Income Protection Withholding Tax

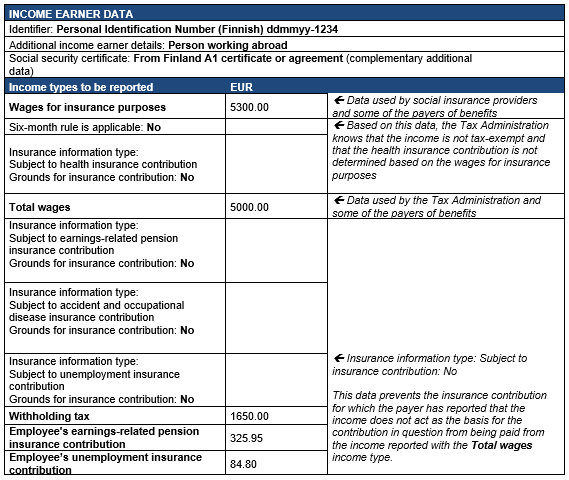

Payment to non resident company directors are subjected to 22 withholding tax.

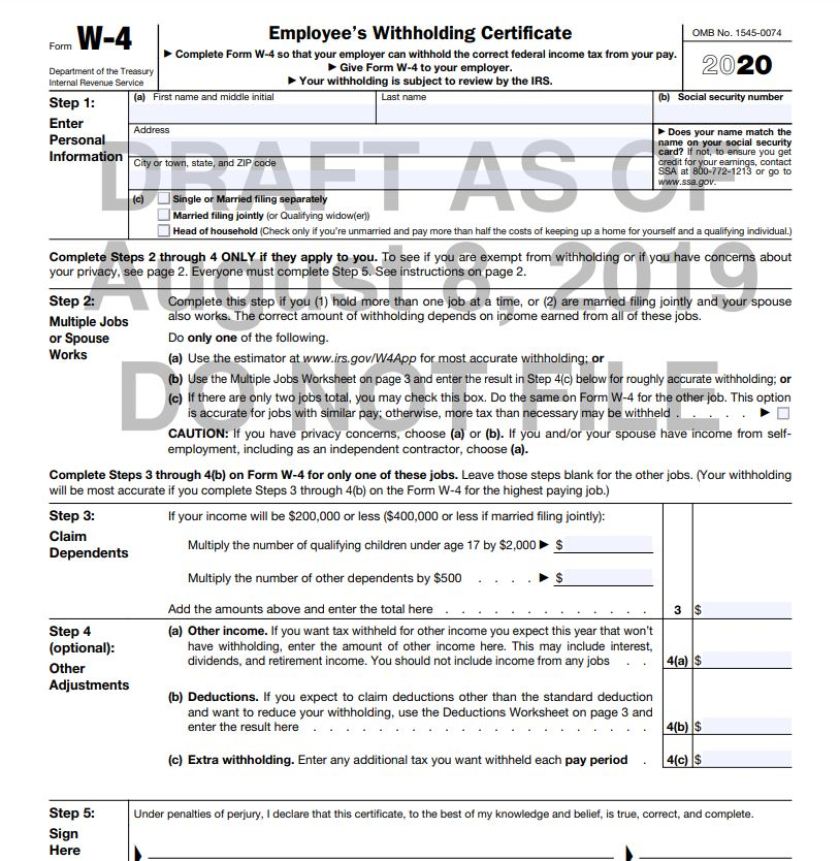

Income protection withholding tax. My wife was recently required to finish work due to serious illness and was paid a tpd payment lump sum superannuation and was also. You must include any payment you receive under such a policy on your tax return. No withholding tax collected. The information you give your employer on form w 4.

