Comparative Income Statement Calculator

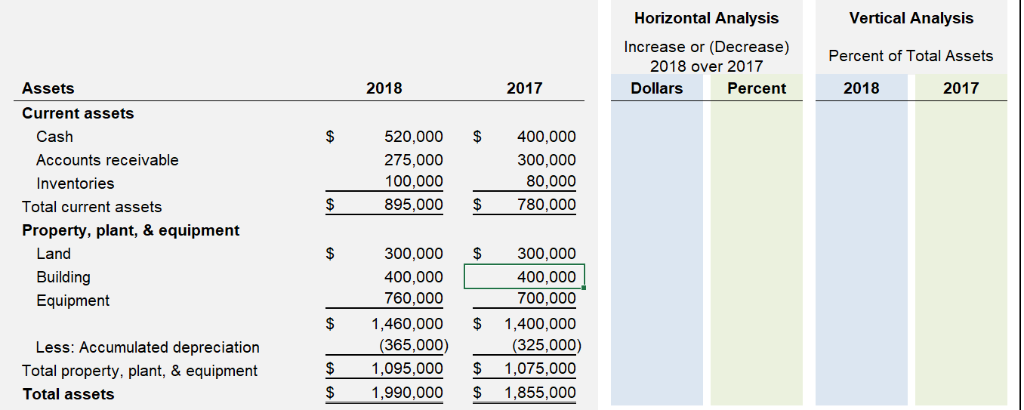

The vertical analysis formula used for each income statement line item is given by.

