Income Withholding Order Ri

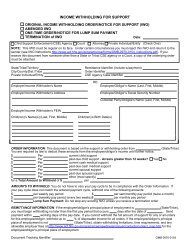

Rhode island law requires that all child support orders established or modified be garnished from the non custodial parent s income.

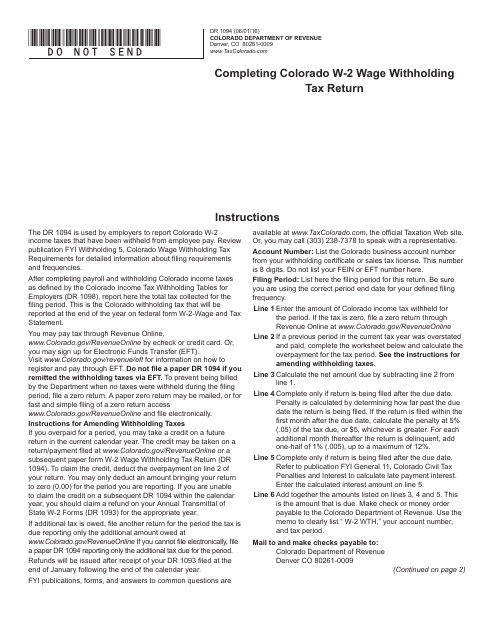

Income withholding order ri. Only use for the months of january february april may july august october and november. Withholding for support has priority over any other legal process under state law against the same income section 466 b 7 of the social security act. Use form ri 941 for the quarter ending months of march june september and december. 1 the employee s wages are subject to federal income tax withholding and 2 any part of the wages were for services performed in rhode island.

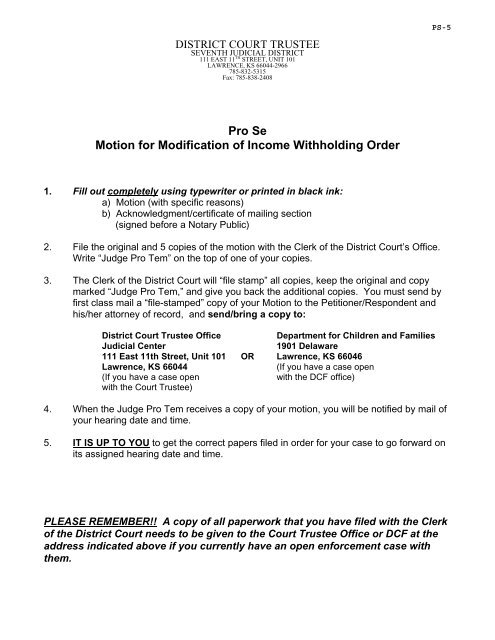

In order to accomplish this there is a national wage withholding form that is currently in use across the country. If a federal tax levy is in effect please notify the sender. Monthly withholding return. Your rhode island income tax return in order to receive credit for any withholding made on your behalf.

Requirement of income withholding support orders issued in this state or other jurisdictions. Rhode island general laws chapter 15 16 15 16 5. A rhode island employer must with hold rhode island income tax from the wages of an employee if. Employees from whose wages rhode island taxes must be withheld.

Rhode island general laws 15 16 5. The information from your ri 1099pt must also be entered on schedule w of your 2019 rhode island income tax return.