Income Statement Dividend Distribution

The income might be in the form of dividends received by the trust from shares it holds on your behalf interest from cash and fixed interest investments lease payments from.

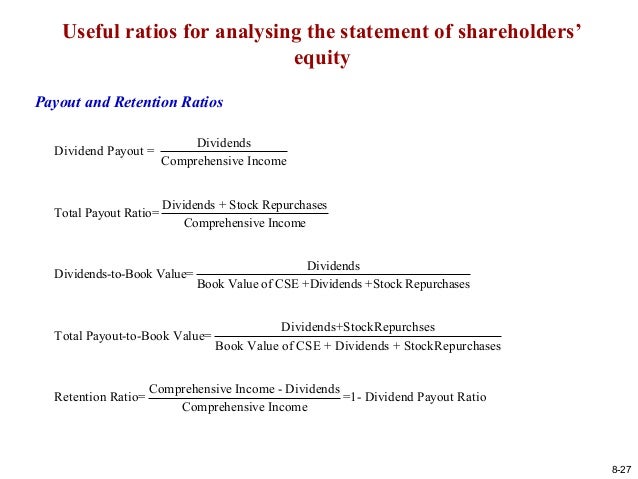

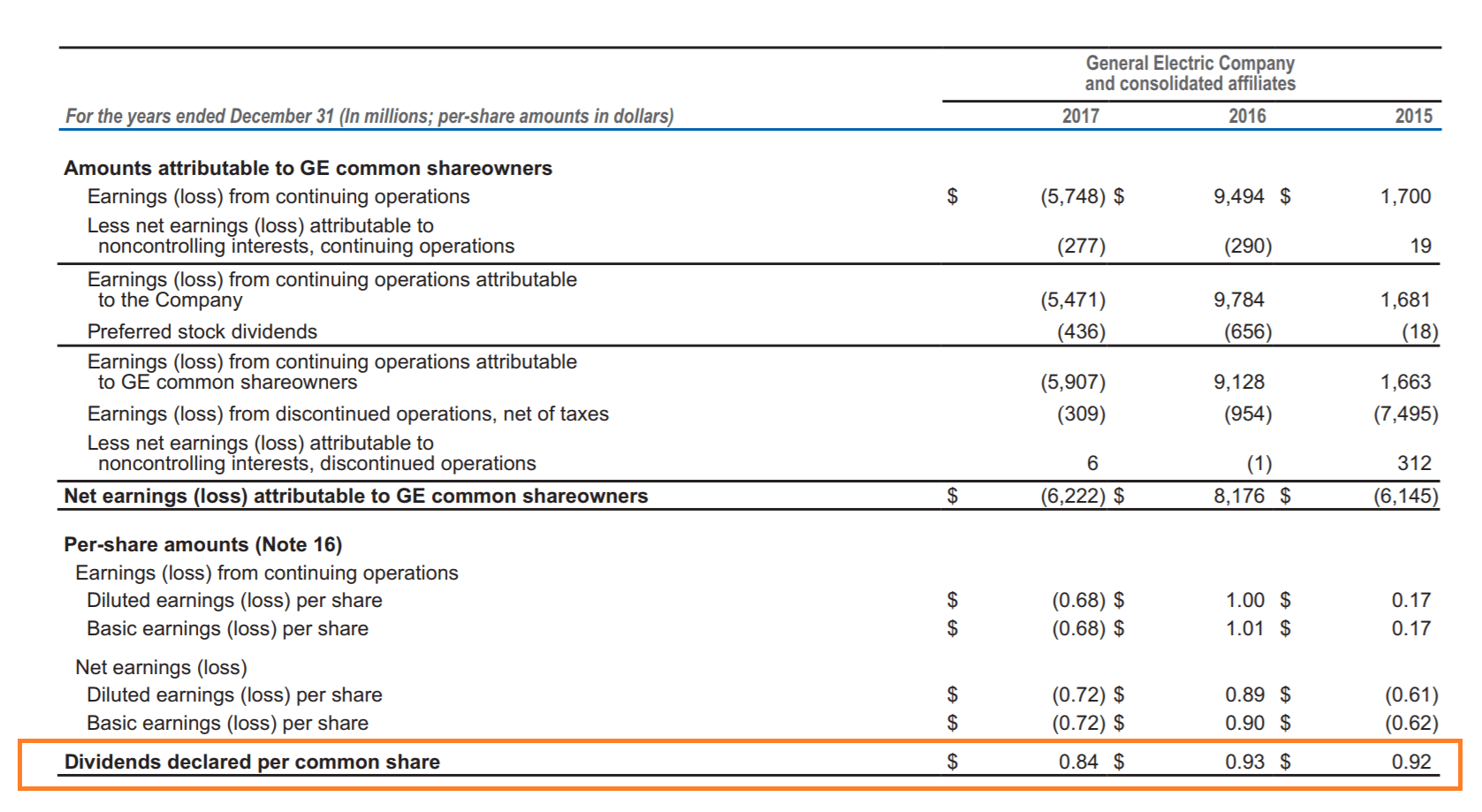

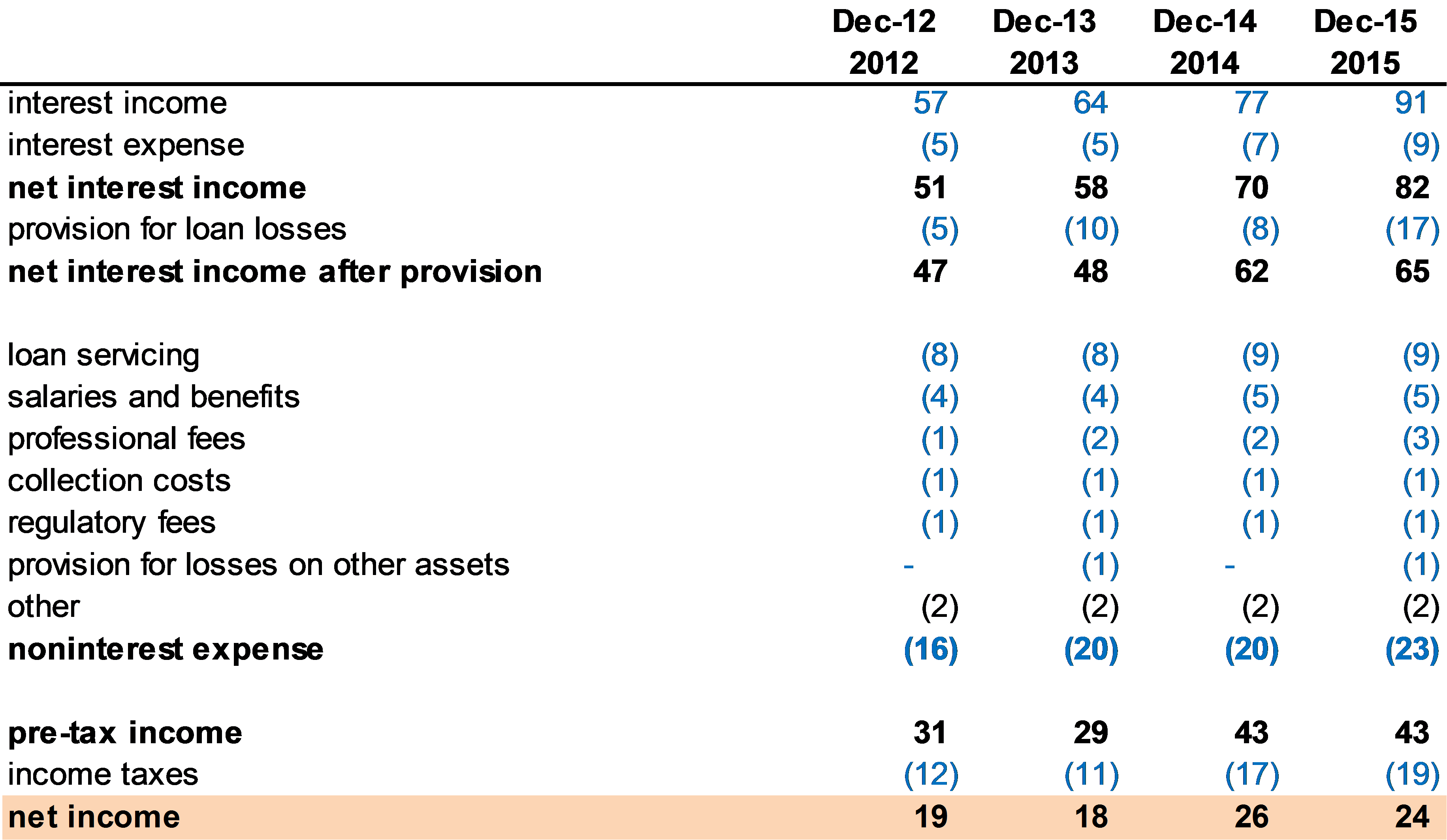

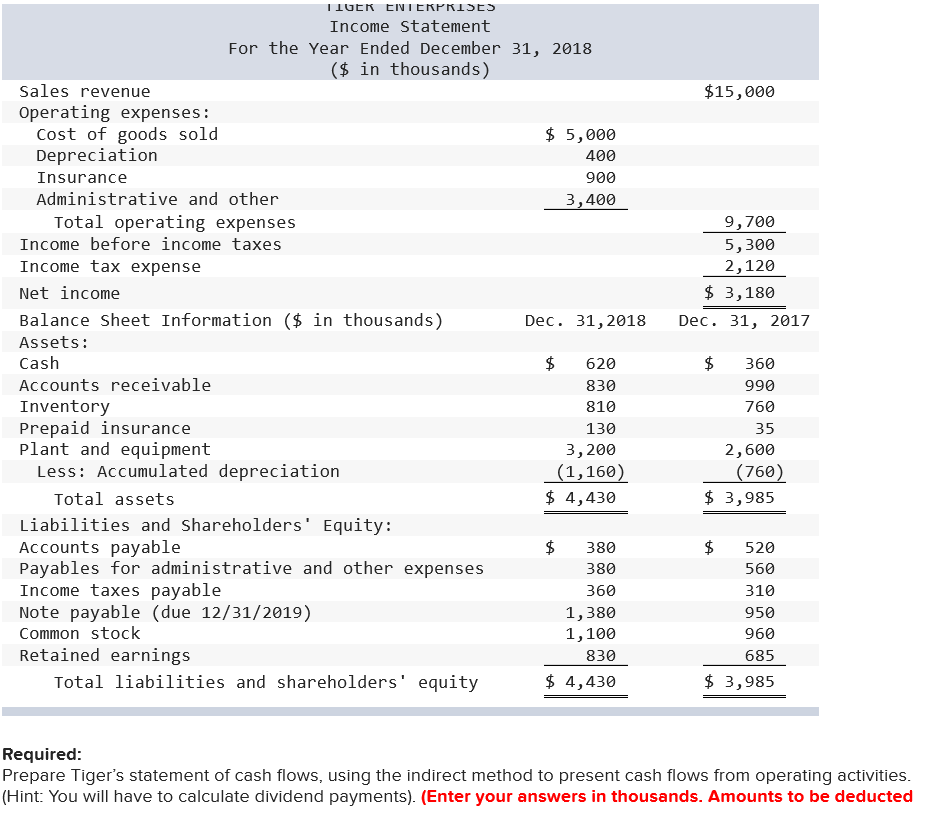

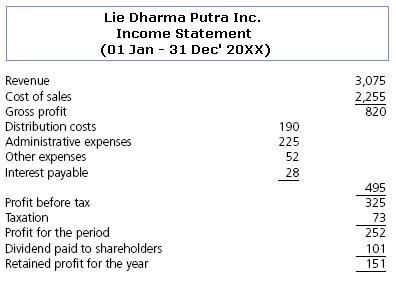

