Interest Income Withholding Tax Uk

For us withholding taxes it applies from 1st may 2003 and for other us taxes from 1st january 2004.

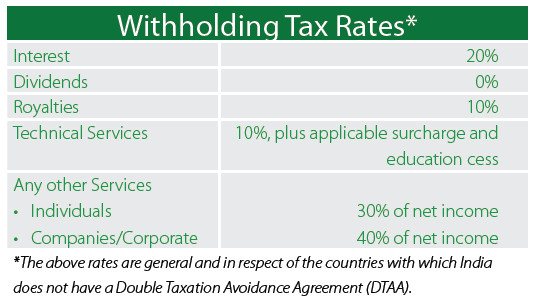

Interest income withholding tax uk. The rate of the wht equals the headline corporate income tax rate which will be 21 7 in 2021. The obligation to deduct tax from interest that has a uk source is imposed by chapter 3 of part 15 ita07 formerly icta88 s349 2. 1 interest derived and beneficially owned by a resident of the united kingdom. Under uk domestic law a company may have a duty to withhold tax in relation to the payment of either interest or royalties or other sums paid for the use of a patent.

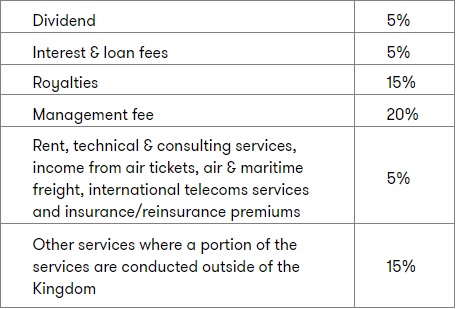

However the uk does still have one significant disadvantage namely the 20 withholding tax imposed by uk domestic law on yearly interest that arises in the uk is paid to persons whose usual place of abode is outside the uk i e. Withholding tax on interest payments generally withholding tax at the standard rate of tax must be deducted from annual interest payments made by. On 31 december of that year. Withholding tax also does not apply if the interest income is attributable to a business ie a branch permanent establishment etc carried out by the non resident in malaysia.

If interest or royalties have accrued and remained outstanding during a calendar year. There is also no withholding tax on interest under a loan between a company and a financial institution. Duty to deduct tax from interest with a uk source. Under the income tax ordinance 2001 a deduction is allowed during a tax year for any profit on debt incurred by a person in that tax year provided that the proceeds or benefit of the debt have been used by the person for business purposes.

Deduction of tax from interest and royalties payments from the eu from 1 january 2021 some eu member states may start to deduct tax from interest and royalty payments made into the uk which used. For more information see payment and receipt of interest without deduction of income tax. The circumstances in which such a liability arises are discussed below. Introductionuk tax must be withheld on uk payments including interest royalties rental incomewithholding tax may be reduced under double tax treaties dtt or european directives both of which may be subject to making a formal claim this guidance note outlines the rules for uk withholding tax and.

Broadly non uk residents under section 874 1 d section 874 2 income tax act 2007.