Chapter 3 Income Tax Worksheet Answers

Lesson 2 1 federal income taxes worksheet answers.

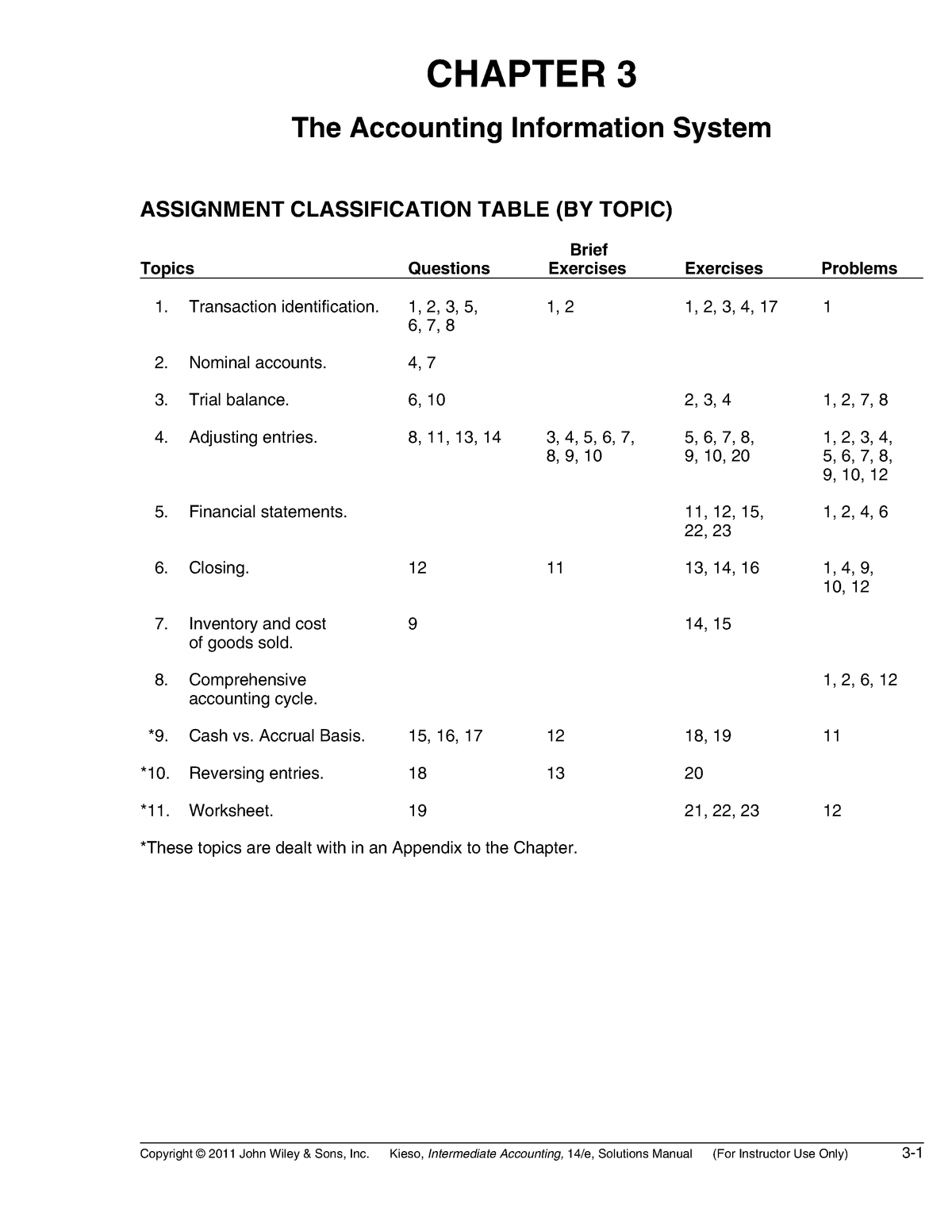

Chapter 3 income tax worksheet answers. Chapter 3 worksheet 1. Chapter 7 federal income tax worksheet answers. Math analysis quiz 11 terms. Motivation emotion and stress vocabulary 38 terms.

Chapter 3 income tax 19 terms. Clothing donation tax deduction worksheet. A the amount of cash on hand at a given time. Other sets by this creator.

Unit 14 taxes 19 terms. Try it 3 1 functions and function notation 1. Income tax 34 terms. Our federal income tax plan worksheet answers.

