Progressive Income And Wealth Taxes

It s done to help lower income families pay for basics like shelter food and transportation.

Progressive income and wealth taxes. Educational attainment is often conditional on cost and family income which for the poor reduces their opportunity for educational attainment. 1 it s based on the taxpayer s income or wealth. Because federal taxes are progressive the distribution of after tax income is more equal than income before taxes. The income tax system in the united states is considered a progressive system although it has been growing flatter in recent decades.

A progressive wealth tax that varies by residence location. High income households have a slightly smaller share of total income after taxes than their share of income before taxes while the reverse is true for other income groups figure 6. A progressive tax is characterized by a more than proportional rise in the tax liability relative to the increase in income and a regressive tax is characterized by a less than proportional rise in the relative burden. A progressive tax allow them to spend a larger share of their incomes on cost of living expenses.

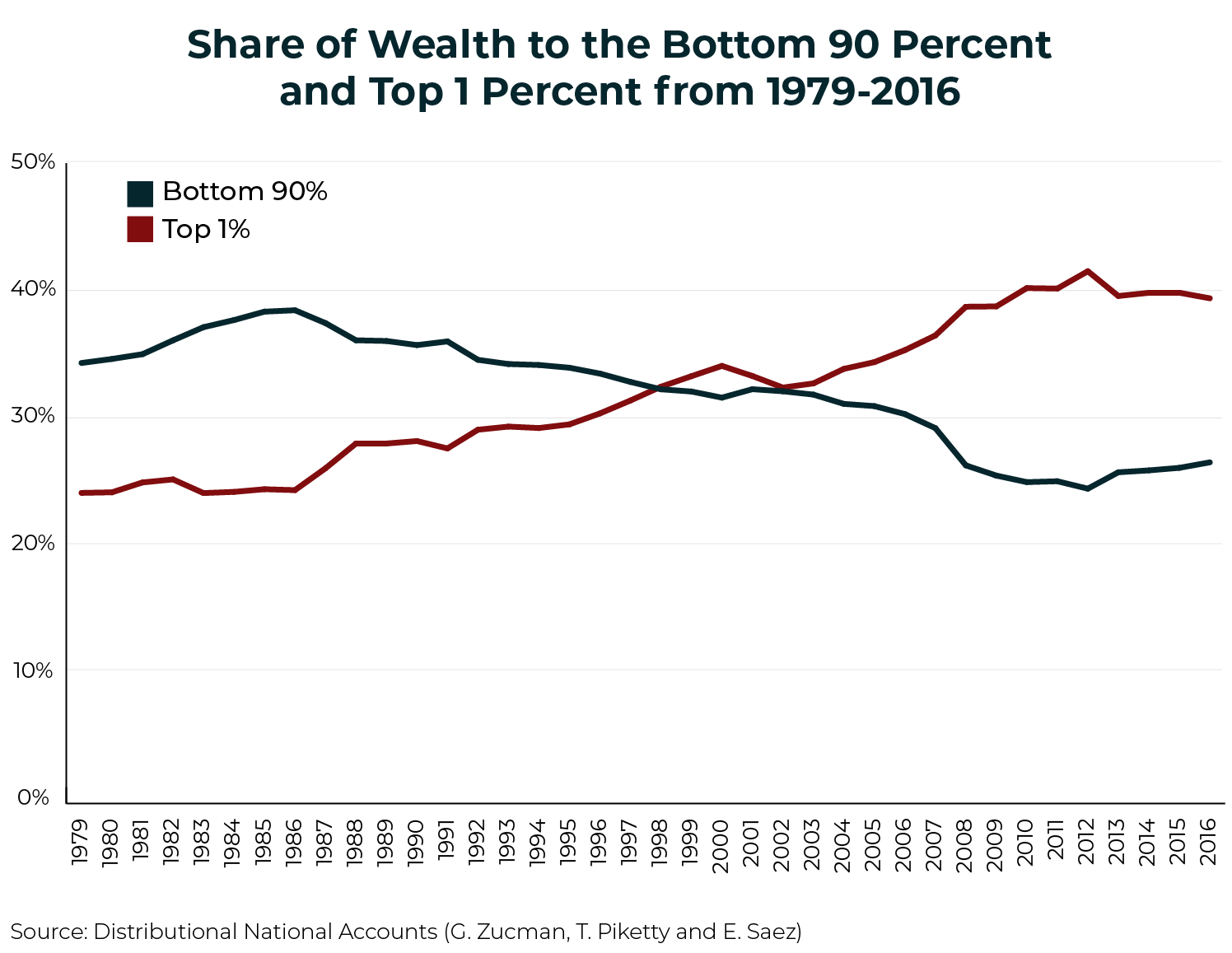

Progressive taxes would help fix the imbalance created by an uneven playing field for the last quarter century. In 2020 there are only seven tax brackets with rates of 10. A progressive tax imposes a higher rate on the rich than on the poor. A 1 wealth tax on the upper half of the top 10 percent s wealth would generate 255 billion a year.

Taxes which are progressive in the sense that they tax corporate pro ts a highly concentrated source of income relative to corporate pro ts have declined from about 50 in the 1950s and 1960s. Federal taxes are more progressive than they were 35 years ago. Wealth taxes are typically very progressive because net wealth is highly concentrated much more than income due to the cumulative and multiplicative processes that govern wealth accumulation. Most cantons have no wealth tax for individual net worth less than chf 100 000 approx.