Income statement dividend distribution. The income statement shows the revenue expenses and net income for a company over a period of time. A corporation s dividends are not an expense and therefore will not appear on its income statement. There are some investment professionals who value companies on dividends and a cash flow basis. Estimating dividends per share from the income statement in order to estimate the dividend per share you must first locate the net income figure from the income statement.

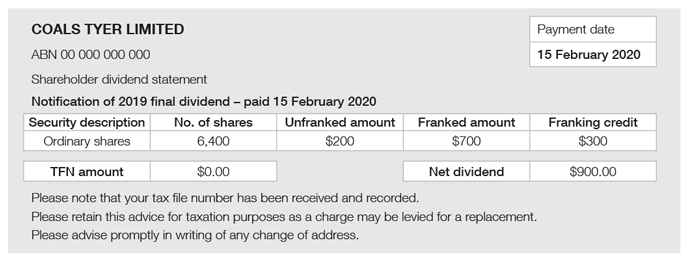

Cash dividends are a distribution of part of a corporation s earnings that are being paid to its stockholders. Dividends and distributions often appear the same to investors but sources of income and tax consequences make these types of payouts differ. Dividends are the distribution of profits to the shareholders as a return on their investments. This extended period of time for private companies means that they can decide what franking credit to allocate after the distribution is paid.

