Net Income Vs Profit Margin

Net profit represents the profit in dollar terms after incurring the direct costs associated with producing the goods and services sold by the business entity all the operating expenses including the depreciation and amortization incurred during the operating cycle other expenses interest and taxes.

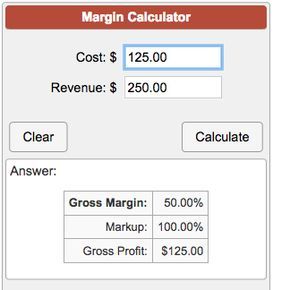

Net income vs profit margin. Net profit is calculated by subtracting interest and taxes from operating profit also known as earnings before interest and taxes ebit. The net profit margin. To calculate the profit margin divide the net income for the business by the total amount of sales and multiply by 100 to arrive at a percentage. For example if a business had total gross sales of 100 000 for the accounting period and reported a net profit of 10 000 the business had a 10 percent net profit margin.

Net income your management department may make decisions on whether to continue selling a product based on the gross margin of the good. The figure that most comprehensively reflects a business s profitability and used in publicly traded. Net income and net profit are two terms frequently used by accountants and business owners alike. Profit margin is calculated by dividing the company s net income by its revenues.

Net income is often called the bottom line for a company or the net profit. Net profit margin or net margin is the percentage of net income generated from a company s revenue. Expressed as a percentage the net profit margin shows how much of each dollar collected by a company as revenue translates into profit. More operating income definition.

3 net profit vs. The result is shown as a percentage. Although net revenue and gross margin are useful internal figures external parties care most about net income. The blueprint explains each term and clarifies if there is a difference between them.