Income Tax Rates For Trusts And Estates 2020

The estate or trust will have federal income tax withheld from any income or the estate or trust would be required to make estimated tax payments to avoid a penalty even if it didn t include household employment taxes when.

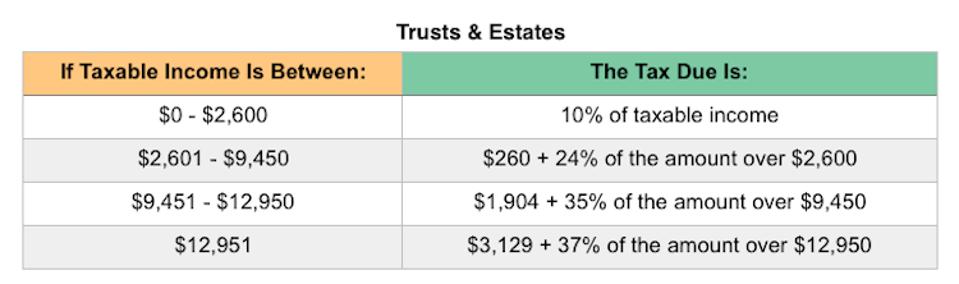

Income tax rates for trusts and estates 2020. The tax rate schedule for estates and trusts in 2020 is as follows. If the settlor has more than one trust this. While other tax brackets reach their final column with 518 000 and a 37 income tax trust reach it with 12 750. By these numbers alone you will see how beneficial it is for your tax planning to have a trust or an estate.

The rate remains 40 percent. For 2020 the highest income tax rate for trusts is 37. The first 1 000 is taxed at the standard rate. Taxable income of up to 39 375.

Most taxpayers pay a maximum 15 rate but a 20 tax rate applies if your taxable income exceeds the thresholds set for the 37 ordinary tax rate. 2020 tax brackets for trusts and estates. Tax filing status 0 rate 15 rate 20 rate. For joint married couples the amount is 612 350 divided into two if they are filing separate reports.

Section for pension payment charges on page ttcg 12 and box t7 30 on page ttcg13 of the trust and estate tax calculation guide 2020 have been updated. Include household employment taxes on line 12 if. Taxable income of up to 78 750. The gst tax exemption amount which can be applied to generation skipping transfers including those in trust during 2020 is 11 580 000 increased from 11 4 million in 2019.

Trustees are responsible for paying tax on income received by accumulation or discretionary trusts. Generally a person dying between jan. 31 2020 may be subject to an estate tax with an applicable exclusion amount of 11 580 000 increased from 11 4 million in 2019. Sometimes trust and estate income gets carried out to those who receive distributions from them but retained income typically gets taxed at trust.