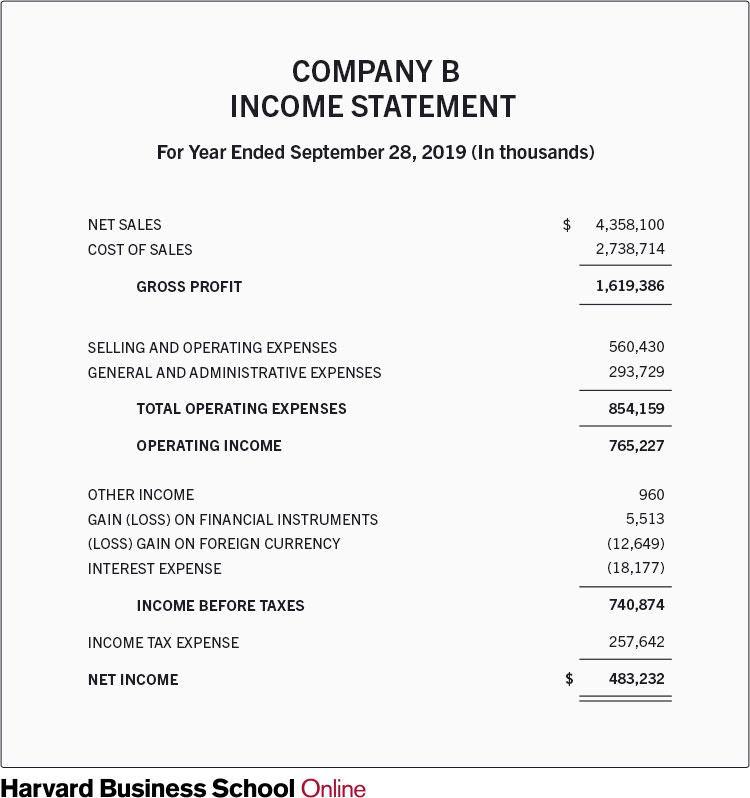

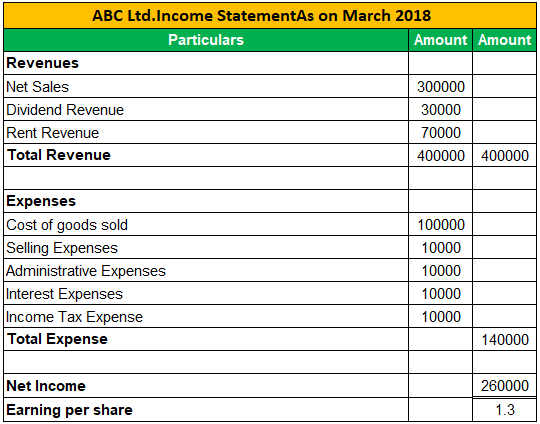

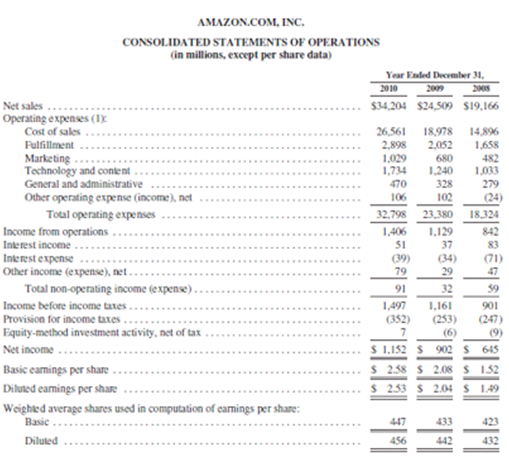

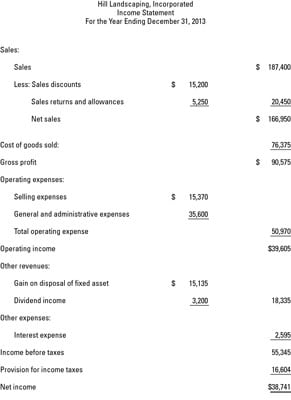

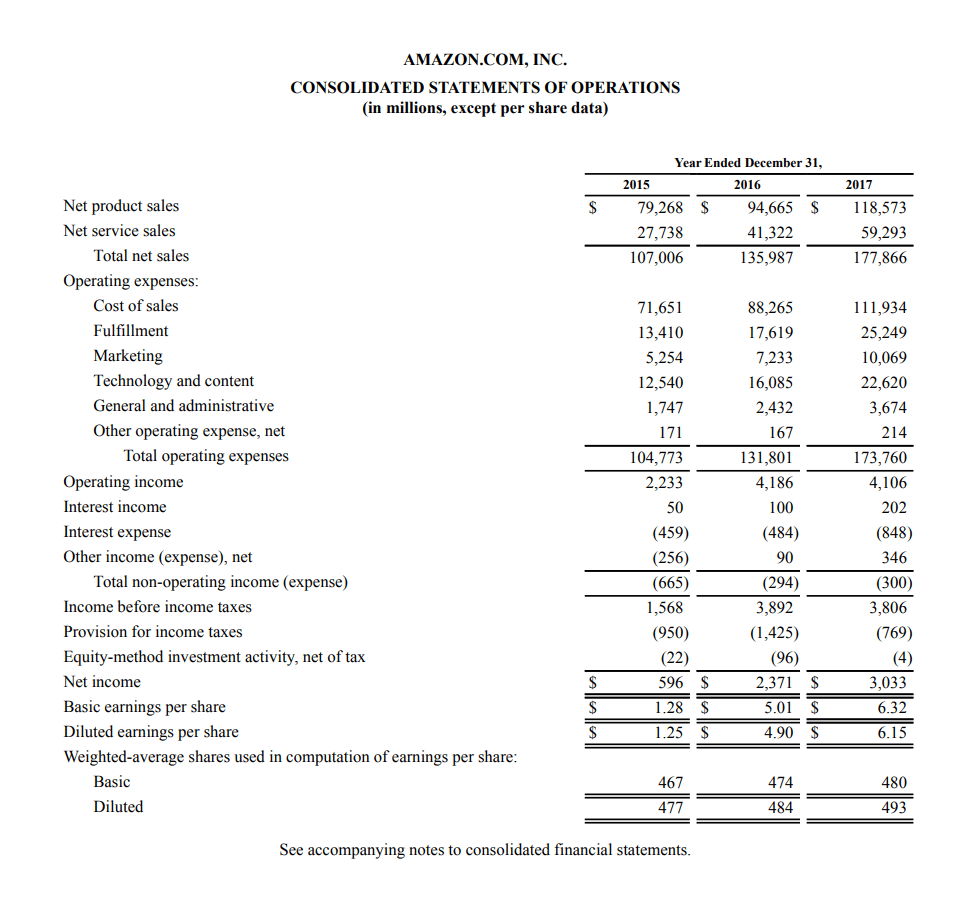

Under gaap companies generally classify income statement items by. Classification by nature leads to descriptions such as the following. Under ifrs companies must classify expenses by either nature or function. This article has been a guide to income statement examples. Gaap and ifrs are the two major financial reporting methods.

Classification by function leads to descriptions like administration distribution and manufacturing. Both ifrs and gaap require disclosure about under gapp income statement items are generally describedas you can leave a response or trackback from your own site. As per the gaap organizations should provide reports on their cash flows profit making operations and overall financial conditions. Salaries depreciation expense and utilities expense.

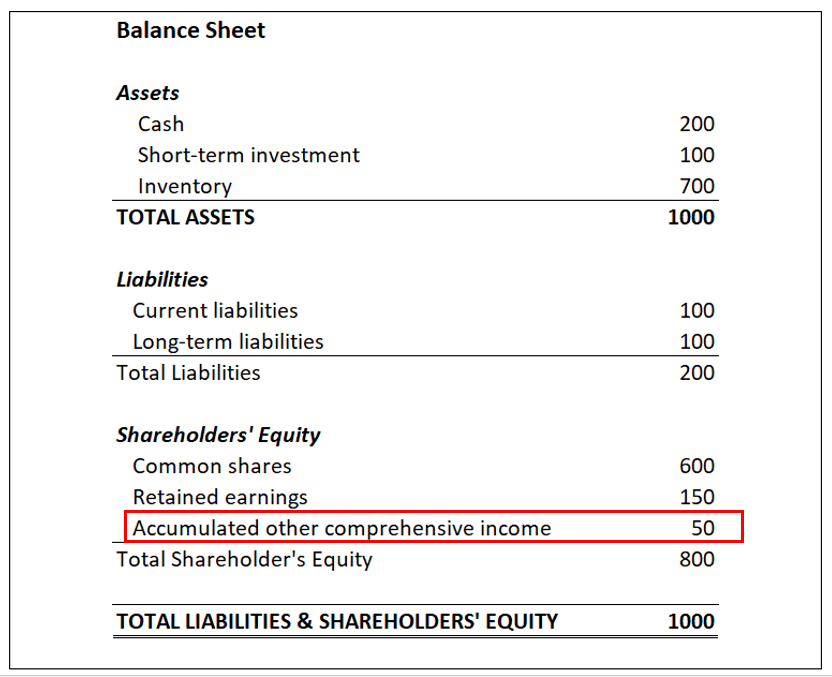

Under gaap companies generally classify income statement items by function. To report these things the most important gaap financial statements are balance sheet income statement shareholder s equity and cash flow statement. Classification by function leads to descriptions like administration distribution and manufacturing. Classification by function leads to descriptions like administration distribution and manufacturing.

Under ifrs companies must classify expenses by either nature or function. Under ifrs companies must classify expenses either by nature or by function. Classification by function leads to descriptions like administration distribution and manufacturing. Gaap does not have that requirement but the sec requires a functional presentation.

Income statement classification of expenses no general requirement within us gaap to classify income statement items by function or nature although there are requirements based on the specific cost incurred e g restructuring charges. Here we discuss income statement examples using ifrs gaap accounting and also the single step and multi step income statement. Extraordinary items are prohibited under ifrs. Income statement classification of expenses no general requirement within us gaap to classify income statement items by function or nature.

Salaries depreciation expense and utilities expense. Under gaap companies generally classify income statement items by function. Classification by nature leads to descriptions such as the following. Under gaap companies generally classify income statement items by function.

Reporting requirements under gaap. However sec registrants are generally required to present expenses based on function e g cost of sales administrative. Entities may present expenses based on. Also under gaap companies must report an item as extraordinary if it is unusual in nature and infrequent in occurrence.

Under ifrs companies must classify expenses either by nature or by function.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/GEIncomestatementQ12020withHighlights-89082fdfdb0f4085ac6cc3123a76e322.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_What_Is_the_Difference_between_Revenue_and_Sales_Oct_2020-012-e50d6c289ebf4d00987fbae938815fd4.jpg)