Income Withholding Notice Illinois

If the employer doesn t submit those withheld funds within 7 days they are also subject to penalty.

Income withholding notice illinois. You are required by law to deduct these amounts from the employee obligor s income until further notice. And publication 121 illinois income tax withholding for household employees. Illinois law places several responsibilities on employers to ensure the proper collection and payment of child support. Per current child support.

Illinois withholding income tax payments are made on form il 501 withholding payment coupon and illinois withholding is reported on form il 941 illinois withholding income tax return. Illinois income withholding for support act 750 ilcs 28 35 provides for a 100 a day penalty with a 10 000 cap for businesses that withhold support payments from paychecks. Make sure to use the correct version of form il 941 for the liability period you are filing. 1 20 ccdr 0556 b.

Private individual entity check one note. The illinois department of revenue issued publication il 700 t illinois withholding tax tables to be used effective with wages paid on and after january 1 2020. The flat and supplemental income tax rate continues at 4 95 for 2020 and the state annual exemption amount per allowance is 2 325. When does the state send out income withholding notices.

Under certain circumstances you must reject. Disclaimer the state initiates a notice to the employer within 2 15 days of learning about a non custodial parent s employment depending on the source of the information. A copy of an income withholding notice and proof of service shall be filed with the clerk of the circuit court only when necessary in connection with a petition to contest modify suspend terminate or correct an income withholding notice an action to enforce income withholding against a payor or the resolution of other disputes involving. Booklet il 700 t illinois withholding income tax tables to calculate withholding.

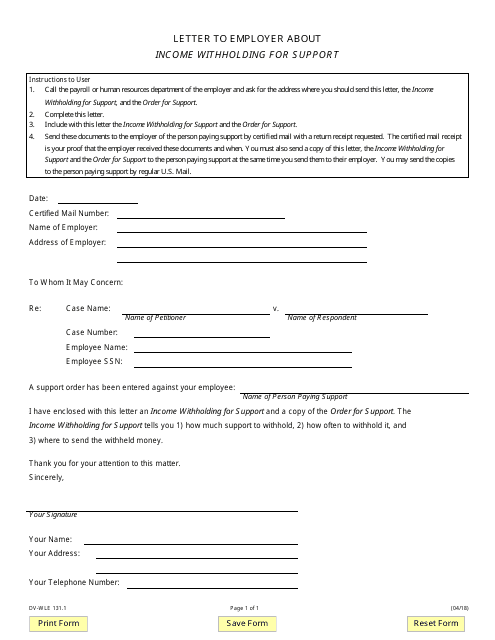

Income withholding the 100 day penalty. Child support enforcement cse agency. Did you know that under the illinois income withholding for support act 750 ilcs28 if an employer does not initiate income withholding within 14 days of receipt of the iwn income withholding notice they are subject to penalty. Income withholding for support income withholding order notice for support iwo amended iwo one time order notice for lump sum payment termination of iwo date.

This document is based on the support or withholding order from illinois state tribe. This iwo must be regular on its face.