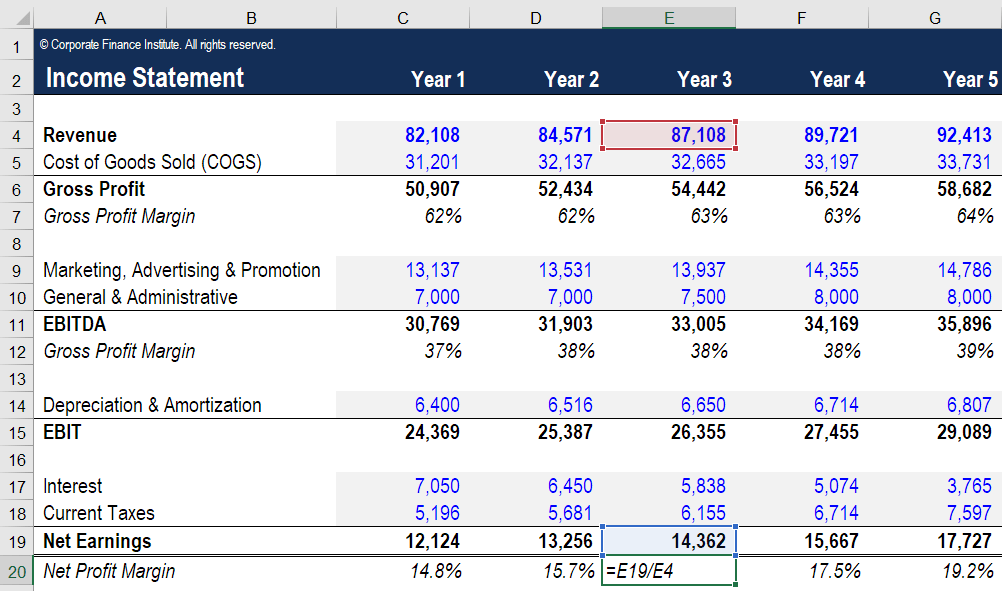

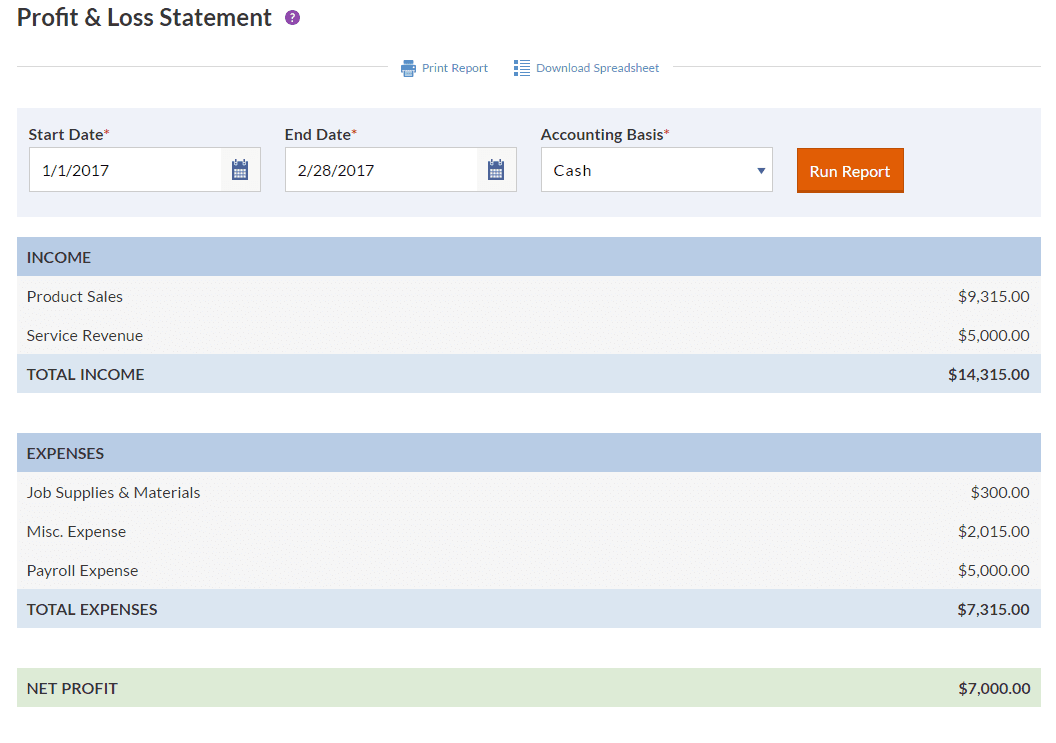

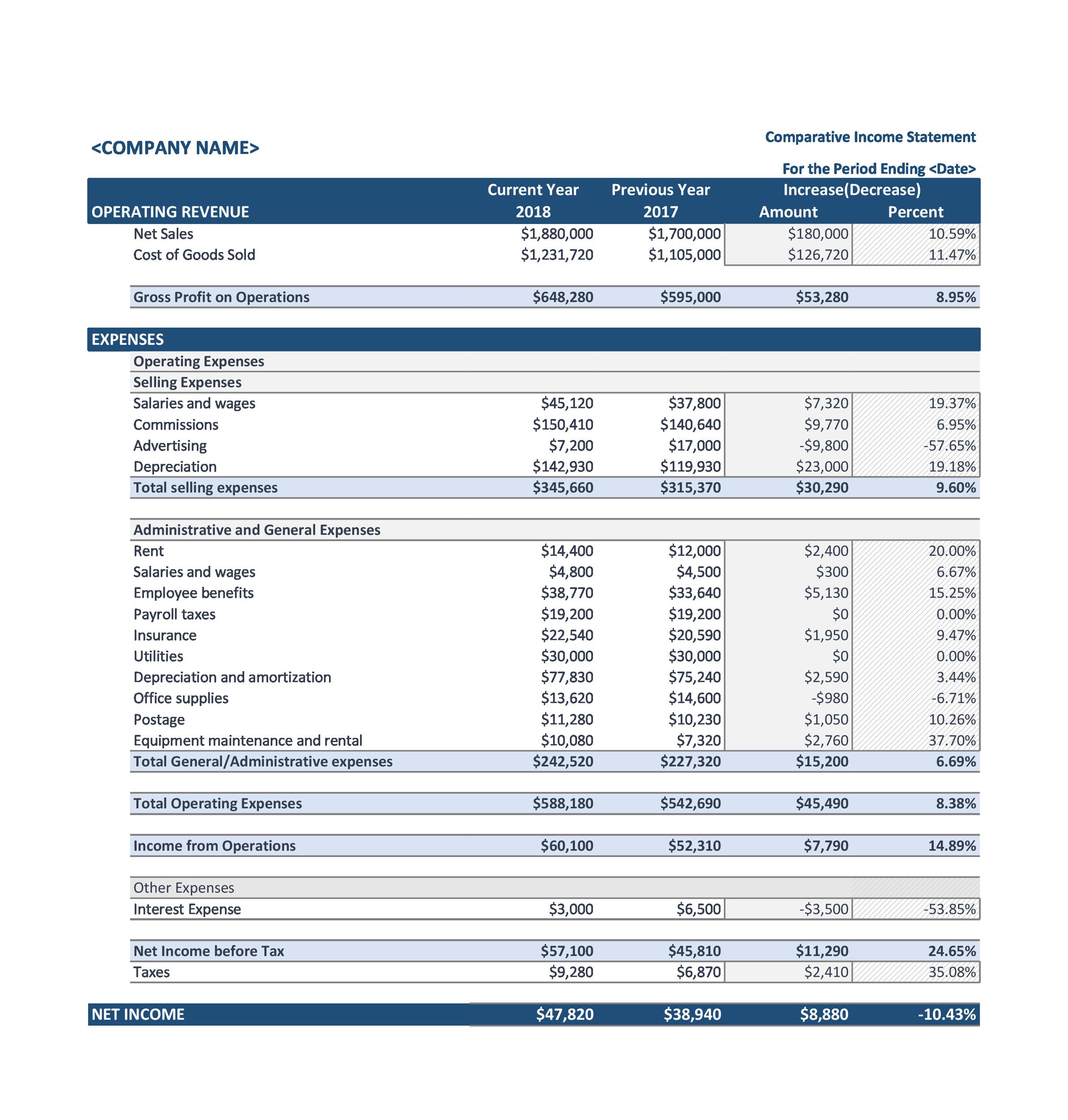

Comparative income statement calculator. The calculate will generate and display an income statement gross profit operating profit net profit. Line item line item value revenue for example if the income statement has total revenue of 40 000 and shows operating expenses of 16 000 then operating expenses are 16 000 40 000 40 0 of total revenue. Enter the total revenue cost of goods sold sales operating expenses and total costs into the calculator. The income statement formula under multiple step method can be aggregated as below net income revenues non operating items cost of goods sold operating expenses explanation of the income statement formula.

