The Income Statement Approach To Estimating Uncollectible Accounts Is Called The

Accounts receivable preparation for test 2 ex.

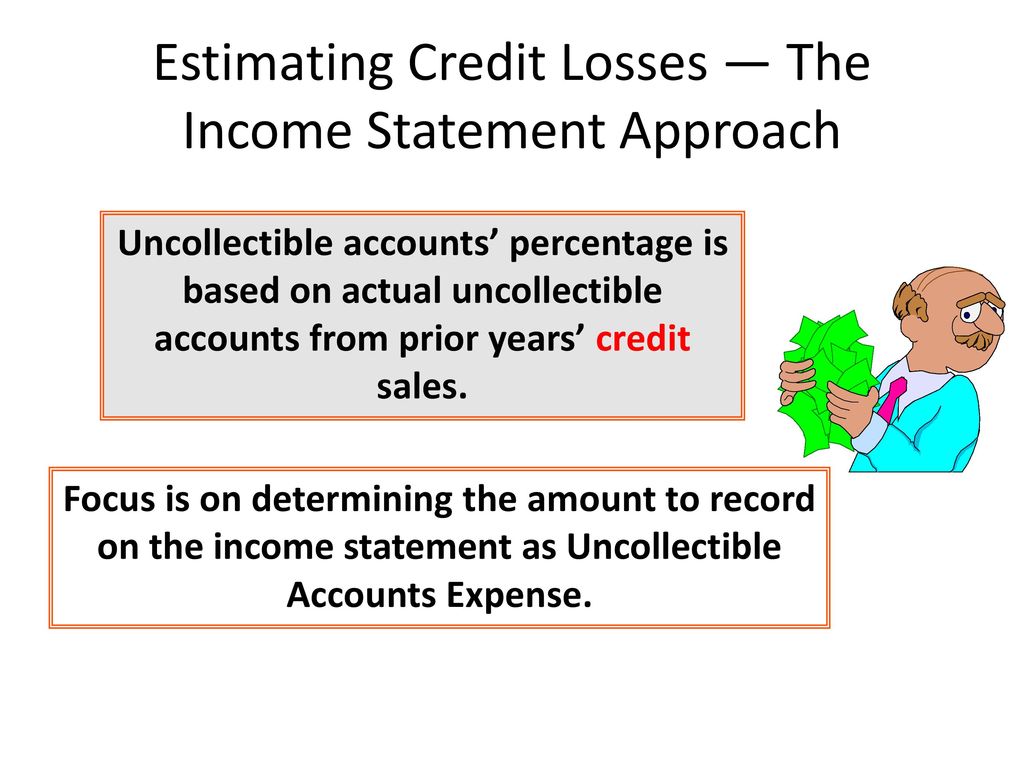

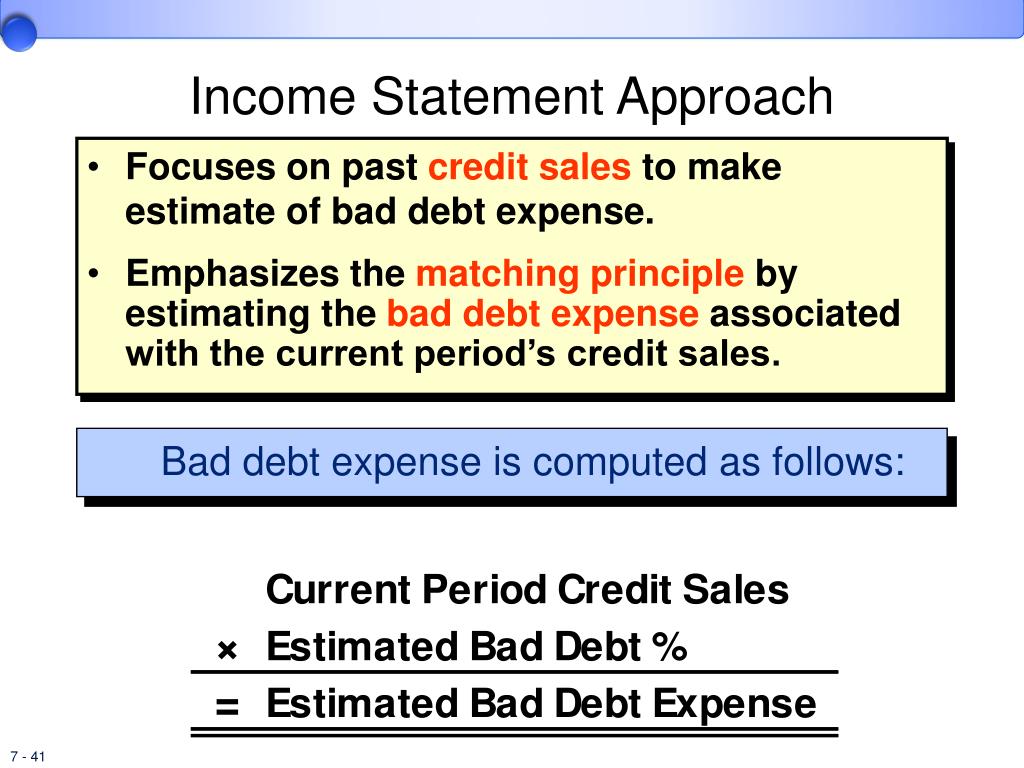

The income statement approach to estimating uncollectible accounts is called the. What is the amount of. The income statement approach for estimating bad debts uses a percentage of net credit sales sales to customers in which the customers pay within 30 to 60 days are referred to as credit sales or sales on account what are. The income statement approach to estimating uncollectible accounts expense is used by kerley company. Windsor uses the income statement approach in estimating uncollectible accounts expense and uncollectible accounts expense is estimated to be 2 of credit sales.

