Income And Substitution Effect Of Taxation

When a target income has been reached and people prefer.

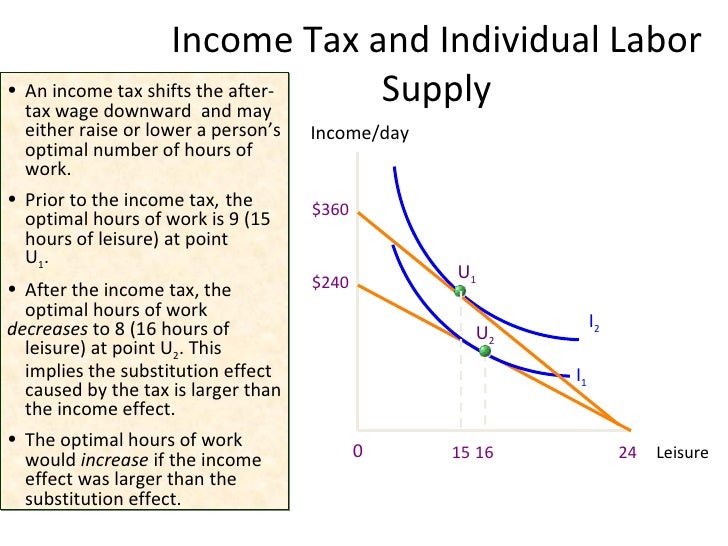

Income and substitution effect of taxation. This is essential to a fundamental knowledge of labor market economics as we understand it today. The substitution effect describes how consumption is impacted by changing relative income and prices. Therefore this gives consumers more income to spend and spending may rise income effect. However if higher tax leads to lower wages then a worker may feel the need to work longer hours to maintain his target level of income.

Higher interest rates increase income from saving. The decrease in quantity demanded due to increase in price of a product. Aggregated income and substitution effects. Income and substitution effects of estate taxation by james r.

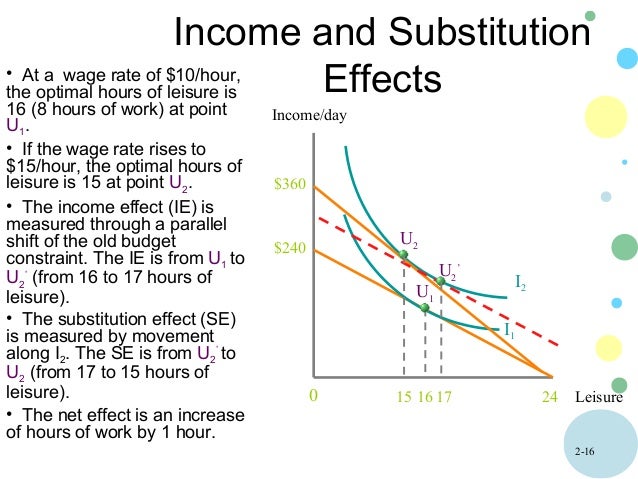

A change in the wage rate has both an income effect and a substitution effect. Income effect shows the impact of rise or fall in purchasing power on consumption. The income effect of a rise in the hourly wage rate. Higher tax leads to lower wages and work becomes relatively less attractive than leisure.

