Traditional Income Statement Equation

Variable cost includes direct material direct labor variable overheads and fixed overheads.

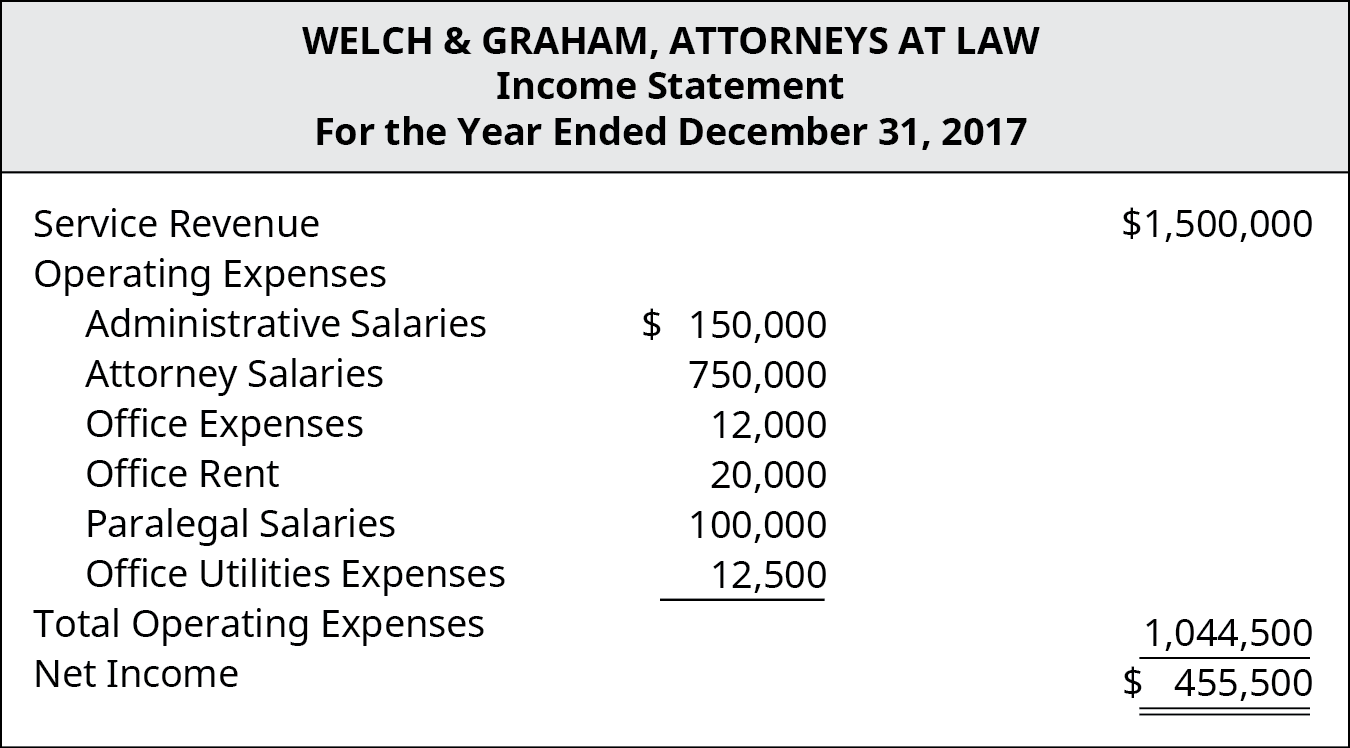

Traditional income statement equation. Cost of goods sold net income revenues cost of goods sold net income revenues login. Traditional income statement also known as a profit and loss statement a traditional income statement shows the extent to which a company is profitable or not during a given accounting period. Let s take a look at a multi step income statement example. Cost of goods sold operating expenses net income b.