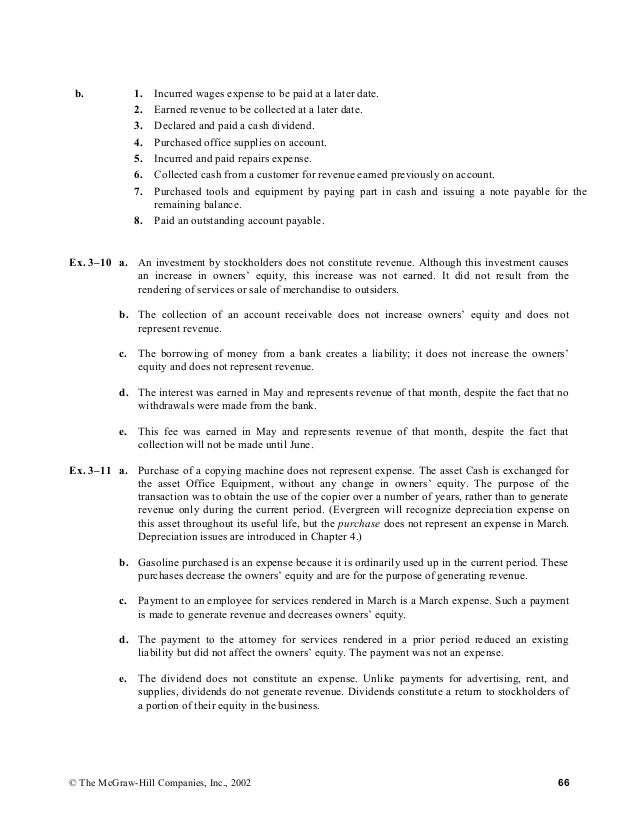

An overview of property transactions solutions to problem materials discussion questions 2. B the readiness of an asset to be converted to cash. Financial management chapter 7 federal income tax 17 terms. If two players had been tied for say 4th place then the name would not have been.

