Ohio Nonresident Income Tax

It calculates tax on total income then it calculates a non resident part year resident credit which it subtracts from the tax it calculated on the total income.

Ohio nonresident income tax. This requires a nonresident tax return when the property is located somewhere other than your home state as does rental income earned there. You d have to file a non resident return if you worked as a consultant or contractor in another state. Nonresidents of ohio only. Thus an ohio resident pays ohio individual income tax on all of his or her compensation distributive share of income from pass through entities interest dividends capital gains rents royalties etc.

Exception a full year nonresident living in a indiana kentucky west virginia michigan or pennsylvania does not have to file if the nonresident s only ohio sourced income is wages. Carrying on a business trade profession or occupation in a state. You are a part year resident of ohio if you were a resident of ohio for a portion of the tax year and a nonresident for the rest of the tax year. Every ohio resident and every part year resident is subject to the ohio income tax.

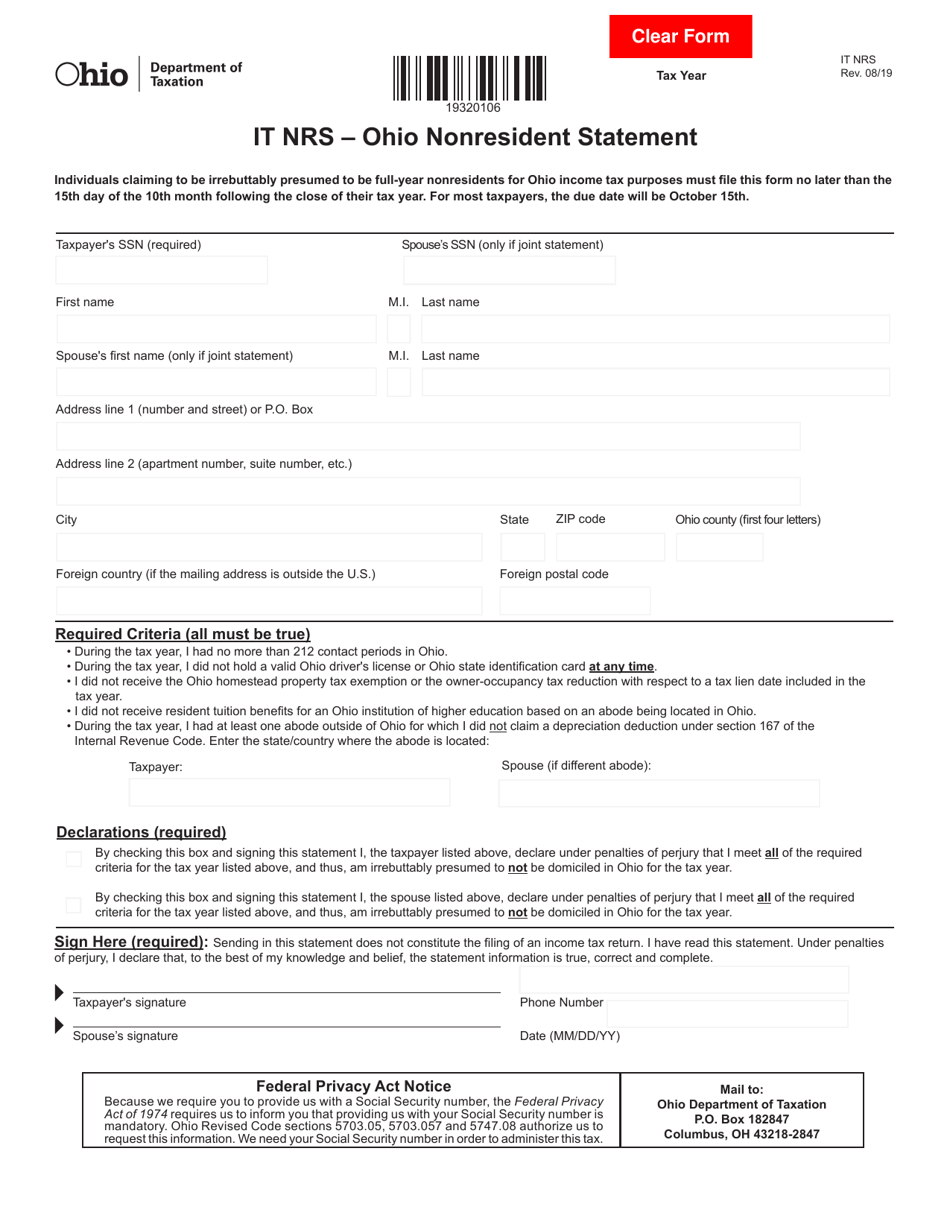

Examples of ohio sourced income include the following. Ohio casino gaming winnings. Ohio governor mike dewine recently signed two bills house bills 62 and 155 that enact several significant ohio income tax changes for the upcoming tax filing season. Ohio it nrc income allocation and apportionment nonresident credit and part year resident credit include this three page form with the ohio it 1040 individuals.

Income or gain from a sole proprietorship doing business in ohio. Your income would only be exempt if you fell into one of the exemptions such as being under 18 if that is an exemption for that city. Modified adjusted gross income ohio nonresident statement opportunity zone credit and more. Hb 494 which was passed late december 2014 increased these contact periods to 212.

Every nonresident having ohio sourced income must also file. This is a 30 contact period increase over the old law. 2019 income tax changes. Wages or other compensation earned in ohio see exception below.

This form is for taxpayers claiming the nonresident credit on the ohio it 1040 for tax years 2016 and forward. It doesn t matter if you are a resident of another country or another state. You do not have to file an. Ohio has made a change to the number of contact periods an individual can have with ohio before the individual will establish ohio residency for income tax purposes.

Income from the sale of property. Income or gain from ohio. Ohio does a convoluted tax calculation for non residents part year residents. The credit is calculated as your non ohio income divided by total adjusted income multiplied by the total.

Ohio imposes its individual income tax on every taxpayer residing in or earning or receiving income in ohio.