Agriculture Income Tax Rate In Pakistan 2020

Agriculture income is defined and explained under section 41 of ito 2001.

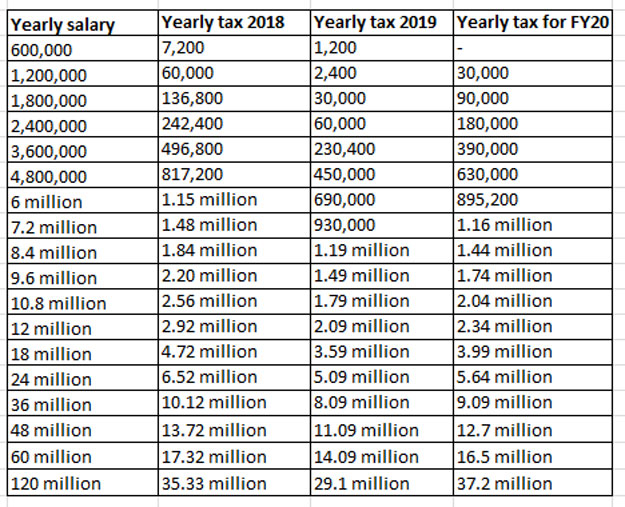

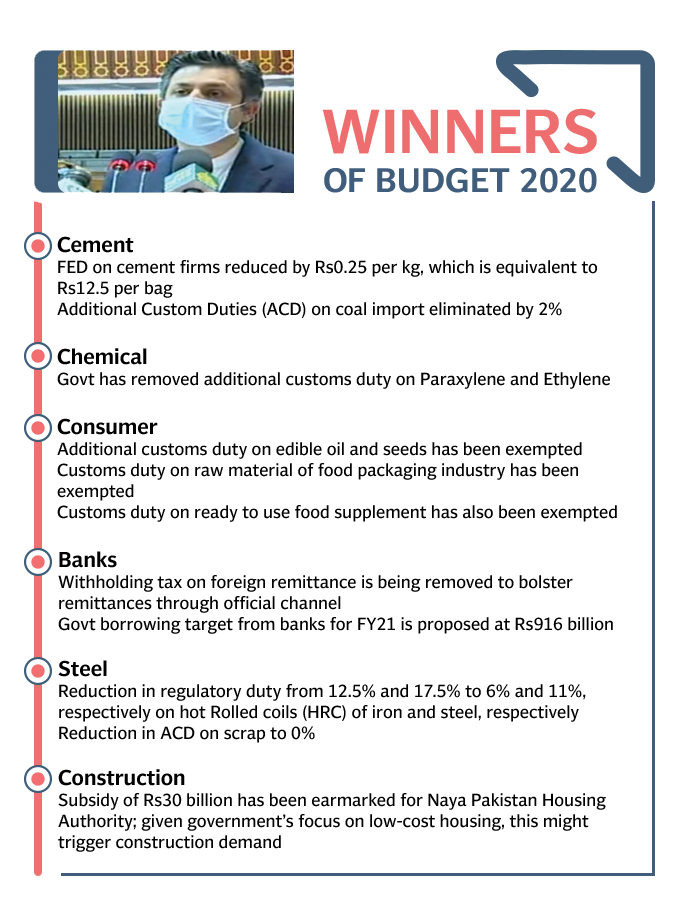

Agriculture income tax rate in pakistan 2020. Latest income tax slab rates in pakistan for fiscal year 2020 21 latest income tax slab rates in pakistan. According to the income tax slabs for fy 2020 21 a certain amount of income tax will be deducted from the salaries of individuals earning more than pkr 600 000 per annum. Please note as for these income tax rates in pakistan where a persons is not appearing in the active taxpayers list the rate of tax required to be deducted or collected as the case may be shall be increased by hundred percent of the rate specified to be deducted or collected. The agricultural income has been exempt from tax under income tax ordinance 2001.

Now compute 1 2 to arrive at the tax liability for the year. Agricultural income is defined under section 2 1a of the income tax act. As per finance bill 2019 presented by government of pakistan in general assembly june 2019 following slabs and income tax rates will be applicable for salaried persons for the year 2019 2020 who meet the following income condition. Agriculture income tax is a provincial subject under the constitution of pakistan 1973 and therefore exempted from federal taxation under income tax ordinance 2001.

The overseas investors chamber of commerce and industry oicci in its budget proposals for the financial year 2020 21 has urged the punjab government to collect the agriculture tax on net income. Agricultural income is defined in the 1973 constitution article 260 1 as follows. Compute income tax on the aggregate income i e. What is withholding tax important note.

If it will be collected then all of the poorer classes will be given relief and benefits. As per section 2 1a agricultural income generally means a any rent or revenue derived from land which is situated in india and is used for agricultural purposes. Finally income tax slab rates for salaried class in pakistan 2020 21 has published in the month of june. Here are the income tax rates in pakistan for year 2022 21.

Paragraph 1a where the income of an individual chargeable under the head salary exceeds fifty per cent 50 of his taxable income the rates of tax to be. This will help and let us to smoother up the flow of our money that also effects on the economy. Compute income tax on sum of amount of basic exemption limit plus agricultural income as per the prevailing income tax rates. Agricultural income other income as per the prevailing income tax rates.

At the time the 1973 constitution was approved the income tax act 1922 was the relevant income tax law. Fbr income tax slabs for salaried persons 2020 21.