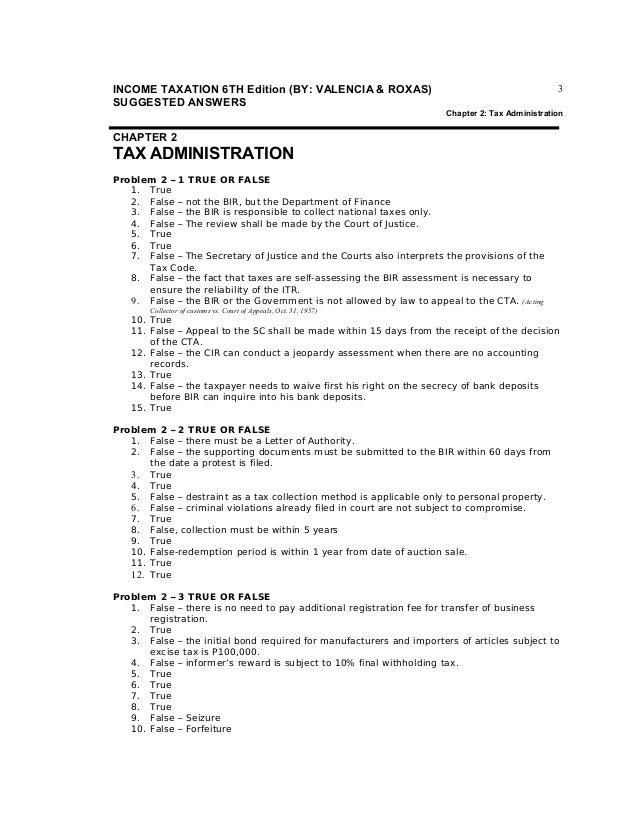

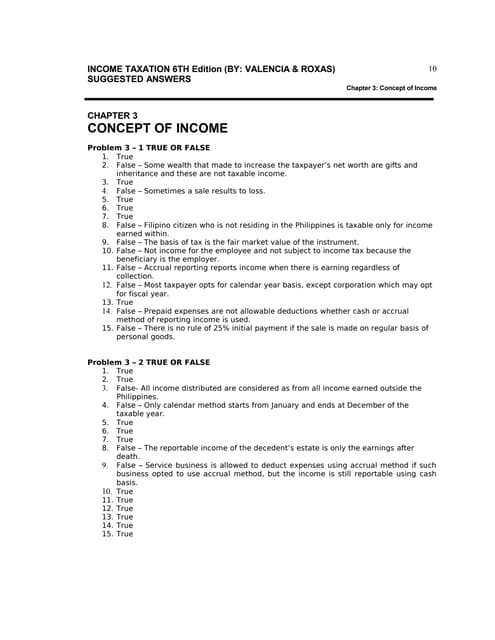

Personal exemptions are deductible from compensation income but a negative compensation income is deductible to other income d. Are taxable payments for services rendered. Tax tables worksheets and schedules 7 2 modeling tax schedules 7 3 income statements 7 4 forms 1040ez and 1040a 7 5 form 1040 and schedules a and b 7. Lesson 2 3 federal income taxes worksheet answers.

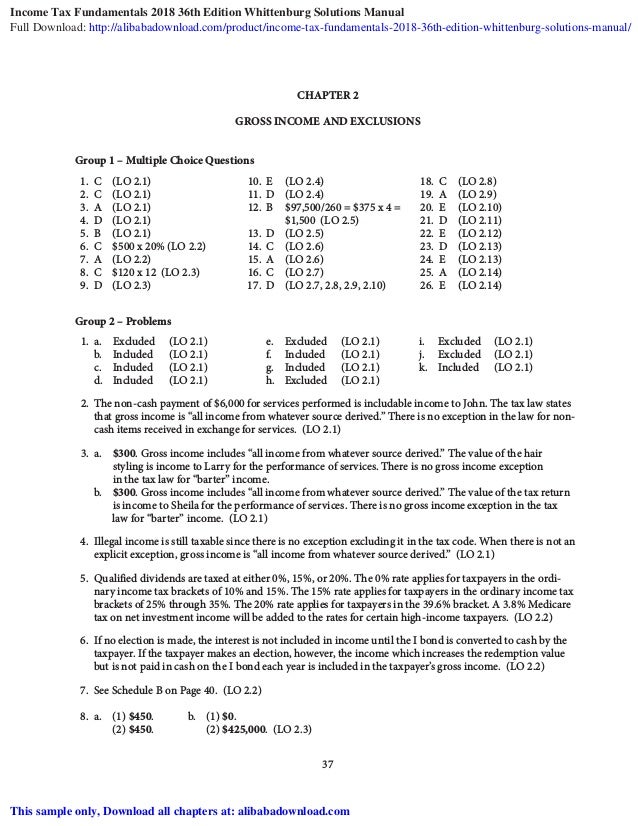

Lo 1 inclusions in gross income include items b c f g h and i. Other sets by this creator. Financial management chapter 3 income tax vocabulary 53 terms. C the period until cash is used and refinancing becomes necessary.

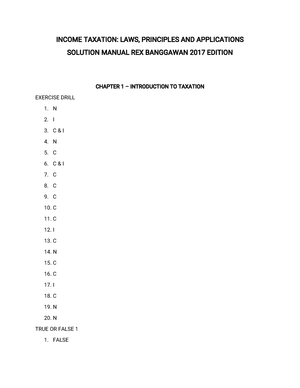

Section 2 1 federal income tax worksheet answers. 3 1 chapter 3 tax formula and tax determination. Advanced accounting chapter 13 review 24 terms. Is a nontaxable return of capital.

