Depreciation Rates As Per Income Tax Act

Depreciation rates as per income tax for fy 2019 20 ay 2020 21.

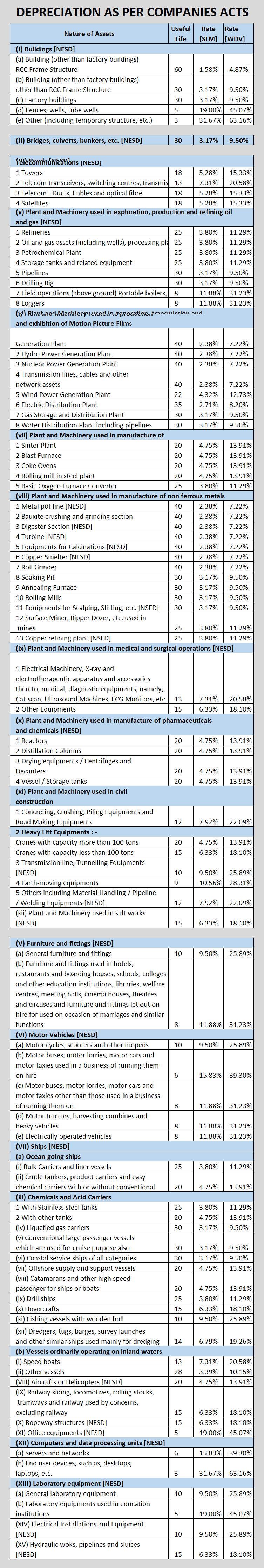

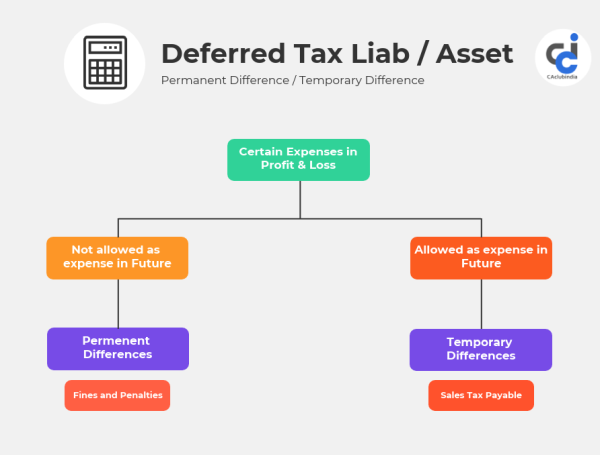

Depreciation rates as per income tax act. 1 schedule ii 2 see section 123 useful lives to compute depreciation. Methods of depreciation as per companies act 1956 based on specified rates. One of the basic differences in income tax depreciation calculation and companies act depreciation other than rates of depreciation is the method of calculation. Notes on depreciation rates on assets.

Depreciation refers to the decrease in value of an asset over a period of time. It is compulsory to calculate depreciation of assets that are used or acquired in a profession or business. 1 schedule ii 2 see section 123 useful lives to compute depreciation. The depreciable amount of an asset is the cost of an asset or other amount substituted for cost less its residual value.

Depreciation rates as per income tax act for the financial years 2019 20 2020 21 are given below. In the computation the depreciation as per income tax act 1961 is allowed while the book depreciation is disallowed. Article provides rates of depreciation as per income tax act 1961 on building plant machinery furniture fittings ships on intangibles assets i e. For which the same rate of depreciation is prescribed under sec 32 of the income tax act.

Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life the depreciable amount of an asset is the cost of an asset or other amount substituted for cost less its residual value. Depreciation is an allowance which is allowed as a deduction while computing the business income of an assessee. Depreciation chart under. Know how patents copyrights trademarks licences franchises or any other business or commercial rights of similar nature for financial year 2002 03 to 2019 20 and onwards.

This is according to the income tax act 1962 which gives the different rates of depreciation for different classes of assets. Meaning of depreciation before knowing the depreciation as per income tax act we must know the meaning of depreciation in simple words depreciation is a reduction in the value of assets over time due in particulars to wear and tear. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Depreciation under companies act 2013.

Rate chart of depreciation u s 32 of the income tax act this rate chart provided here covers the amended rates of depreciation according to the circular notified by the cbdt with notification no. Depreciation under companies act 2013. Most commonly employed methods of depreciation are straight line method and written down value method. This is because income tax act prescribes its own rate of depreciation.

In technical words we can say that depreciation is the systematic allocation of the depreciable amount of an asset over its useful life where the depreciable.