Ifrs 16 Income Statement Presentation

In this article we highlight key considerations affecting preparers when choosing the structure format and contents of the income statement and other presentation matters.

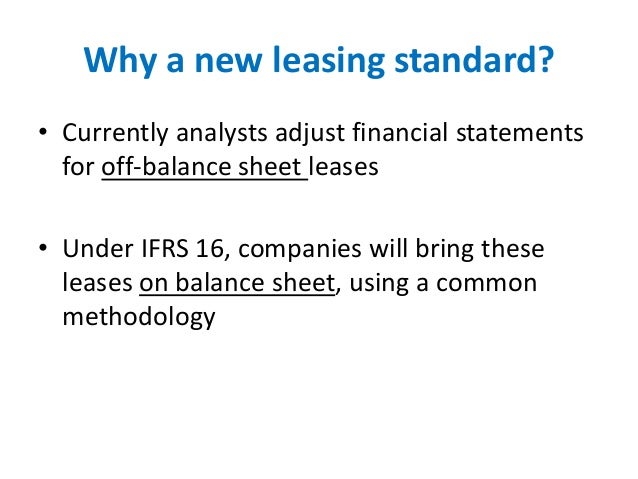

Ifrs 16 income statement presentation. And related interpretations and is applicable for the first time for entities with an annual reporting period beginning on or after 1 january 2019. Included in the financial statements of some. Ifrs 16 will have a significant impact on companies such as airlines transport telecommunication sector as they rely on operating leases as off balance sheet financing. The international accounting standards board iasb issued ifrs 16 leases in january 2016.

What does ifrs 16 mean for a company s income statement. Impact of ifrs 16 on lessee s financial statements. So ifrs is a more comprehensive and informative type of reporting income statement. Ifrs 16 replaces the straight line operating lease expense for those leases applying ias 17 with a depreciation charge for the lease asset included.

Ifrs 16 sets out the principles for the recognition measurement presentation and disclosure of leases for both parties to a contract namely the customer lessee and the supplier lessor. 2 ifrs 16 does not require separate presentation of amortisation expense of right of use assets on the face of the income statement nor does it mandate which line item should include the amortisation expense which will in part be driven by whether the entity presents its expenses by function or by nature. The standard explains how this information should be presented on the face of the statements and what disclosures are required. The most significant effect of ifrs 16 requirements will be an increase in lease assets and financial liabilities.

The income statement is one of the three fundamental financial statements that aims at the calculation of net income from the operations of the organization. For companies with material off balance sheet leases ifrs 16 changes the nature of expenses related to those leases. Ifrs 16 requires lessees and lessors to provide information about leasing activities within their financial statements. 2 ifrs 16 does not require separate presentation of amortisation expense of right of use assets on the face of the income statement nor does it mandate which line item the amortisation expense should be included in which will in part be driven by whether the entity presents its expenses by function or by nature.

Ifrs 16 is effective from 1 january 2019. Example 3 ifrs based income statement. Applying the new standard is expected to significantly affect the disclosures.