Personal Income Tax Relief 2020 Malaysia

The gobear complete guide to lhdn income tax reliefs.

Personal income tax relief 2020 malaysia. An individual whether tax resident or non resident in malaysia is taxed on any income accruing in or derived from malaysia. Receiving full time instruction of higher education in respect of. Disabled individual additional relief for self. Companies are not entitled to reliefs and rebates.

Now that you know about all the income tax reliefs rebates and deductions that are available for malaysia personal income tax 2020 ya 2019 make sure to get your tax filing in order so you don t miss out on any claims. Reliefs are available to an individual who is a tax resident in malaysia in that particular ya to reduce the chargeable income and tax liability. Diploma level and above in malaysia. Ringgitplus everything you should claim as income tax relief.

Ringgitplus malaysia personal income tax guide 2020. Per child below 18 years old 2 000. Don t miss out on maximising your income tax refund 2020. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability.

Per child over 18 years old. Personal tax reliefs in malaysia. Comparehero 7 tax exemptions in malaysia to know about. Spouse under joint assessment 4 000.

The prime minister announced that personal income tax relief in the amount of myr 1 000 on travel expenses incurred from 1 march 2020 to 31 august 2020 is to be extended to 31 december 2021. Disabled spouse additional spouse relief. Ya 2020 rm self. Personal tax relief malaysia 2020.

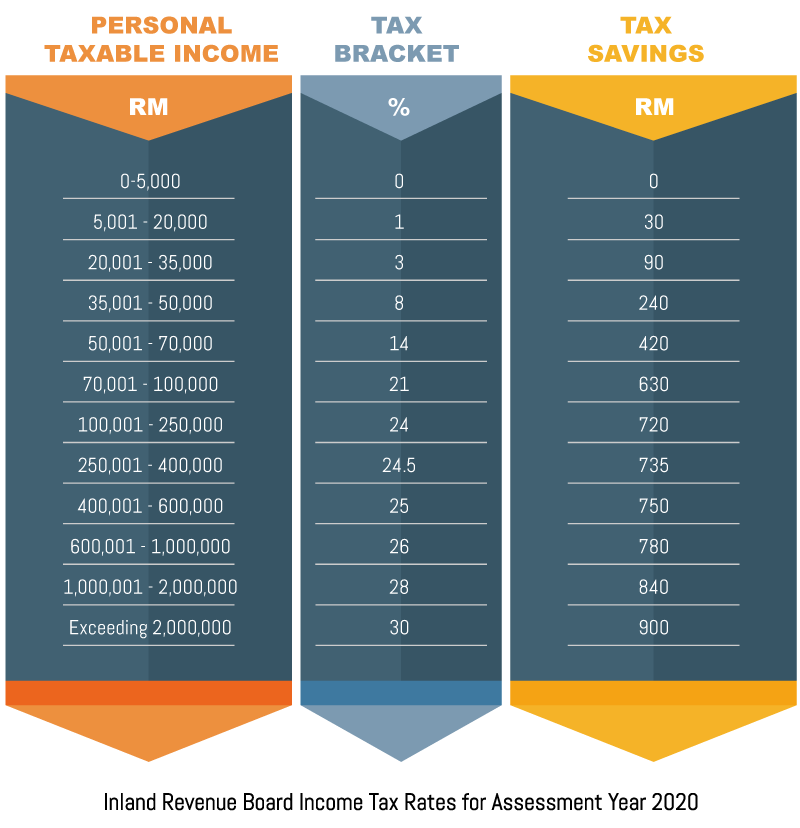

Over 18 years of age who is receiving full time instruction at an establishment of higher education in malaysia at diploma level and higher or outside malaysia at degree level and above or serving under article of indentures in a trade or profession provided certain. Personal income tax rates. The relief amount you file will be deducted from your income thus reducing your taxable income make sure you keep all the receipts for the payments. The following rates are applicable to resident individual taxpayers for ya 2020.

Below is the list of tax relief items for resident individual for the assessment year 2019. Hence the tax relief is claimable by resident individuals for ya2020 and ya2021. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. Loanstreet my 9 things to know when doing 2019 income tax e filing.

Reliefs ya 2020 myr.