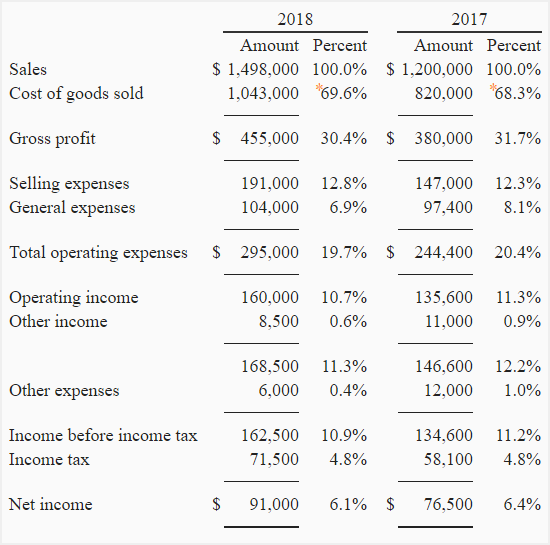

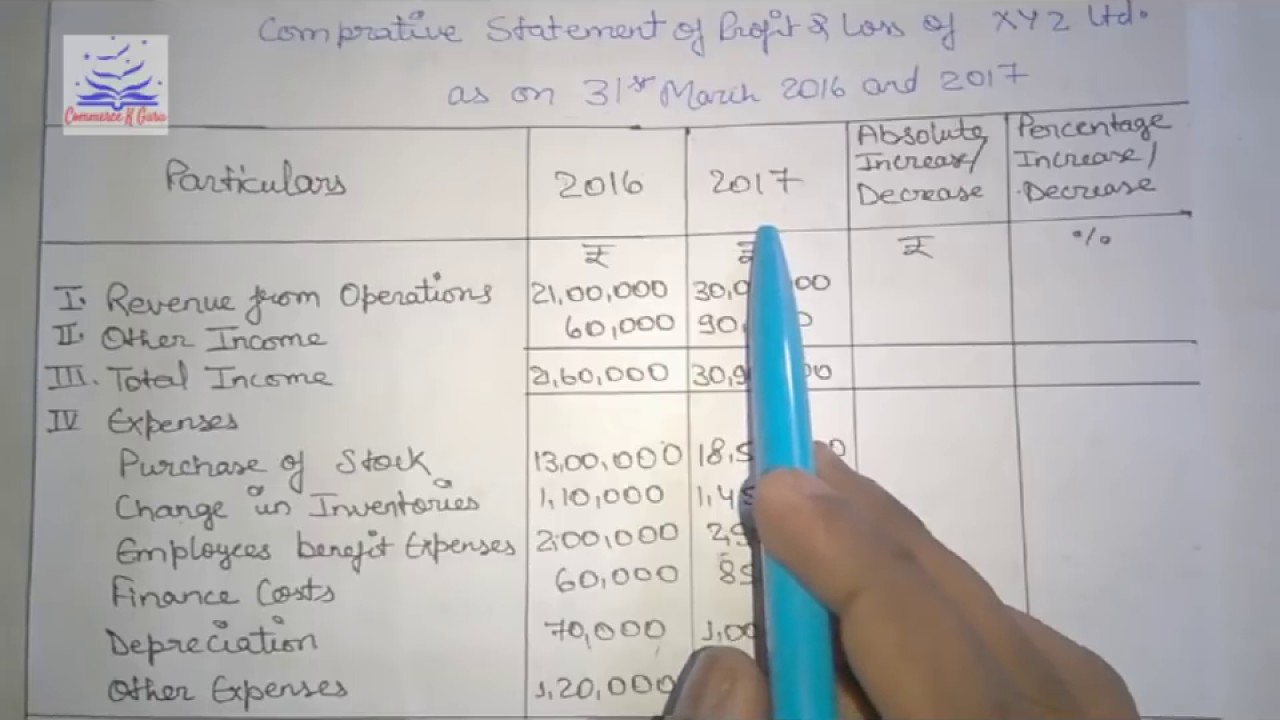

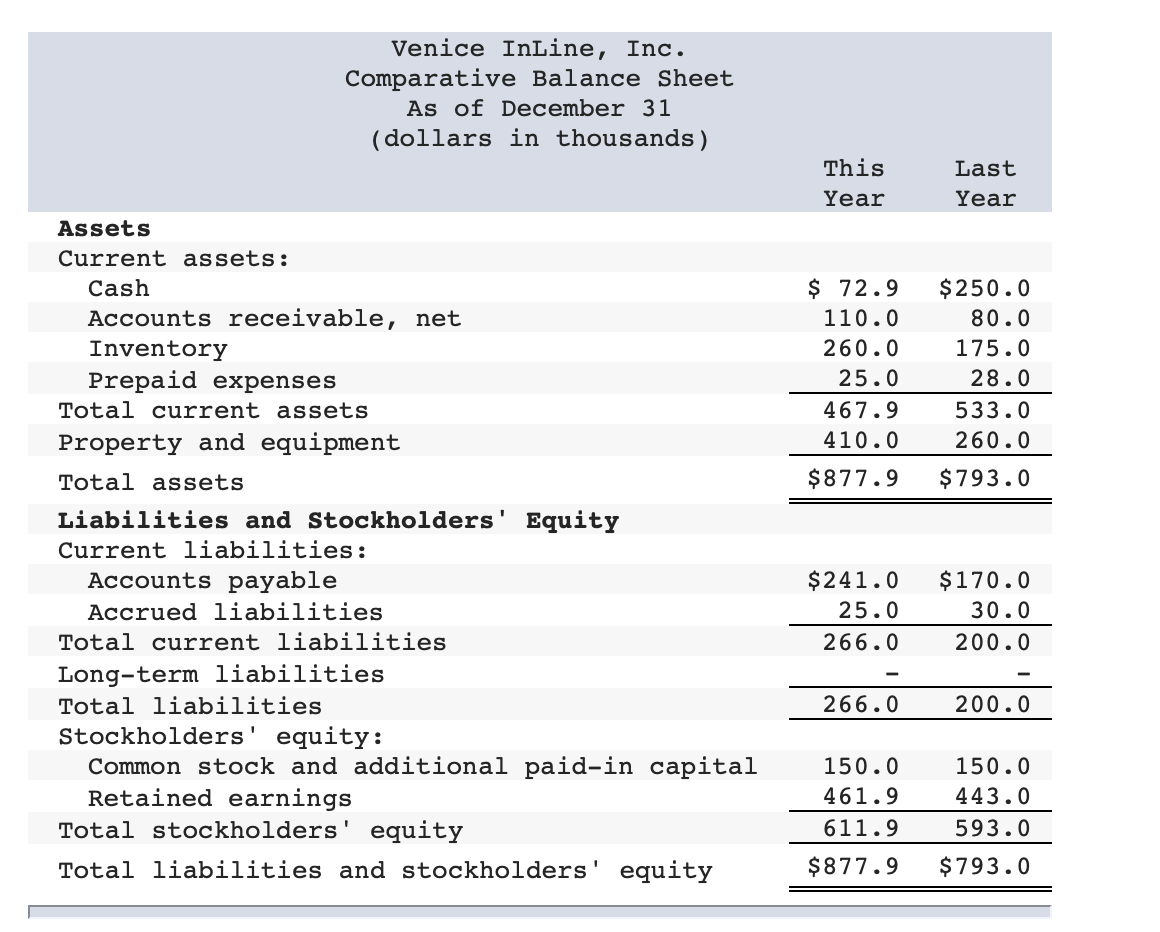

The use of the common size income statement as a comparison tool is discussed more fully in our common size income statement tutorial. Using the business s tax returns select the appropriate tax year and enter the applicable line items in the table below. Find out the absolute change in the items mentioned in the income statement. Then create columns for each accounting period with the most current closest to the left.

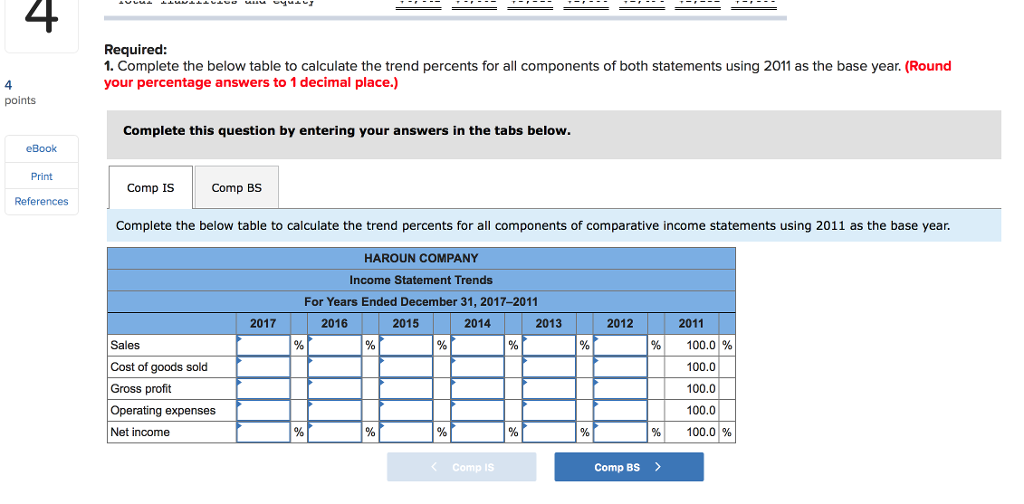

Comparative income statement format of abc limited for the period ended 2016 and 2017 based on the above comparative income statement of abc limited it can be analyzed how an increase in sales 25 over the. The comparative income statement is a very useful tool for business owners. Tvm calculator currency converter compound interest calculator return on investment roi calculator irr npv calculator bond calculator tax equivalent yield calculator rule of 72 calculator college savings calculator. The common size income statement calculator allows for two income statements to be entered so that comparisons can be made.

It provides a way to analyze the results of operations over multiple accounting periods with a few different options for review. This is done by subtracting the previous year s item amounts from the current year ones. There is no standard comparative income statement format. The easiest way to create a comparative income statement is to list the accounts in the left column.

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)