Formula Of Statement Of Comprehensive Income

Comprehensive income and other comprehensive income are two components of the income statement that can have a material effect on the profitability of a company.

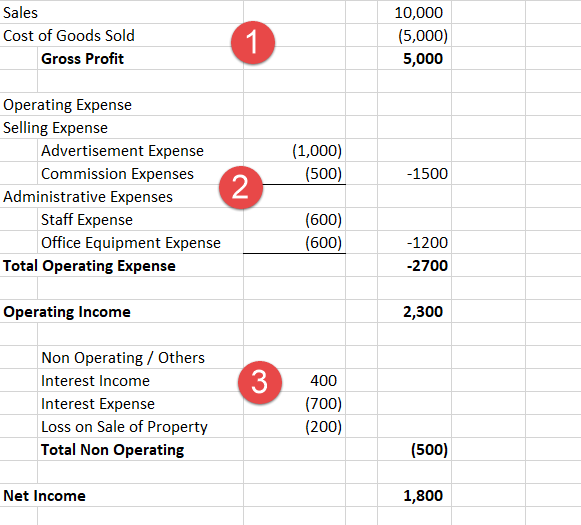

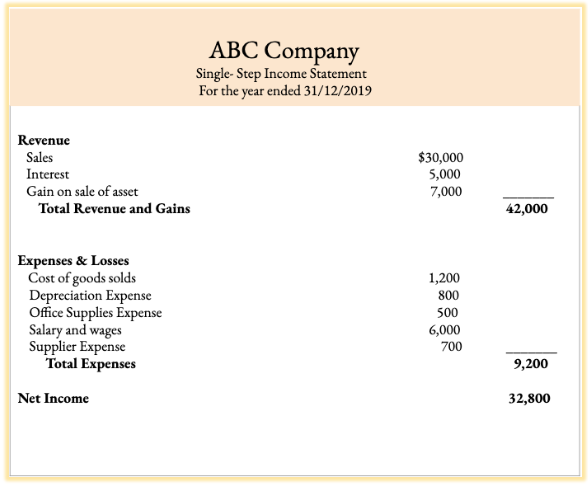

Formula of statement of comprehensive income. Income statement formula consists of the 3 different formulas in which the first formula states that gross profit of the company is derived by subtracting cost of goods sold from the total revenues second formula states that operating income of the company is derived by subtracting operating expenses from the total gross profit arrived and the last formula states that the net income of the. Unlike net income comprehensive income measures the change in a company s assets. Section 5 statement of comprehensive income and income statement specifies requirements for presenting an entity s financial performance for the period. Statement of comprehensive income.

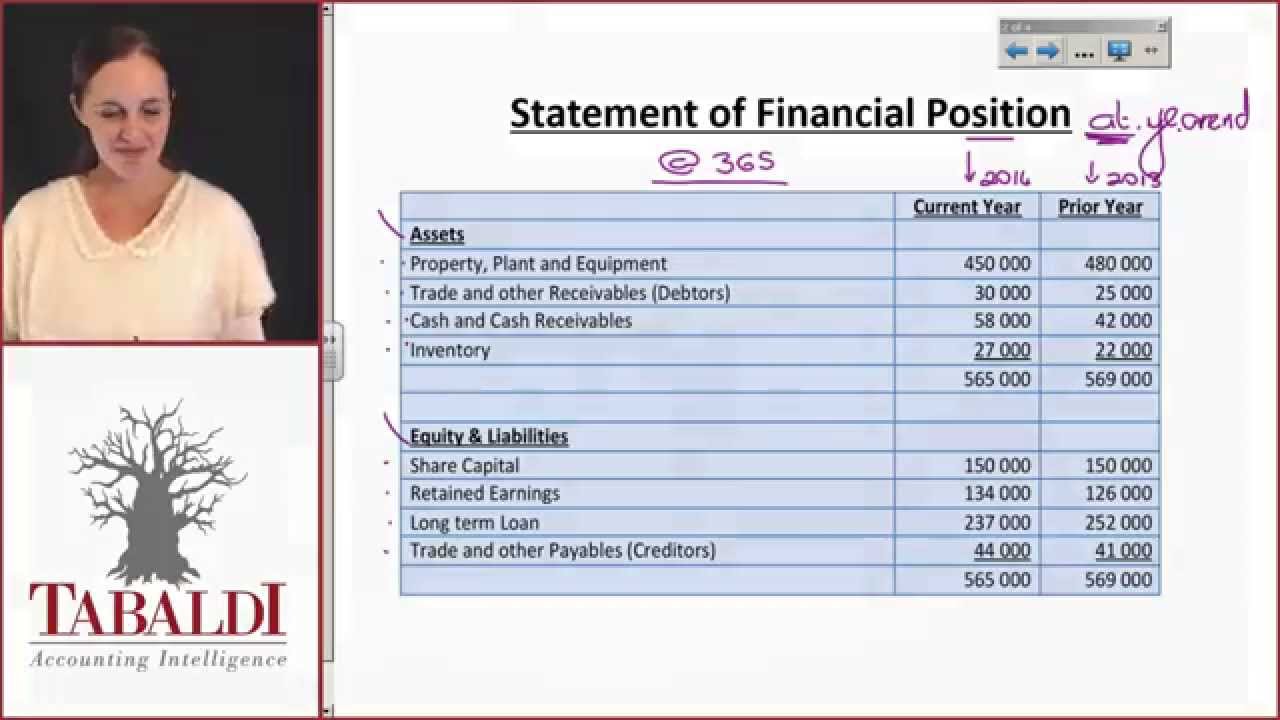

A standard ci statement is usually attached to the bottom of the income statement and includes a separate heading. It is therefore very important to understand the difference between these two items and the impact they may have on financial ratio analysis. Other comprehensive income does not include changes relating to ownership such as dividends paid to shareholders new shares issued or share buy backs. A statement of comprehensive income is the overall income statement that consolidates standard income statement which gives details about the repetitive operations of the company and other comprehensive income which gives details about the non operational transactions such as the sale of assets patents etc.

A statement of comprehensive income is a financial statement that includes both standard income and other comprehensive income. Statement of comprehensive income. This video explains how to use financial information to complete a statement of comprehensive income. This is a task you may need to complete in your exam.

Whenever ci is listed on the balance sheet the statement of comprehensive income must be included in the general purpose financial statements to give external users details about how ci is computed. But don t depend solely on it. The income statement encompasses both the current revenues resulting from sales and the accounts receivables which the firm is yet to be paid. A statement of comprehensive income that begins with profit or loss bottom line of the income statement and displays the items of other comprehensive income for the reporting period ias 1 p 81 so the statement of comprehensive income aggregates income statement profit and loss statement and other comprehensive income which isn t.

It provides an accounting policy choice between presenting total comprehensive income in a single statement or in two separate statements.