Income Statement Equation Approach

The format of this statement can be expressed in equation form as follows.

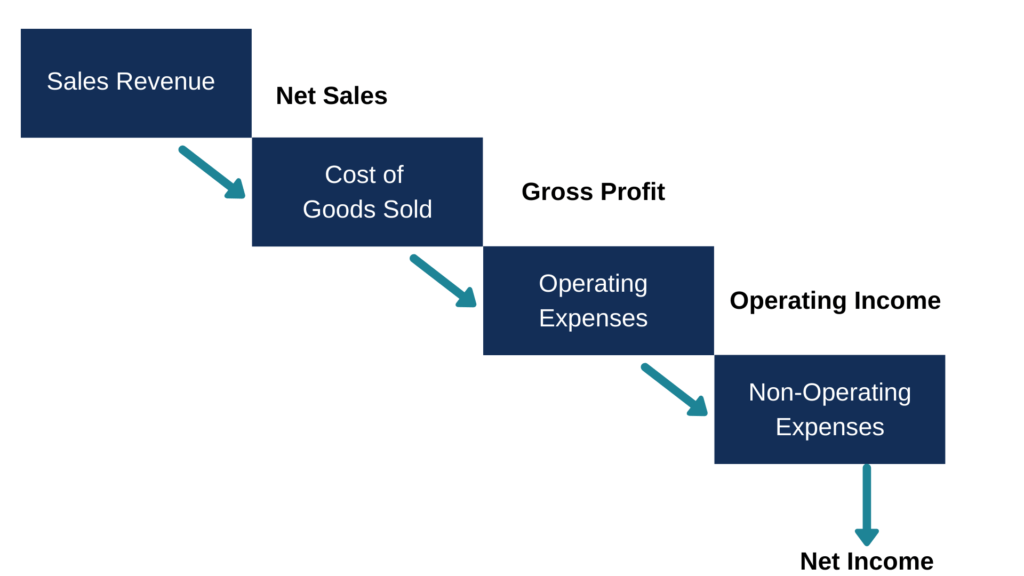

Income statement equation approach. Using the following market assumptions let s estimate the cash flows to the owner over a five year holding period. Total national income is the sum of all salaries and wages rent interest and profits. And also show the gross profit less the selling and administrative expenses and that equals the operating income. The income approach sometimes referred to as the income capitalization approach is a type of real estate appraisal method that allows investors to estimate the value of a property based on the.

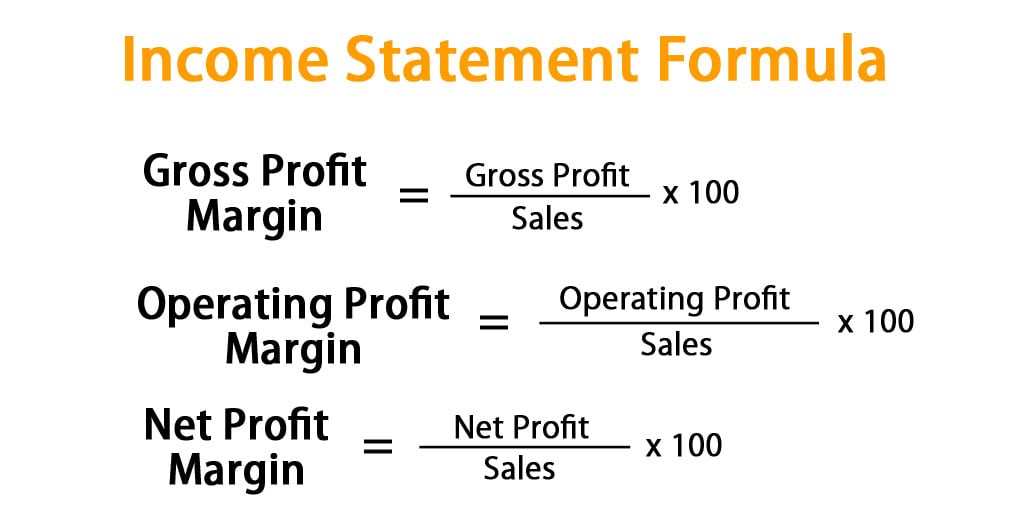

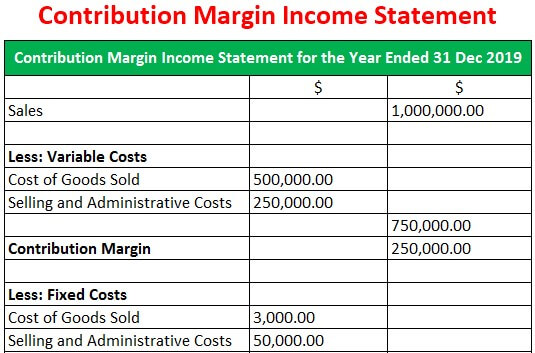

Income statement formula the income statement is one of the major financial statement for a business which shows its expenses revenue profit and loss over a period of time. Use the income statement equation approach to calculate the number of flags kincaid should sell each year to break even. Employ the contribution margin ratio cvp formula to calculate the dollar sales kincaid needs to earn 33 000. Sales taxes describe taxes imposed by the government on the sales of goods and services.

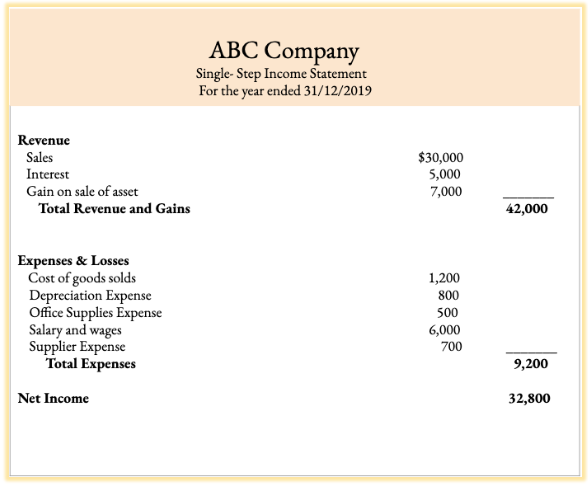

According to the income approach gdp can be computed as the sum of the total national income tni sales taxes t depreciation d and net foreign factor income f. Net operating income i capitalization rate r estimated value v 10 000 0 10 100 000 by dividing the net operating income of the subject property by the capitalization rate you have chosen you arrive at an estimate of. Example of the traditional income statement. In order to estimate the subject property value using the income approach the first step is to create a proforma cash flow statement for the anticipated holding period.

The income statement formula under multiple step method can be aggregated as below net income revenues non operating items cost of goods sold operating expenses explanation of the income statement formula. The equation method centers on the contribution approach to the income statement.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)