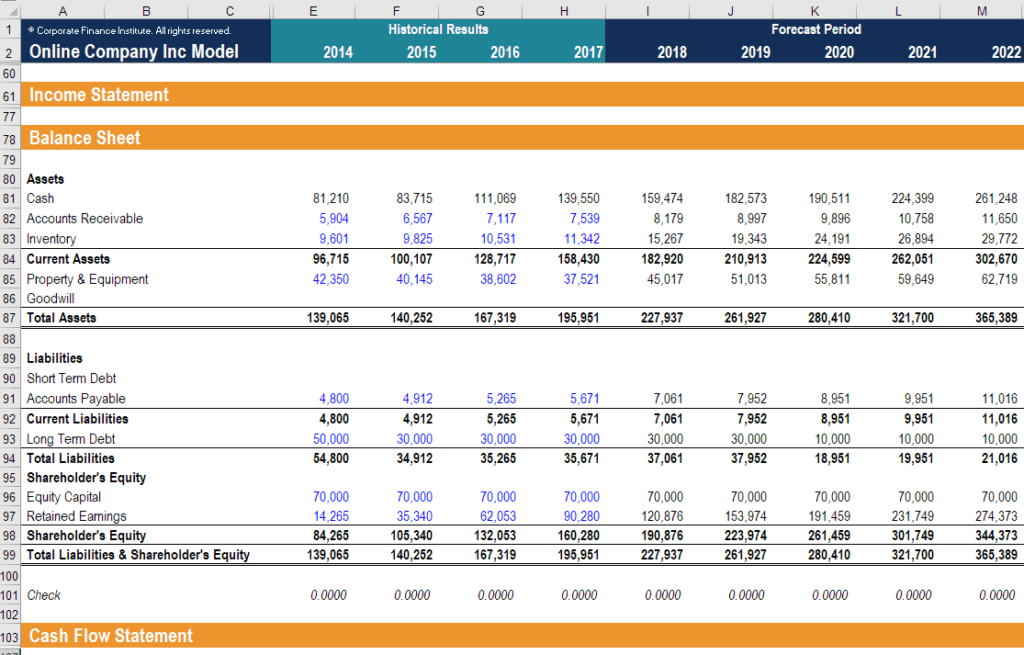

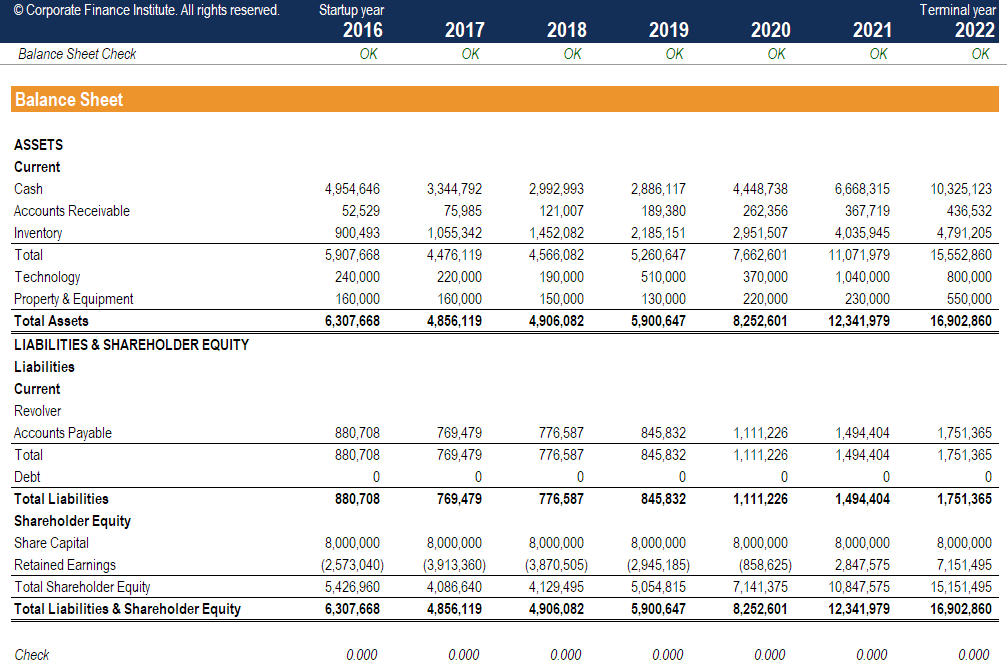

So at the end of each financial year you should receive a tax distribution statement outlining the amounts and types of income you ve earned as a member of the trust. Dividends are paid out of the net profits or accumulated reserves of the company which are calculated after deducting all the expenses and paying. Correspondingly is dividend income reported on the income statement. Income statement statement of comprehensive income balance sheet statement of cash flows statement of stockholders equity wh.

This is generally the. A dividend is a distribution made to shareholders that is proportional to the number of shares owned. Private companies must issue a distribution statement within four months of the end of the income year in which the distribution is made. A dividend is not an expense to the paying company but rather a distribution of its retained earnings.

The dividends are not considered as an expense in the income statement due to the following reasons. Definition of dividends cash dividends are a distribution of a company s profits. There are four components of the financial statements the following table shows how dividends appear in or impact each one of these statements if at all.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.15.35AM-a3c24d655e9748e19bab699b55c1b7b6.png)