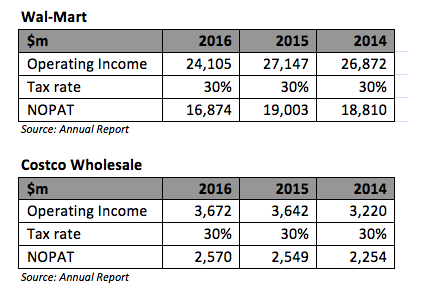

Income Tax Rates Meaning

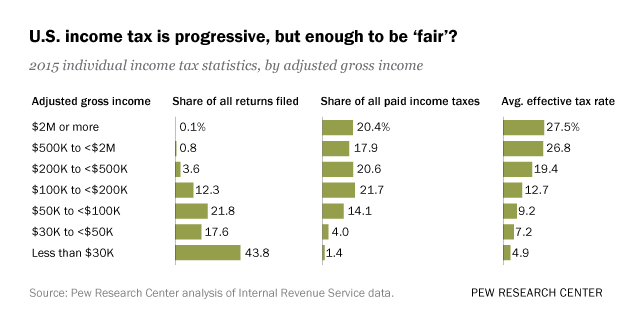

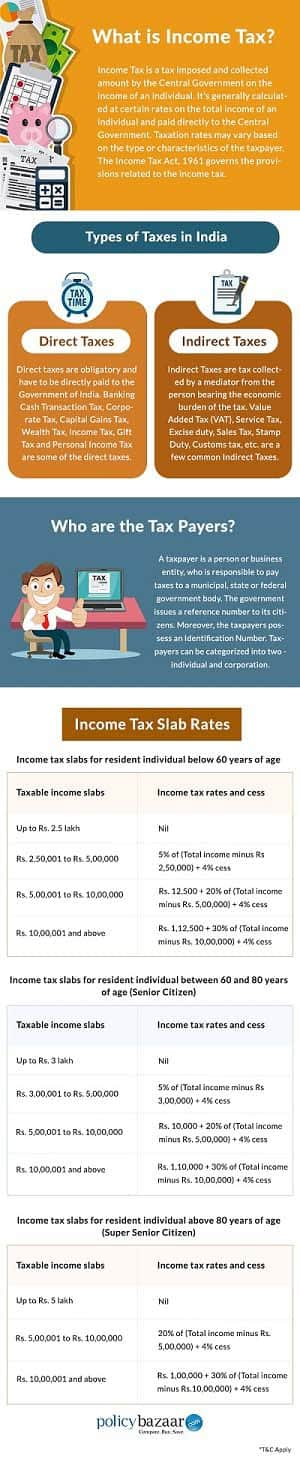

Your marginal tax rate is the rate you pay on the taxable income that falls into the highest bracket you reach.

Income tax rates meaning. Because the us income tax system is progressive your tax rate rises as your taxable income rises through two or more tax brackets. 19 cents for each 1 over 18 200. This can mean changing the tax rate of a bracket or the amount of yearly taxable income that puts a person or household in that bracket. Understanding tax brackets.

This is different from the applicable marginal tax rate which is the tax rate applicable on the last dollar. 5 092 plus 32 5 cents for each 1 over 45 000. Progressive tax proportional or regressive. A progressive tax is one.

Imposes a progressive tax rate on income meaning the greater the income the higher the percentage of tax levied. 29 467 plus 37 cents for each 1 over 120 000. Resident tax rates 2020 21. Income tax is used to fund public services pay government.

Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. Tax on this income. In the u s the internal revenue service irs uses a progressive tax system meaning taxpayers will pay the lowest rate of tax on the first level of taxable income. 51 667 plus 45 cents for each 1 over.

The tax free schedule is due to stay at 18 200 until at least 2024 25. 10 15 25 28 33 or 35. For australian residents the tax free threshold is currently 18 200 meaning the first 18 200 of your income is tax free but you are taxed progressively on income above that amount. The percent of income paid as tax or the percent of the value of a good service or asset paid as tax.

:max_bytes(150000):strip_icc()/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/UAETaxBrackets2-0db7d9918b414b2e978772ebeeb0f101.jpg)