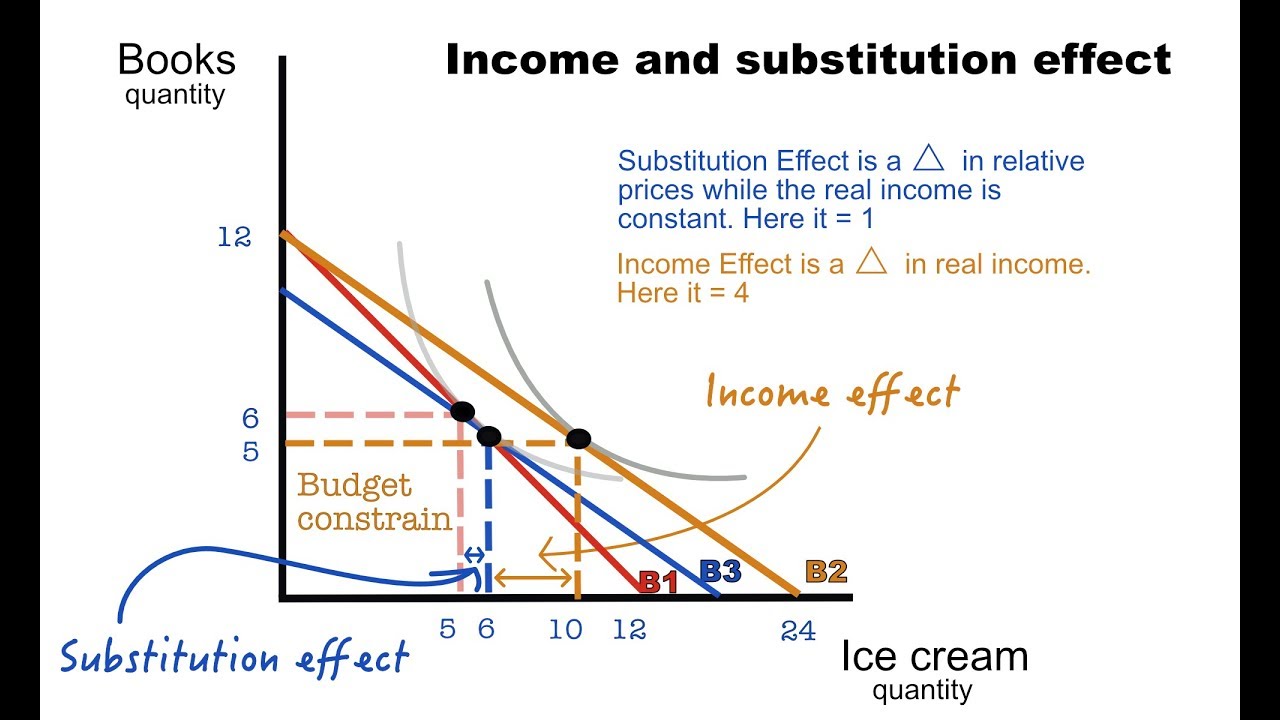

Published in volume 103 issue 3 pages 484 88 of american economic review may 2013 abstract. Many studies have demonstrated that the price elasticity of labor supply is positive meaning that the substitution effect dominates more than the income effect in aggregate. The movement from s on a lower indifference curve to r on a higher indifference curve is the result of income effect. Income effect arises because a price change changes a consumer s real income and substitution effect occurs when consumers opt for the product s substitutes.

