Create Income Statement Closing Journals Process

Parameter ledger or ledger set does not have any values for data access set that does not have full access to the ledger or ledger sets doc id 2304343 1 last updated on october 23 2019.

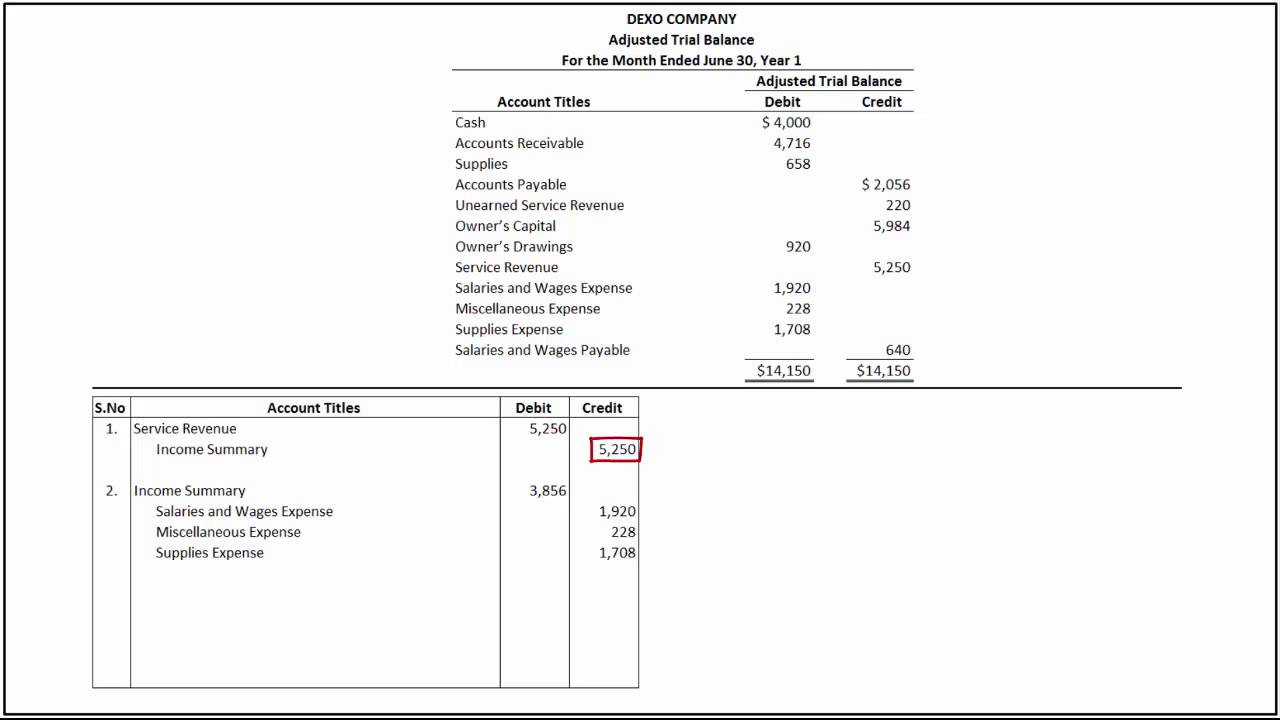

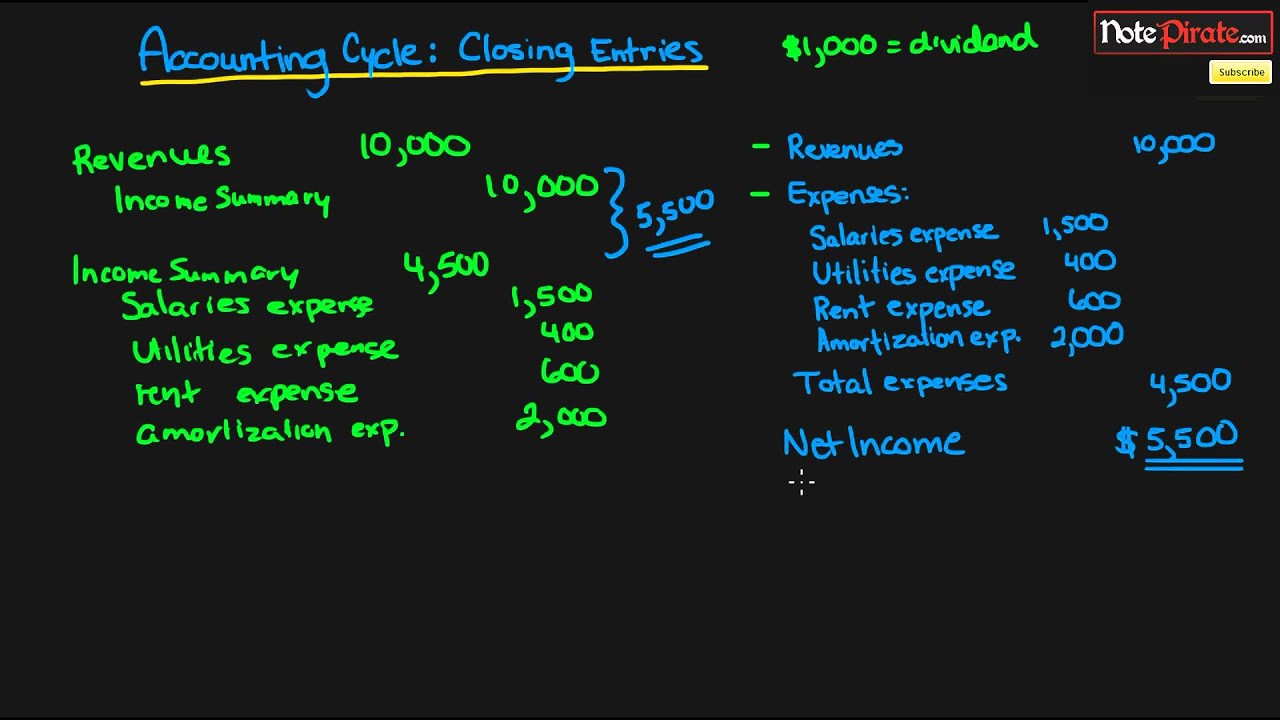

Create income statement closing journals process. The create accounting process of sla submits journal import process. Fsgs can also be published via the application desktop. Use the create income statement closing journals process to meet audit requirements. The balance in income summary now represents 37 100 credit 28 010 debit or 9 090 credit balance does that number seem familiar.

