Income Statement Higher Accounting

Accounting for limited liability companies.

Income statement higher accounting. As you can see this example income statement is a single step statement because it only lists expenses in one main category. And it yields the profit or loss p l. Sales revenue the amount of money received for selling goods or services. Zimsec o level principles of accounting.

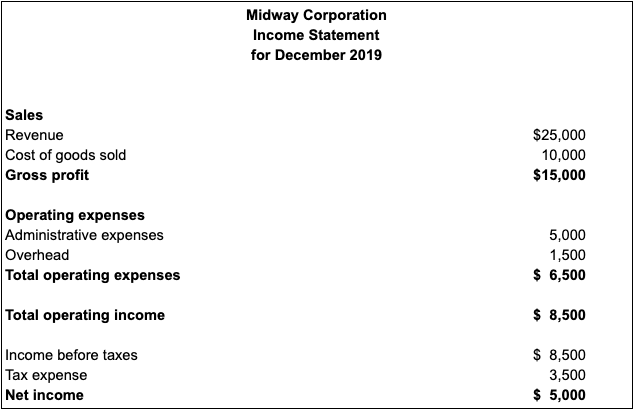

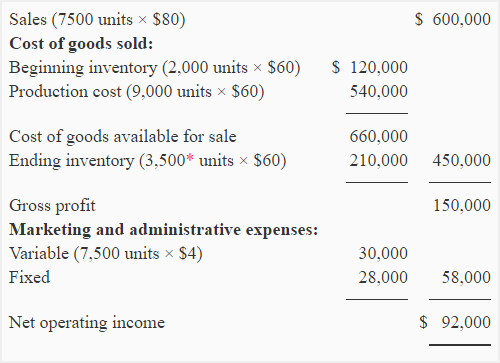

To write an income statement and report the profits your small business is generating follow these accounting steps. The income statement is comparatively the simpler of the two year end documents. The more complex multi step income statement as the name implies takes several steps to find the bottom line starting with the gross profit. Example 2 multi step income statement.

The income statement can be prepared in one of two methods. It measures sales minus all the costs to produce the sales. Businesses typically choose to report their income statement on an annual quarterly or. A statement of comprehensive income shows the contents of an income statement followed by a list of other comprehensive income.

An income statement concerns a whole accounting period most usually a year frequently the calendar year. Income statement as already pointed out in our introduction the structure of the income statement profit and loss part prepared for limited liability companies such as private limited pvt ltd and public limited liability companies. Here is an example of how to prepare an income statement from paul s adjusted trial balance in our earlier accounting cycle examples. The income statement format above is a basic one what is known as a single step income statement meaning just one category of income and one category of expenses and prepared specifically for a service business.

Examples of service businesses are medical accounting or legal practices or a business that provides services such as plumbing cleaning consulting design etc. An income statement shows. Pick a reporting period. Gross profit is calculated by.

Other comprehensive income includes gains and losses that cannot be reported as profit and loss such as unrealized gains and losses and revaluation surplus. The multi step income statement format comprises a gross profit section where the cost of sales is deducted from sales followed by income and expenses to reach an income before tax. The first step in preparing an income statement is to choose the reporting period your report will cover. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time.

The single step income statement takes a simpler approach totaling revenues and subtracting expenses to find the bottom line. Gross profit the profit made from buying and selling goods. As compared to a single step income statement a multi step income statement examples are more complex.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)