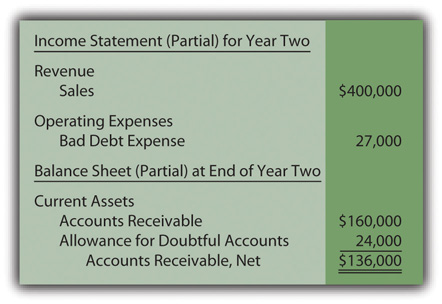

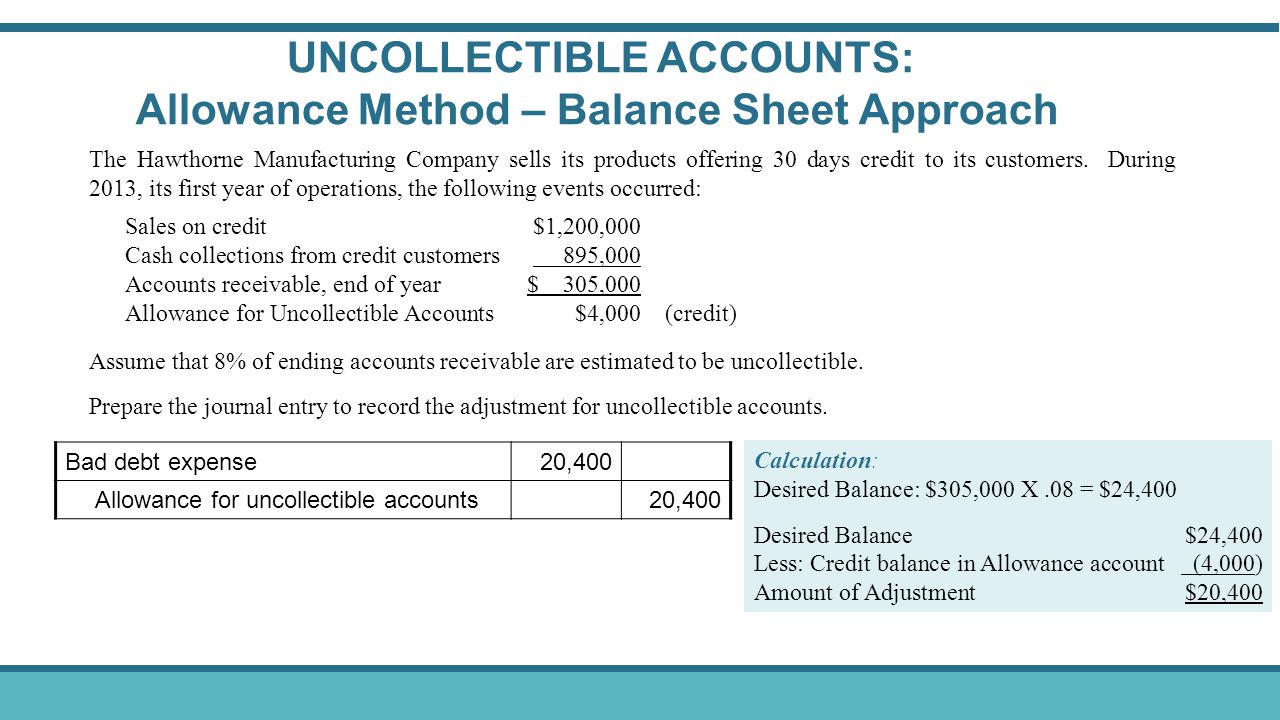

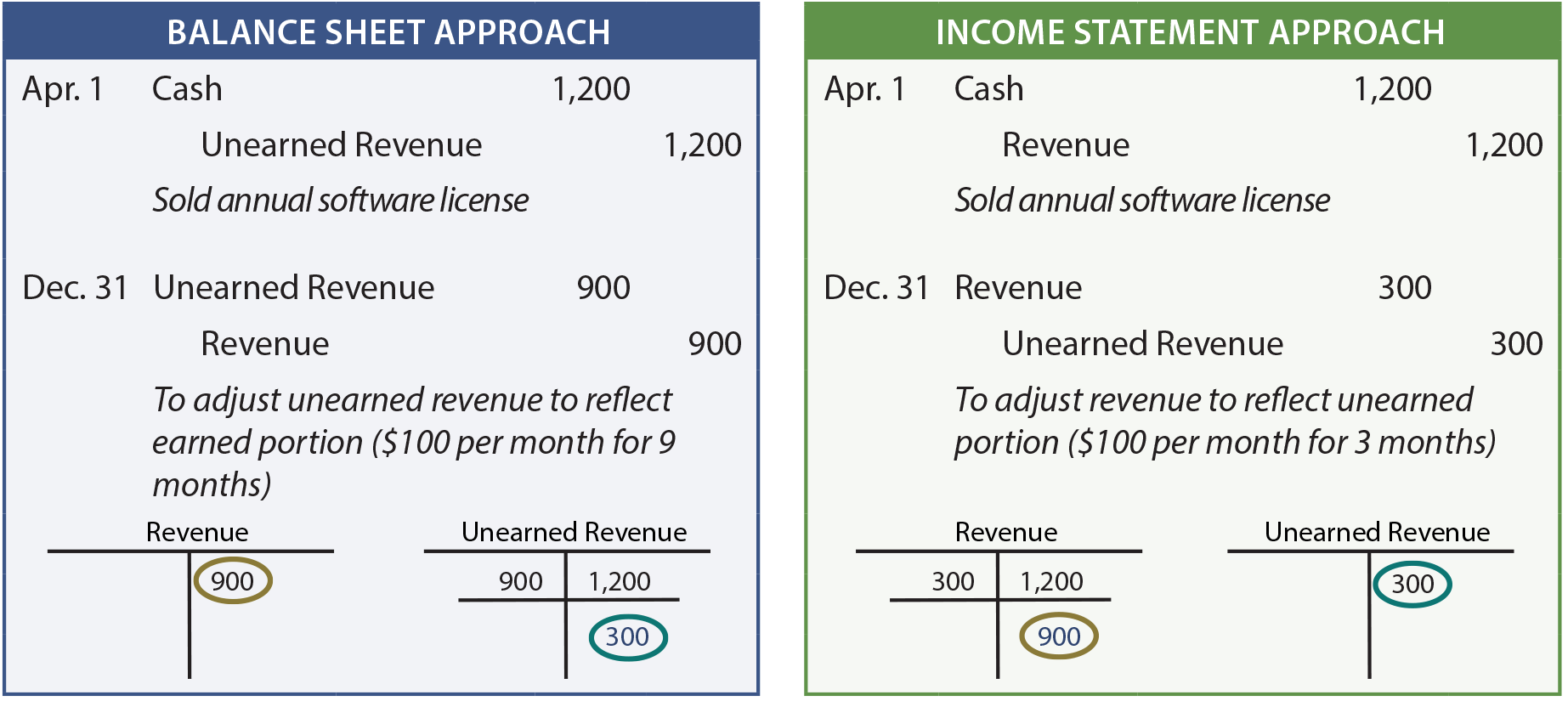

8 000 8 10 000 c. 53 account for uncollectible accounts using the balance sheet and income statement approaches you lend a friend 500 with the agreement that you will be repaid in two months. The sales method also referred to as income statement approach estimates allowance for doubtful accounts using total credit sales for the period. While these expenses are listed on the income statement accurate presentation of uncollectible accounts expense is critical for analysis of financial statements.

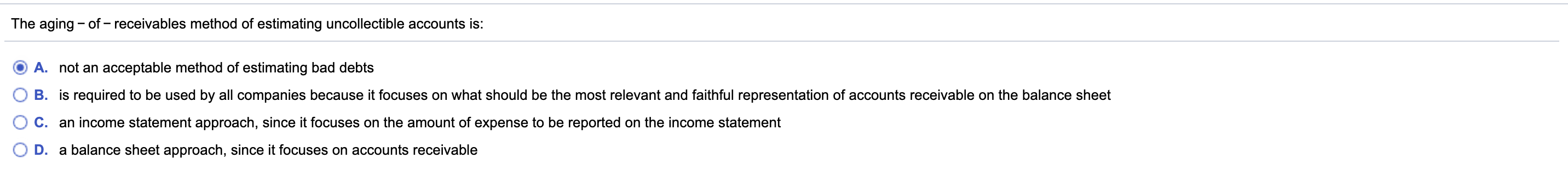

At the end of two months your friend has not repaid the money. Is required to be used by all companies because it focuses on what should be the most relevant and faithful representation of accounts receivable on the balance sheet o c. 230 the income statement approach to estimating uncollectible accounts expense is used by landis company. The income statement approach to estimating uncollectible accounts is called the method.

The aging of receivables method of estimating uncollectible accounts is. On february 28 the firm had accounts receivable in the amount of 437 000 and allowance for doubtful accounts had a credit balance of 2 140 before adjustment. Under this approach some percentage of the total credit sales for the period is. This page explains the use of sales method for estimating allowance for doubtful accounts.

Not an acceptable method of estimating bad debts o b. Tutor uses the income statement approach in estimating uncollectible accounts expense and uncollectible accounts expense is estimated to be 3 of credit sales. When accounting for uncollectible accounts and recording the expense entry it s critical to follow established write off procedures and to save supporting documentation. Click here to read aging method.