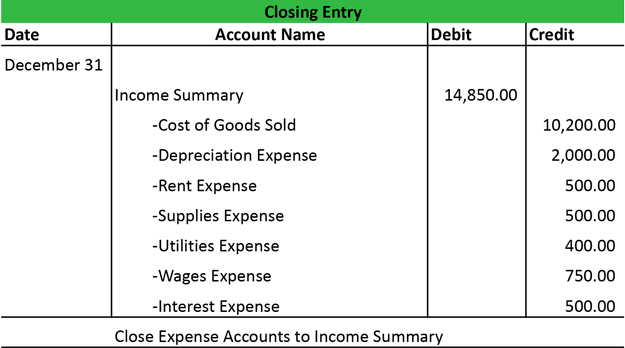

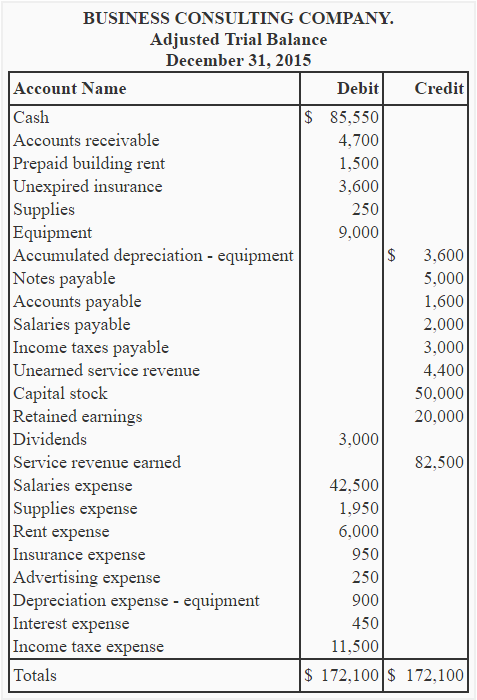

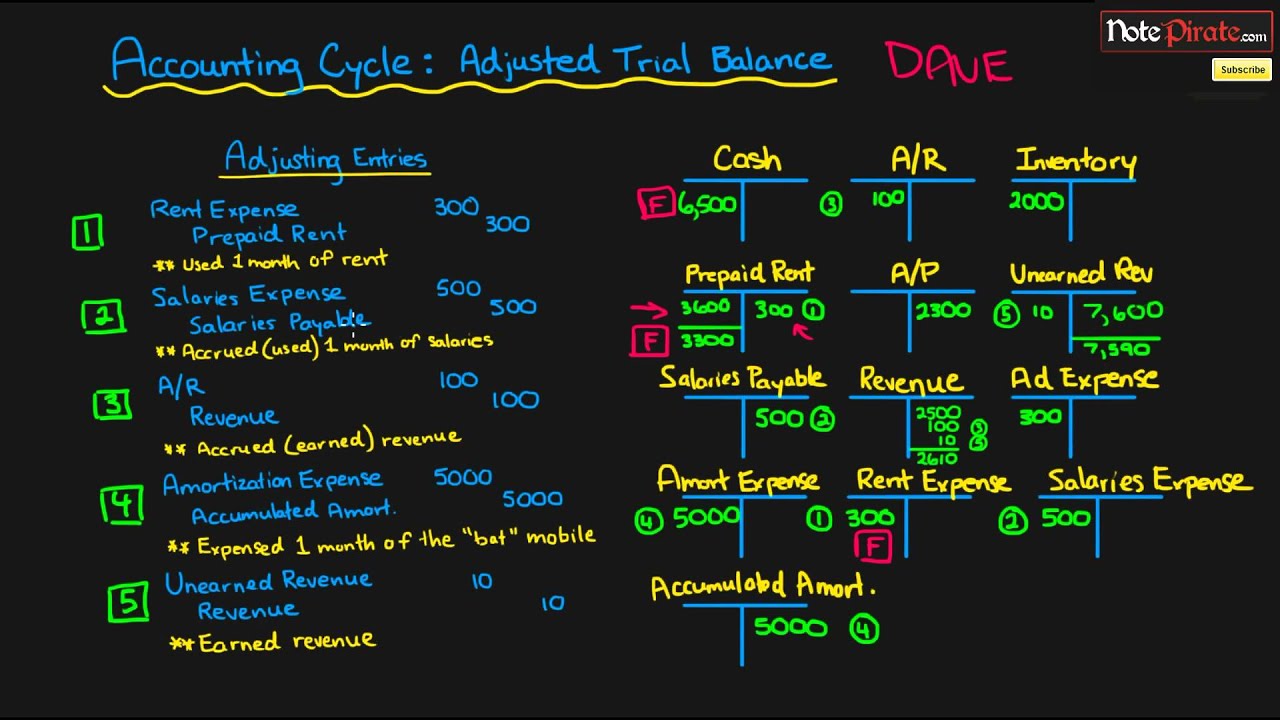

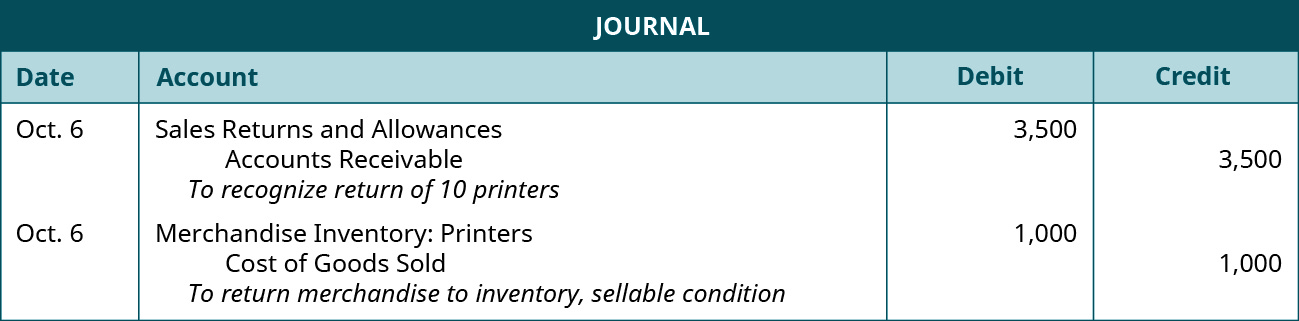

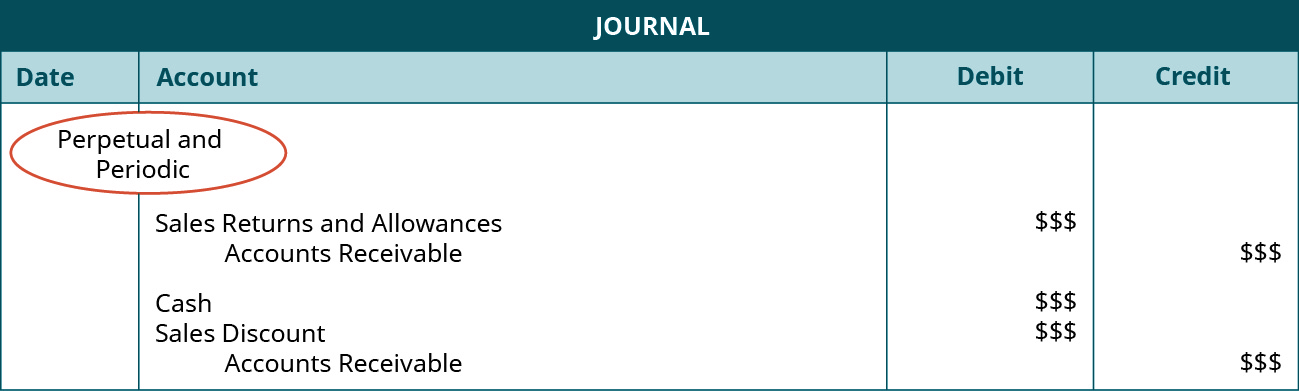

The preparation of closing entries is a simple four step process which is briefly explained below. The process of preparing closing entries. When you run the process create income statement closing journals and you enter an account for the field closing account in the parameters window entries are posted against each revenue and expense account in the account range processed. Close process create income statement closing journals navigation.