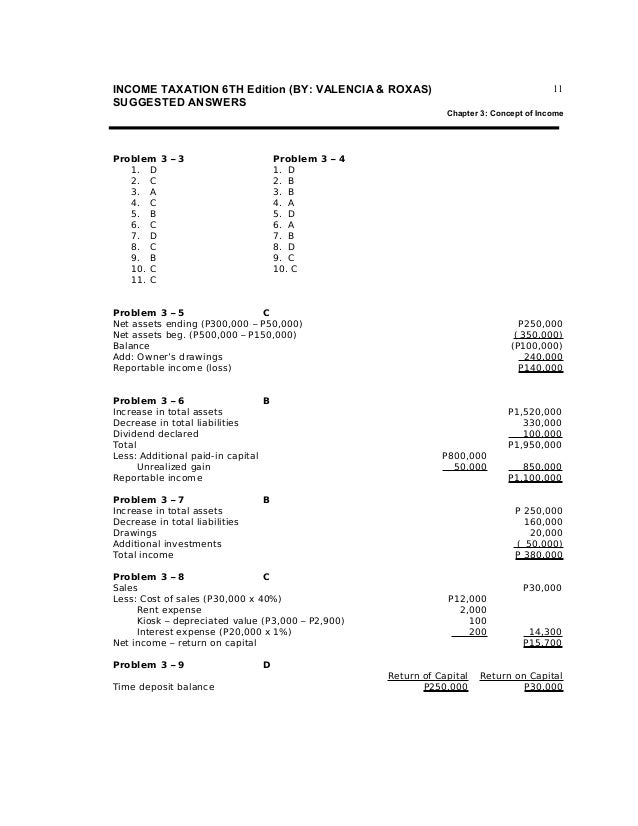

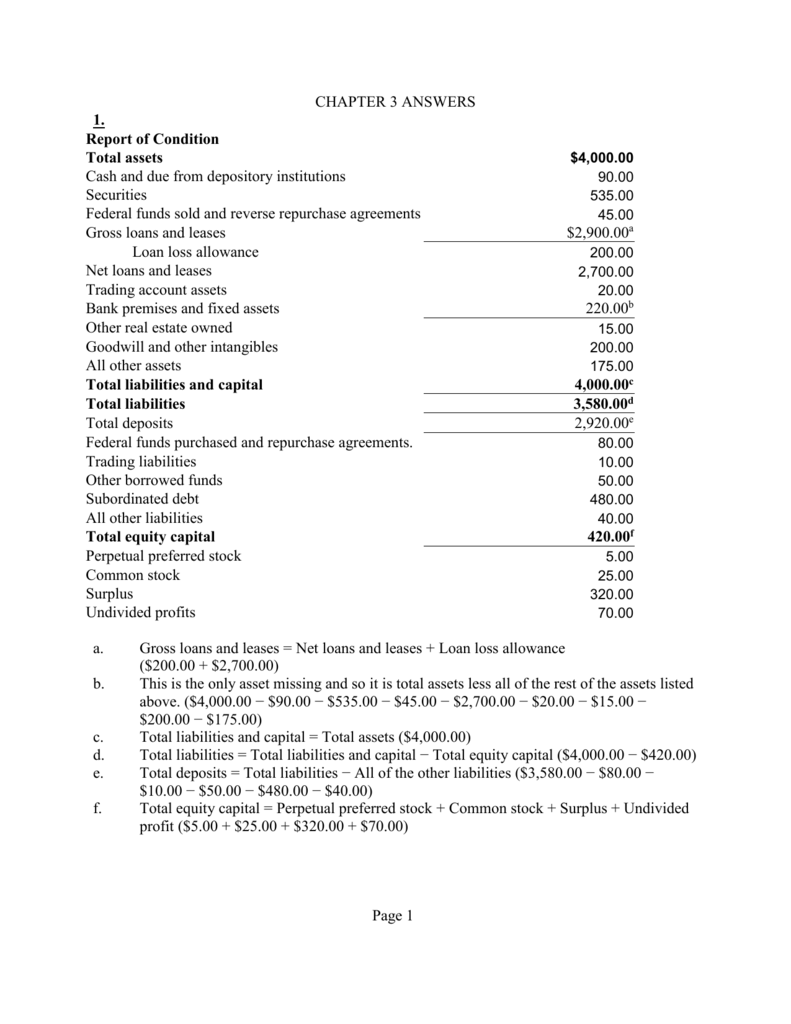

The balance sheet reports a company s financial position at a point in time. The balance sheet the next is the income statement shown in figure 3 2 which provides information on the revenues and expenses of the firm and the resulting income made by the firm during a period. Deductions are deductible from gross income from business only c. Regular tax gross income includes all income that qualifies the gross income test in chapter 3 but is not subject to tax under chapter 5 and chapter 6 b.

In order to provide answers for exercises in this chapter the tax schedules and forms used to complete the. Chapter 2 salary income perquisites allowances 16 chapter 3 overview of income from house property 30 chapter 4 overview of capital gains 33 chapter 5 deductions under chapter via 39 chapter 6 tax rebate relief 51 chapter 7 permanent account number 55 chapter 8 taxability of retirement benefits 57 chapter 9 pensioners senior citizens 63. Accounting semester 1 final vocab review 59 terms.