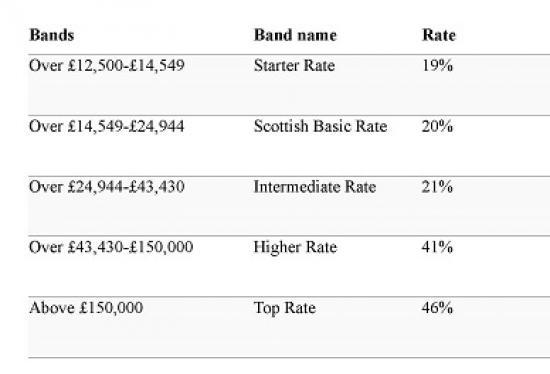

Income Tax Bands 2019 To 2020

Income tax rates and thresholds annual tax rate taxable income threshold income from 0 00.

Income tax bands 2019 to 2020. Your tax free personal allowance the standard personal allowance is 12 500 which is the amount of income you do not have to pay tax on. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22. Tax rates and bands. Taxes on director s fee consultation fees and all other income.

Germany residents income tax tables in 2019. The current tax year is from 6 april 2020 to 5 april 2021. View all tax calendars. This tax information and impact note explains the changes to income tax rates and thresholds for 2019 to 2020.

02 10 2019 calculating company car tax. Rate income after allowances 2020 to 2021 income after allowances 2019 to 2020 income after allowances 2018 to 2019 income. This applies to all residents non residents and working holiday visa holders. Paye tax rates and thresholds 2019 to 2020.

Scottish starter tax rate. Tax rates bands and reliefs the following tables show the tax rates rate bands and tax reliefs for the tax year 2020 and the previous tax years. This measure will reduce income tax for 30 6 million income tax payers in 2019 to 2020 30 7 million in 2020 to 2021 including low and middle income individuals improving incentives to enter. Income tax personal allowance and basic rate limit from 2019 to 2020 gov uk skip to.

The tax brackets for each year are listed on the ato website. Tax rates and allowances. Income from 9 169 00 to. Calculating your income tax gives more information on how these work.

Income from 55 962 00 to. This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals. Income from 265 328 00 and above. 21 07 2019 how does ir35 impact take home pay use our new calculator to see.

02 10 2019 shiny new tax tools for autumn.