Interest Expense Negative On Income Statement

On a financial statement the income can be listed separately from expenses or provide a net interest number which is either positive or negative.

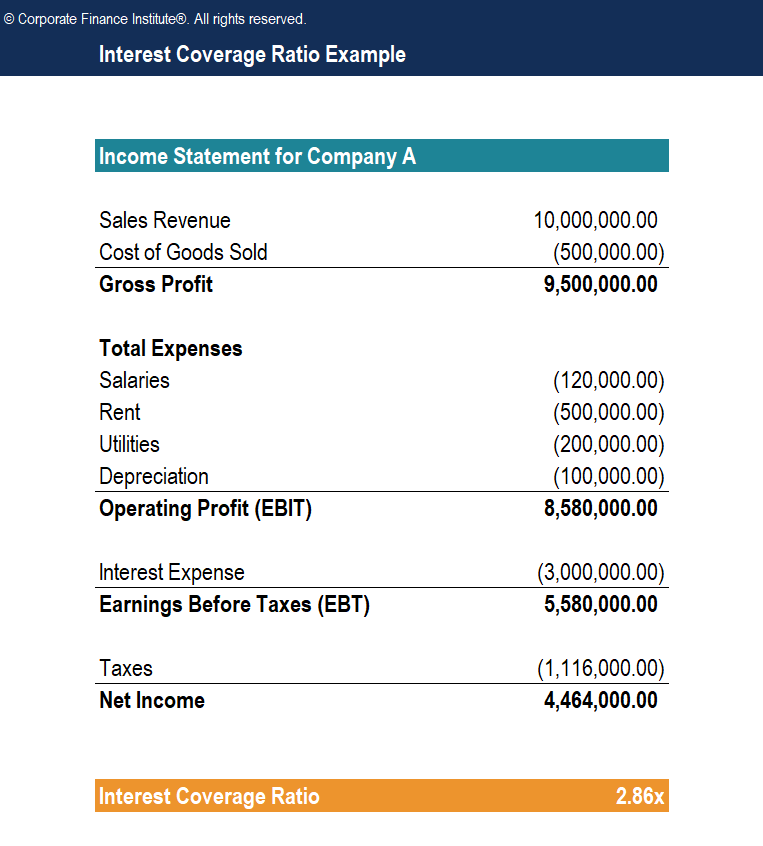

Interest expense negative on income statement. In other words if a company paid 20 in interest on its debts and earned 5 in interest from its savings account the income statement would only show interest expense net of 15. On an earnings statement your interest expense is deducted from your total operating income. Sometimes interest expense is combined with interest income. Net refers to the fact that management has simply subtracted interest income from interest expense to come up with one figure.

In september 2012 the ifrs interpretations committee discussed the ramifications of the economic phenomenon of negative interest rates for the presentation of income and expenses in the statement of comprehensive income the interpretations committee considered the situation where against the backdrop of the economic crisis the demand of investors for. However they believed that the negative interest could be included as part of the net interest income or expense. One possibility is that you have misread or misinterpreted what you re reading. One committee member said it was confusing to her that this negative interest would still be included in the effective interest rate and it would therefore be disclosed under ifrs 7 as part of interest income and expense.

If negative the net effect is inco. Net interest expense is the total interest net of any interest income that a company receives on investments.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)