Foreign Currency Gains And Losses On Income Statement

Foreign currency translation is used to convert the results of a parent company s foreign subsidiaries to its reporting currency.

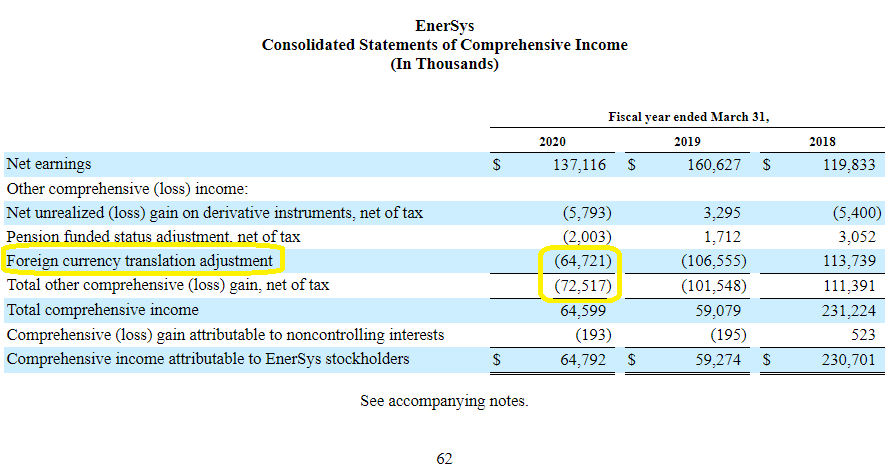

Foreign currency gains and losses on income statement. Currency gains and losses that result from the conversion are recorded under the heading foreign currency transaction gains losses on the income statement. Year to date is based on the number of days. According to the fasb summary of statement no. The gains and losses arising from this are compiled as an entry in the comprehensive income statement of a translated balance sheet.

Non interpretative straight application of the law. Gains and losses on pension plans. Therefore foreign exchange adjustments will appear as unrealized gains or losses in other comprehensive income. Translate revenues expenses gains and losses using the exchange rate as of the dates when those items were originally recognized.

52 a cta entry is required to allow investors to differentiate between actual day to day operational gains and losses and those caused due to foreign currency. An entity is required to determine a functional currency for each of its operations if necessary based on the primary economic environment in which it operates and generally records foreign currency transactions. Recording the exchange the easiest way to show the effect of currency gains and losses is through an example. Do i need to show foreign currency gains or losses on my business activity statement bas.

Unrealised foreign currency translation gains or losses as of the balance sheet date are usually accounted for under financial expenses or income on accounts 563 or 663 this relates to receivables payables stamps and vouchers foreign currency treasury and foreign currency accounts. Foreign currency gains or losses are not an adjustment event and are not required to be shown on the bas. Ias 21 outlines how to account for foreign currency transactions and operations in financial statements and also how to translate financial statements into a presentation currency. Gains and losses on those foreign currency transactions are generally included in determining net income for the period in which exchange rates change unless the transaction hedges a foreign currency commitment or a net investment in a foreign entity.