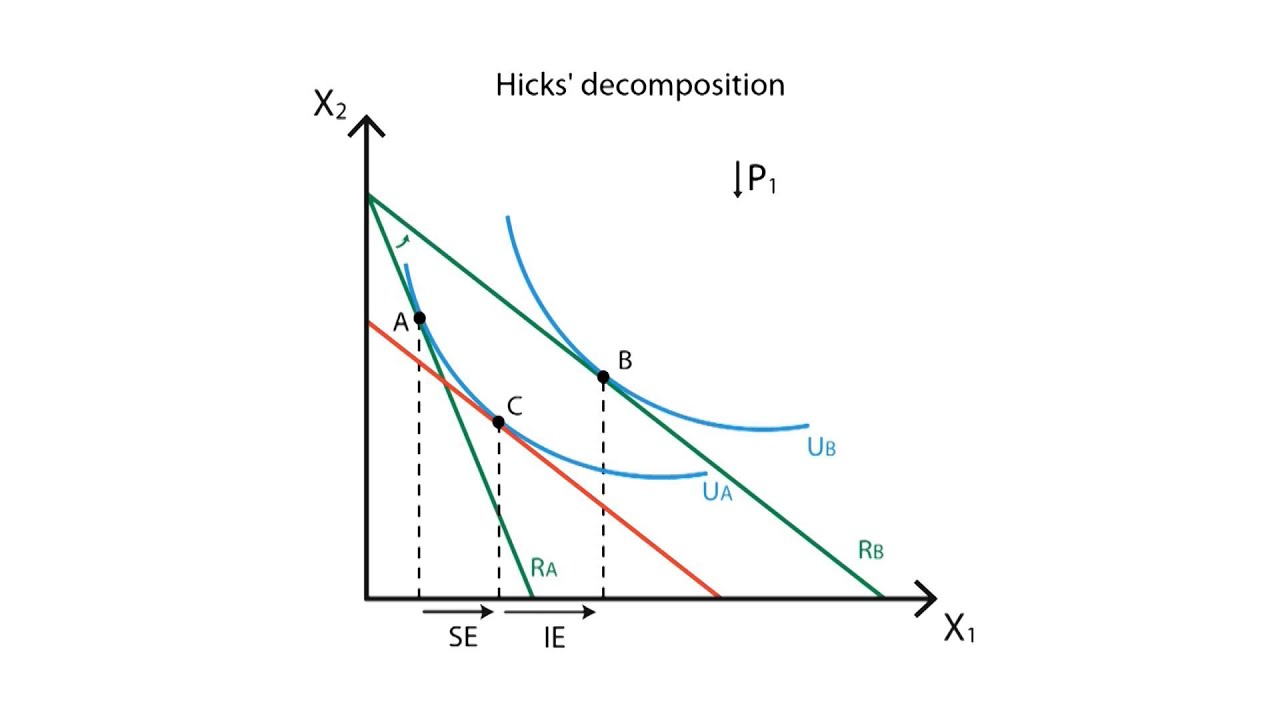

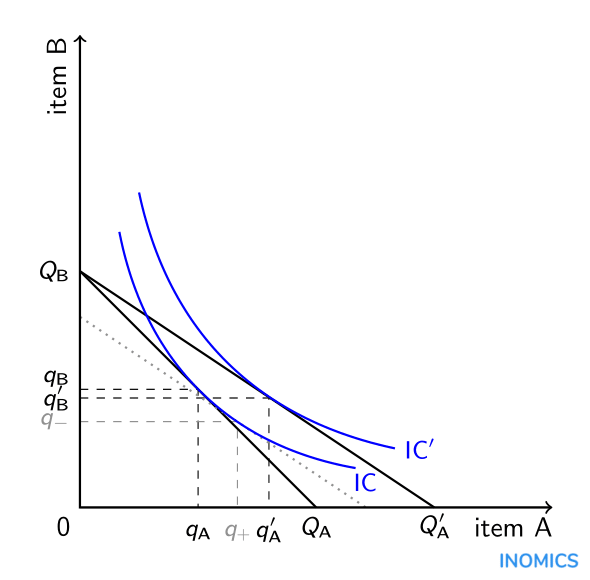

Income effect and substitution effect are the components of price effect i e. The income effect will soon dominate. Unlike substitution effect which is depicted by movement along price consumption curve which have a negative slope. If two commodities are perfect complements the substitution effect of a fall in the price of x 1 or p 1 is zero so the change in demand is entirely due to income effect.

When higher wages cause people to want to work more hours in order to reach a target desired income. The income effect expresses the impact of higher purchasing power on consumption. The substitution effect of a higher tax is that workers will want to work less. Thus the movement form q to r due to price effect can be regarded as having been taken place into two steps first from q to s as a result of substitution effect and second from s to r as a result of income effect.

This paper evaluates the effect of estate taxes on labor supply. Here is an elaborated discussion on the income and substitution effect in case of different types of goods. The analysis decomposes the effect of estate taxation into the su.