Income Tax Free Zone In India

Income tax know about income tax in india income tax rules acts.

Income tax free zone in india. The income tax department also referred to as it department or itd is a government agency undertaking direct tax collection of the government of india. The income tax department never asks for your pin numbers passwords or similar access information for credit cards banks or other financial accounts through e mail. The category sez covers a broad range of more specific zone types including free trade zones ftz export processing zones epz free zones fz industrial estates ie free ports urban enterprise zones and others. India has specific laws for its sezs.

Income tax in india is governed by entry 82 of the union list of the seventh schedule to the constitution of india empowering the central government to tax non agricultural income. A free trade zone ftz is a class of special economic zone 1 2 it is a geographic area where goods may be landed stored handled manufactured or reconfigured and re exported under specific customs regulation and generally not subject to customs duty. Sez is a geographically demarcated region which enjoys liberal economic laws and various tax benefits for a special economic zone in india. Free trade zone ftz section 10a.

Agricultural income is defined in section 10 1 of the income tax act 1961. Free trade zones are generally organized around major seaports international airports. Tax holiday sections 10a 10aa 10b 10ba special economic zone section 10aa. Income tax in india.

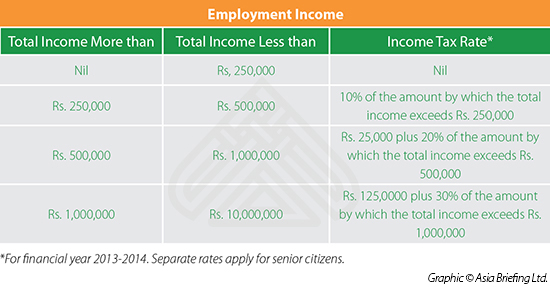

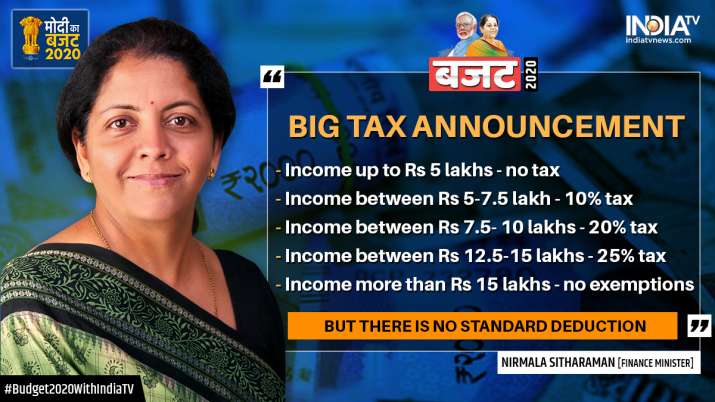

Check tax slabs fy 2020 21 efiling income tax income tax return and refund. It functions under the department of revenue of the ministry of finance 5 income tax department is headed by the apex body central board of direct taxes cbdt. Main responsibility of it. Tax holiday sections 10a 10aa 10b 10ba 100 export oriented undertakins 100 e o u.