Foreign Exchange Income Statement Presentation

When a report is generated the appropriate exchange rate for the date of the report is used to convert any foreign currency amounts to your business home currency amount for that date.

Foreign exchange income statement presentation. The steps in this translation process are as follows. Subsequent to the year end the business pays the overseas supplier. Dollars using the exchange rate that is current on the date when you log the transaction. The standard balance sheet and income statement reports must be given in your own local currency.

While generating these reports the currency exchange rates are used to convert and any foreign currency transactions into the local currency for the business. The exchange rate gain is recorded in the income statement of the business under the heading of foreign currency transaction gain. The effects of changes in foreign exchange rates 5 income statement for the year ended in functional currency usd translated to. An important rule of accounting is that your balance sheet and income statement must be reported in your home currency.

This will be used to generate the foreign exchange income statement for a business with foreign clients. For example assume that a company paid 10 000 in salaries for part time contractors located in europe at an exchange rate of 1 15 to 1 euro the transaction is recorded in the income statement as 11 500 at the end of the accounting period. Hope it helps s. Example of foreign exchange gain loss.

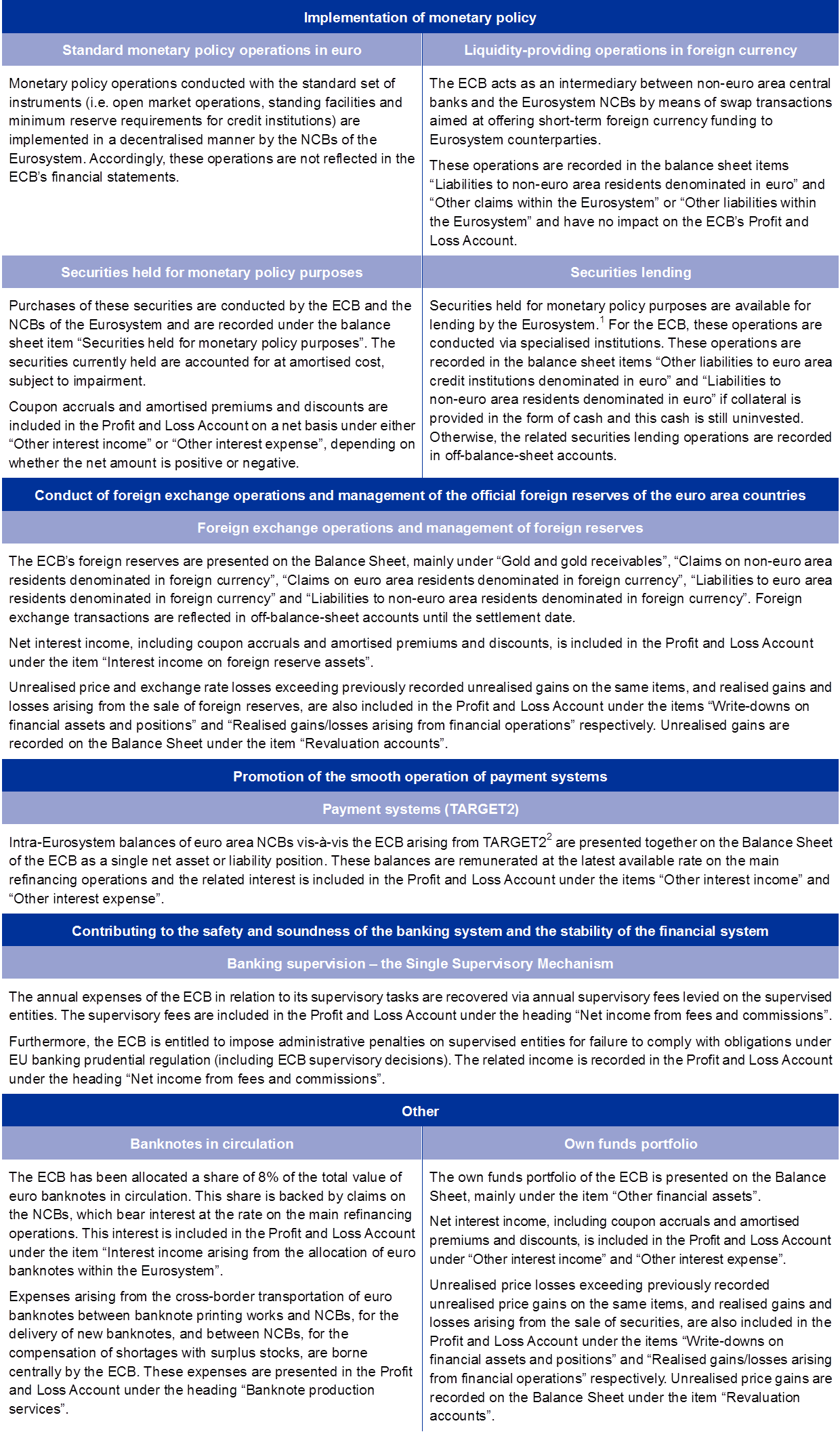

The gains and losses arising from this are compiled as an entry in the comprehensive income statement of a translated balance sheet. Ias 21 outlines how to account for foreign currency transactions and operations in financial statements and also how to translate financial statements into a presentation currency. Determine the functional currency of the foreign entity. With foreign exchange fluctuations the value of these assets and liabilities are also subject to variations.

Then you re probably translating the whole statements to presentation currency and resulting exchange difference goes to oci. At the year end the balance on the accounts payable account with the supplier is now usd 9 100 350 usd 8 750. Presentation currency is the currency in which the financial statements. Cost of sales.

Foreign currency translation is used to convert the results of a parent company s foreign subsidiaries to its reporting currency. This is a key part of the financial statement consolidation process. An entity is required to determine a functional currency for each of its operations if necessary based on the primary economic environment in which it operates and generally records foreign currency transactions.