Personal Income Tax Definition Macroeconomics

Personal income has a large effect on consumer consumption.

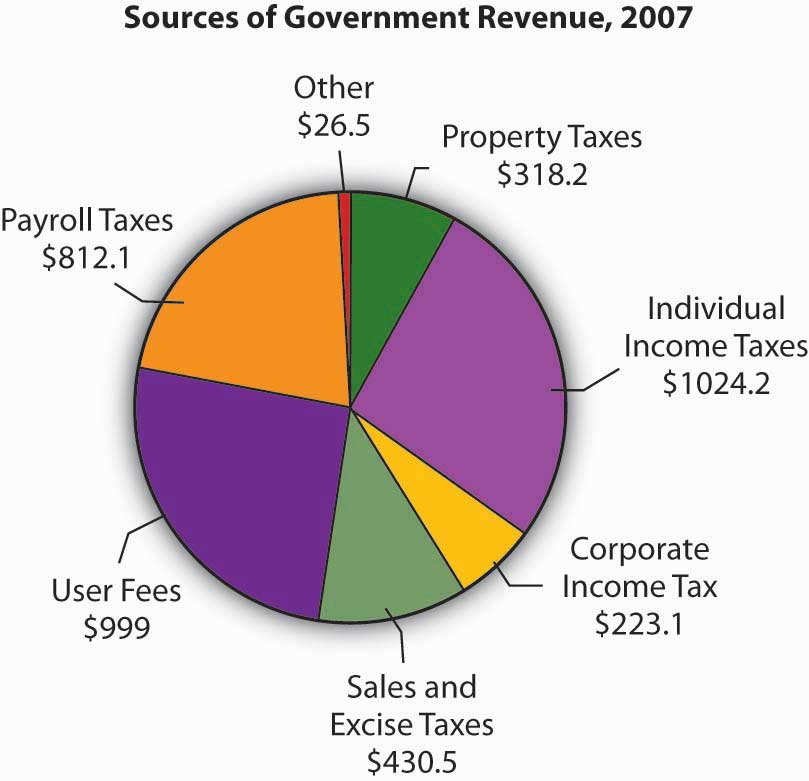

Personal income tax definition macroeconomics. Personal income is that income which is received by the individuals or households in a country during the year from all sources. Personal income tax is a type of income tax that is levied on an individual s wages salaries and other types of income. As consumer spending drives much of the economy national statistical organizations economists and analysts track personal income on a. Personal income is the summation of total earned and unearned income that the individuals receive.

The personal income is calculated as.

Source : pinterest.com