Outline The Income Statement Approach To Calculating The Bad Debts Expense

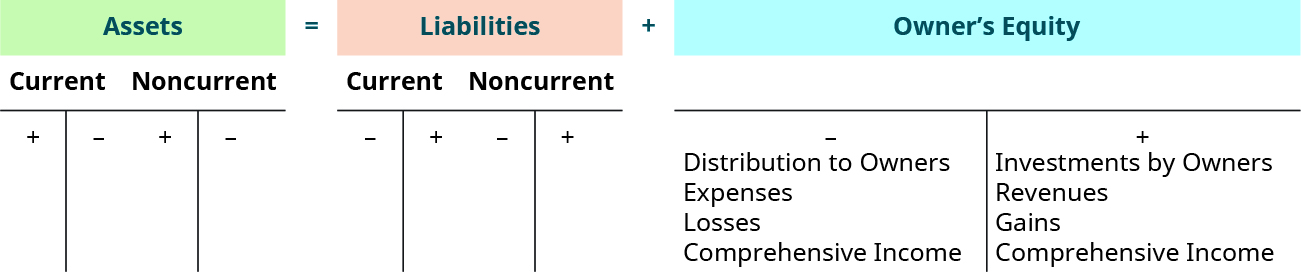

Bad debts get recorded on a company s income statement.

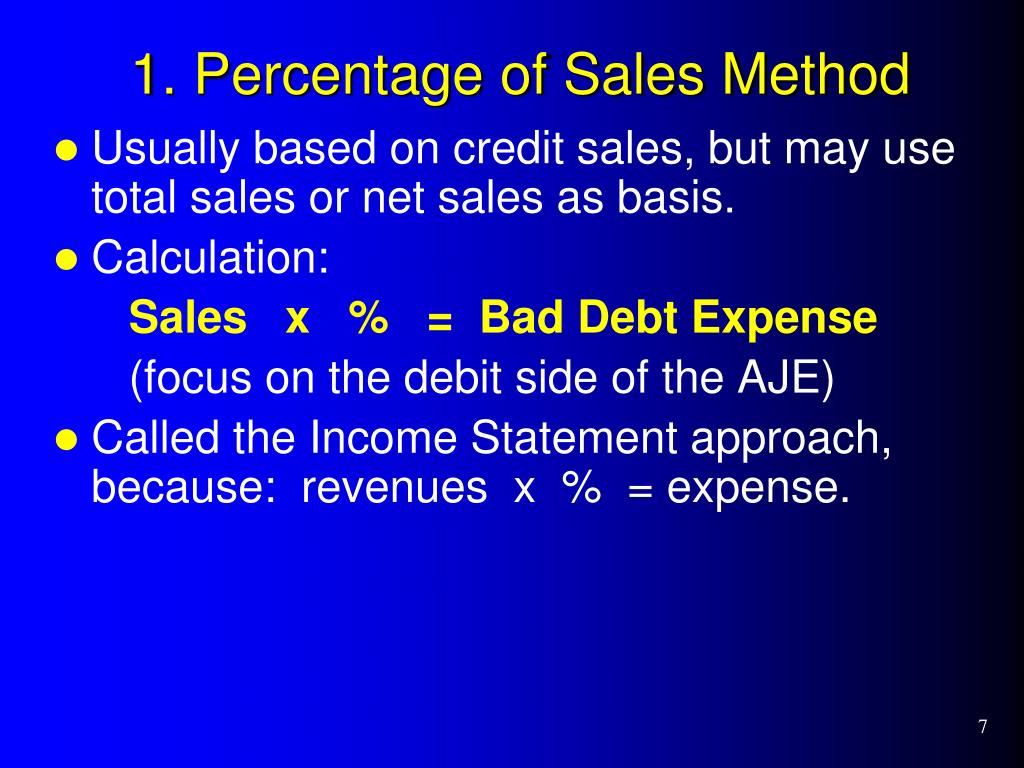

Outline the income statement approach to calculating the bad debts expense. On the income statement bad debt expense would still be 1 of total net sales or 5 000. Why is there a difference in the amounts for bad debts expense and allowance for doubtful accounts. It means under this method bad debt expense does not necessarily serve as a direct loss that goes against revenues. The difference between.

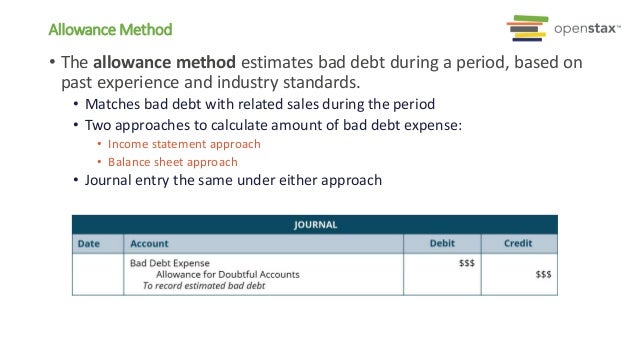

The reason why this contra account is important is that it exerts no effect on the income statement accounts. The income statement approach to estimating bad debts determines bad debt expense directly by relating uncollectible amounts to credit sales. It s an inevitable reality that not all customers will pay down their account balances. The balance sheet approach to bad debts expresses uncollectible accounts as a percentage of accounts receivable.

Bad debt expense equation helps in obtaining a true and fair view of financial statements as net profit and debtors are correctly estimated by identifying bad and doubtful debts. For example at the end of the accounting period your business has 50 000 in accounts receivable. Under this approach businesses find the estimated value of bad debts by calculating bad debts as a percentage of the accounts receivable balance. With respect to financial statements the seller should report its estimated credit losses as soon as possible using the allowance method.

Journal entry dr bad debts expense 400 cr allowance for doubtful debts 400 the balance sheet approach is superior to the income statement approach because it ensure s the net balance of accounts receivable is the best. In applying the percentage of sales method companies annually review the percentage of uncollectible accounts that resulted from the previous year s sales. Amount reported as bad debts expense the amount reported in the income statement account bad debts expense pertains to the estimated losses from extending credit during the period shown in the heading of the income statement. Bad debt expense recognized through the allowance method helps the organization to keep some funds aside for meeting future expenses.

To account for this lost income businesses record bad debt expense on a periodic basis.