In other words the income summary account is simply a placeholder for account balances at the end of the accounting period while closing entries are being made. It is the reciprocal of the account s ytd balance and zeroes out each account. Oracle fusion general ledger cloud service version 11 12 1 0 0 and later. Close process create income statement closing journals short code.

Close process create income statement closing journals and balance sheet at year end. This question is not answered. Transfer the balances of all revenue accounts to income summary account. The income summary account is a temporary account used to store income statement account balances revenue and expense accounts during the closing entry step of the accounting cycle.

Close income summary account. Last updated on january 02 2012. Oracle e business suite mosc general ledger ebs mosc 5 replies. It is the reciprocal of the account s ytd balance and zeroes out each account.

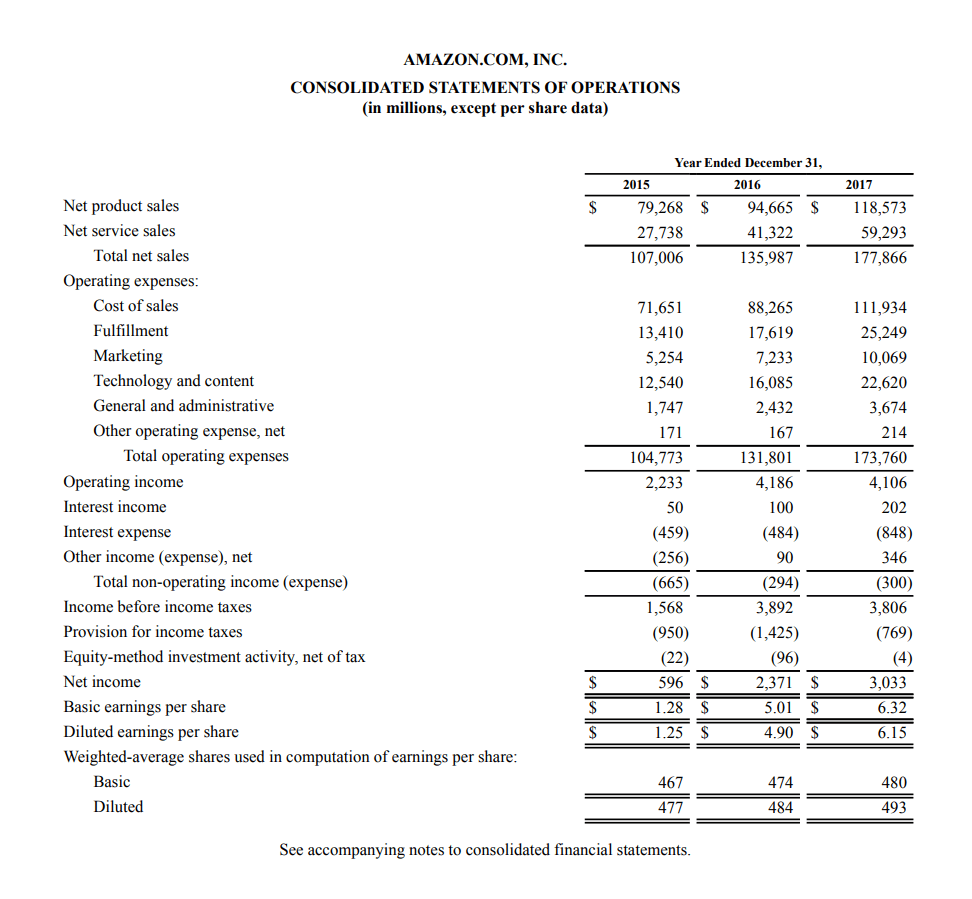

The process creates a journal entry that shows the revenue and expense account balances moved to the retained earnings account. At this point you have closed the revenue and expense accounts into income summary. To correct errors in account balances made by posting incorrect journals create and post adjusting and reversing journals. It should income summary should match net income from the income statement.

Oracle gl responsibility view requests submit a new request select single request click ok select name of concurrent program report. When you run the process create income statement closing journals and you enter an account for the field closing account in the parameters window entries are posted against each revenue and expense account in the account range processed. Step 1 closing the revenue accounts. Oracle general ledger description.