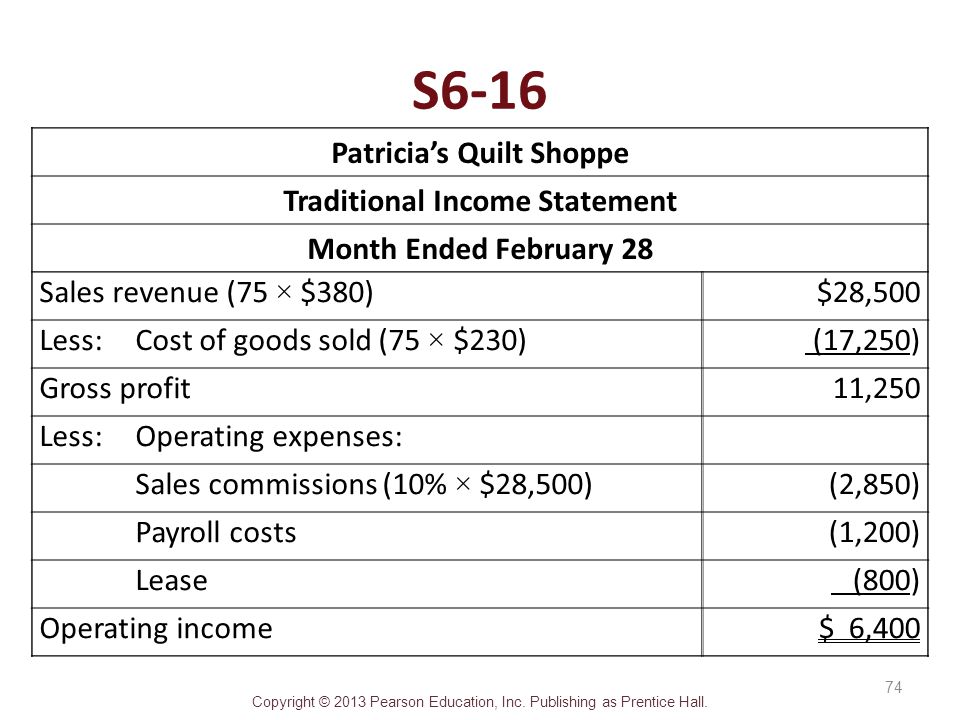

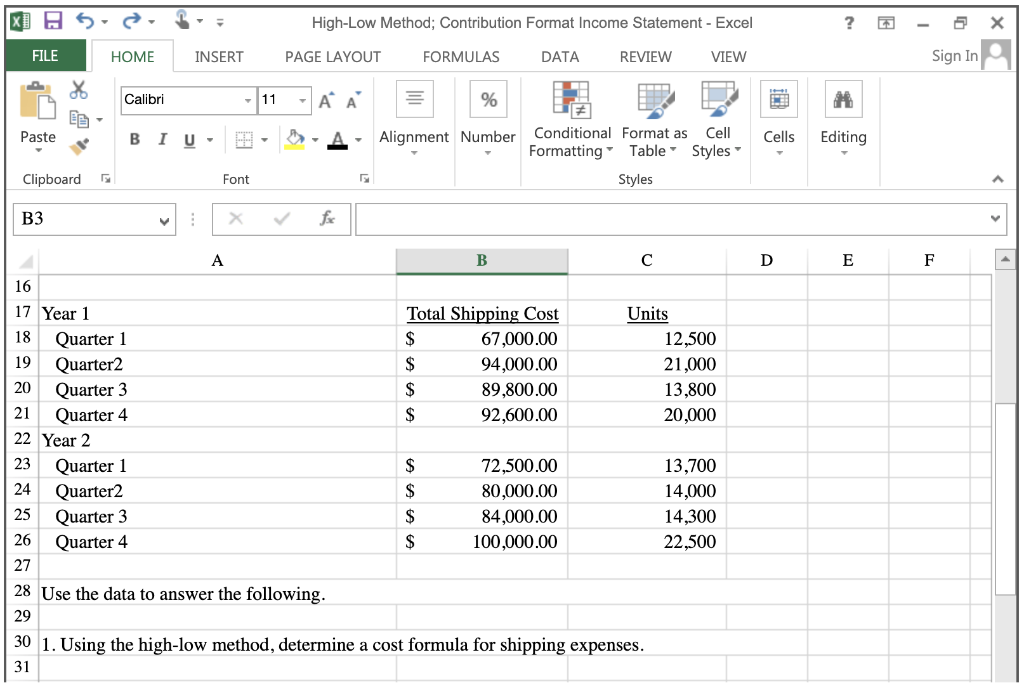

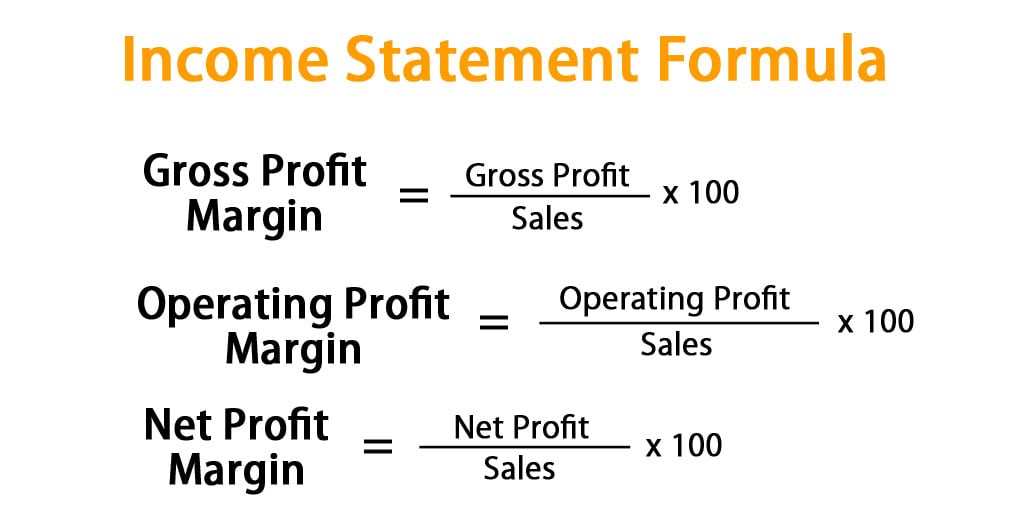

The income statement summarizes a company s revenues and expenses over a period either quarterly or annually. The income statement formula under multiple step method can be aggregated as below net income revenues non operating items cost of goods sold operating expenses explanation of the income statement formula. Problem 1 19 traditional income statement. Compute gross profit total sales cost of goods sold step 2.

It does not matter if your expenses are production expenses or selling and administrative expenses. It is calculated by subtracting any discounts allowances or returns from revenue generated during the reporting period. As you can see this multi step income statement template computes net income in three steps. Cost of goods sold cost per unit x number of units sold cost of goods sold 48 80 x 8 000.

The income statement comes in two forms multi step and single step. Example of calculating the cost of goods sold for the traditional income statement using the cost per unit that we calculated previously we can calculate the cost of goods sold by multiplying the cost per unit by the number of units sold.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)