Income Tax Definition Pdf

This article discusses the practical.

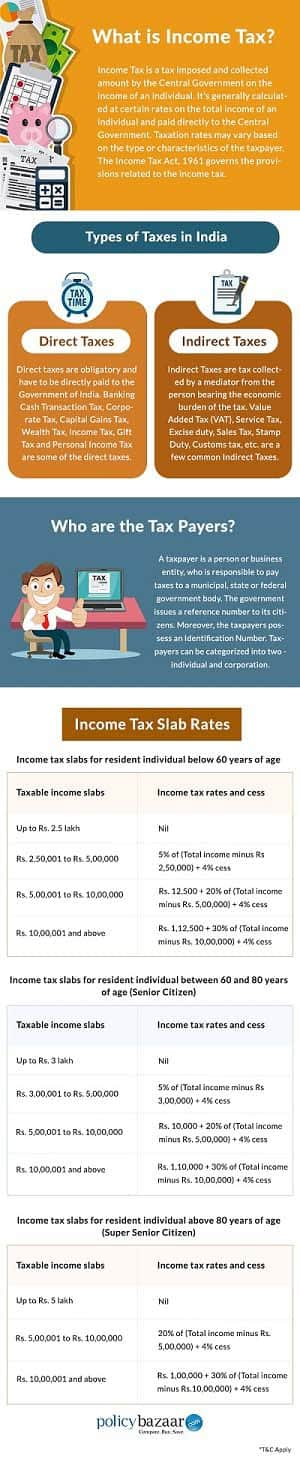

Income tax definition pdf. 2 see annex 1 for a discussion of the concept of agency capacity. 3 it is usually possible to identify amount of social security contributions and payroll taxes but not other taxes paid by government. Concept and definition of income in the national accounts fachhochschule rheinland pfalz mainz germany it is a truism that the national accounts have engendered their own concept of income which is different from other contexts such as business accounting taxation or welfare analysis. It is deductible from income tax before calculating education cess.

The amount of rebate is 100 per cent of income tax or rs. Any underpayment of tax must be settled before submission of the annual tax return e g. Costs for purposes of section 8 1 of the income tax act 58 of 1962 fixing of rate per kilometre in respect of motor vehicles for the purposes of section 8 b ii and iii general regulations under the income tax act 1962 insurance regulations. 12 500 whichever is less.

Definition of official rate of interest in paragraph 1 of the seventh. 4 if however a levy which is considered as non tax revenue by most countries is regarded as a tax or raises. Example individual income tax return for fiscal year 2014 should be filed by 31 march 2015. Maximum marginal rate section 2 29c it means the rate of income tax including surcharge on income tax if any applicable in relation to the highest slab of income in the case of an individual association of persons or as the case may be body of individuals as specified in the finance act of the relevant year.

6 notes 1 all references to the sna are to the 1968 edition. 2 50 000 nil nil rs. Income tax and wealth tax 70 marks 1. Apparently it is assumed that everybody understands what the word tax means.

Income tax is used to fund public services pay government. Non resident individual huf net income range income tax rates health and education cess up to rs. Many contemporary social economical and political studies in the area of taxation do not give any definition of the term tax.