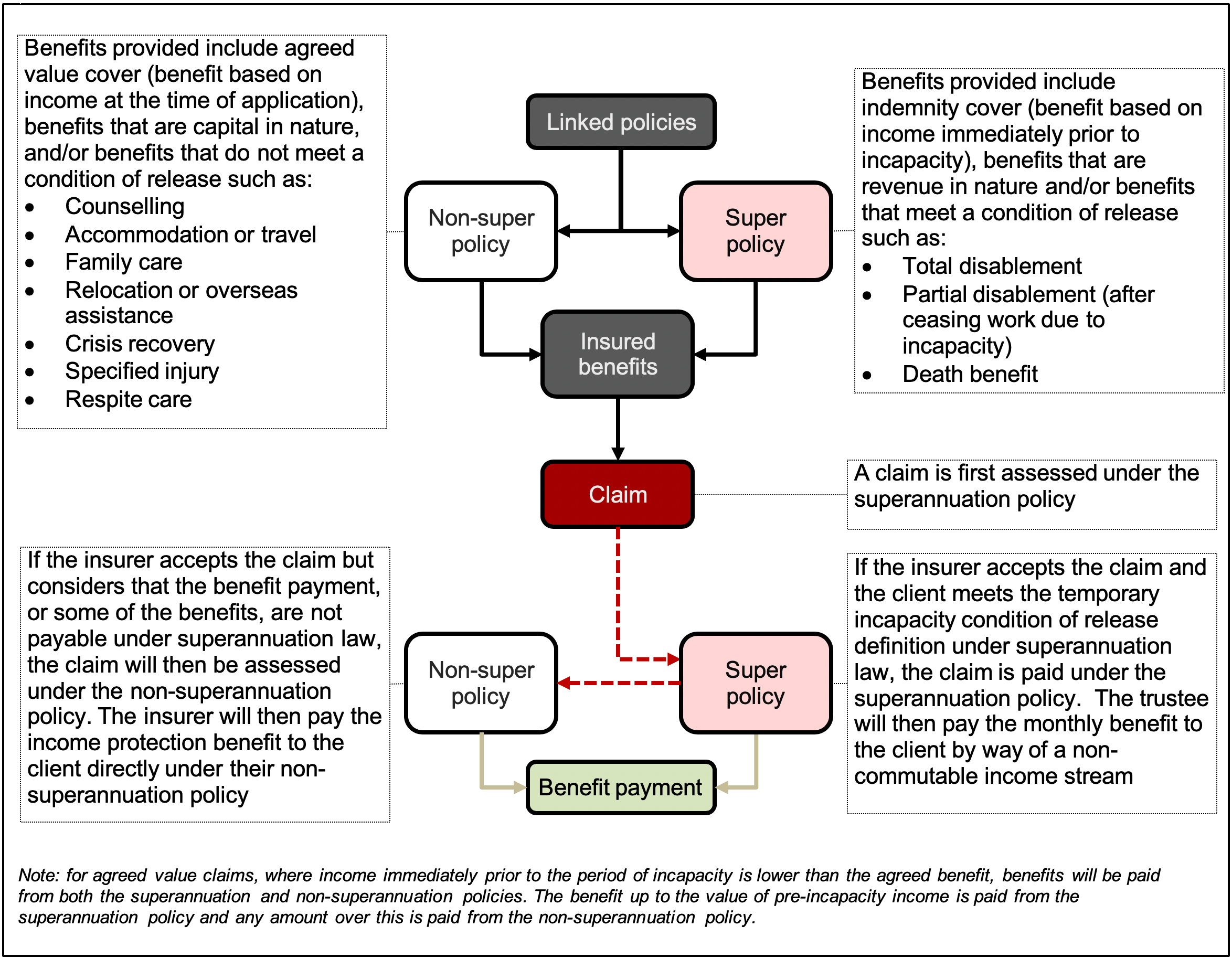

I have a question on tax payable on income protection payments. For 2019 application for exemption for spouse of employment income earner pdf 287kb outline of japan s withholding tax system related to salary the 2020 edition outline of japan s withholding tax system related to salary the 2019 edition pdf 271kb for those applying for an exemption for dependents etc. If the policy provides benefits of an income and capital nature only that part of the premium that relates to the income benefit is deductible. How to remit income tax withholding.

Account set up changes. The money taken is a credit against the employee s annual income tax. Many jurisdictions also require withholding tax on payments of interest or dividends. The income tax department appeals to taxpayers not to respond to such e mails and not to share information relating to their credit card bank and other financial accounts.

The tax is thus withheld or deducted from the income due to the recipient. You can use the tax withholding estimator to estimate your 2020 income tax. There are two main methods small businesses can use to calculate withholding tax. How to report year end withholding statements.

You can claim the cost of premiums you pay for insurance against the loss of your income. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. For help with your withholding you may use the tax withholding estimator. The wage bracket method and the.

Employers calculate withholding tax by referring to an employee s form w 4 and the irs s income tax withholding table to determine how much federal income tax they should withhold from the employee s salary or wages. With regard to non resident. The amount you earn. A withholding tax or a retention tax is an income tax to be paid to the government by the payer of the income rather than by the recipient of the income.

The singapore payer must still pay withholding tax and needs to work out the amount to be paid to iras on top of the amount paid to the nrp. The general withholding tax rate for nrps is a flat 15 of gross income except in the following cases. In most jurisdictions withholding tax applies to employment income.