Income Statement Shows Profitability

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

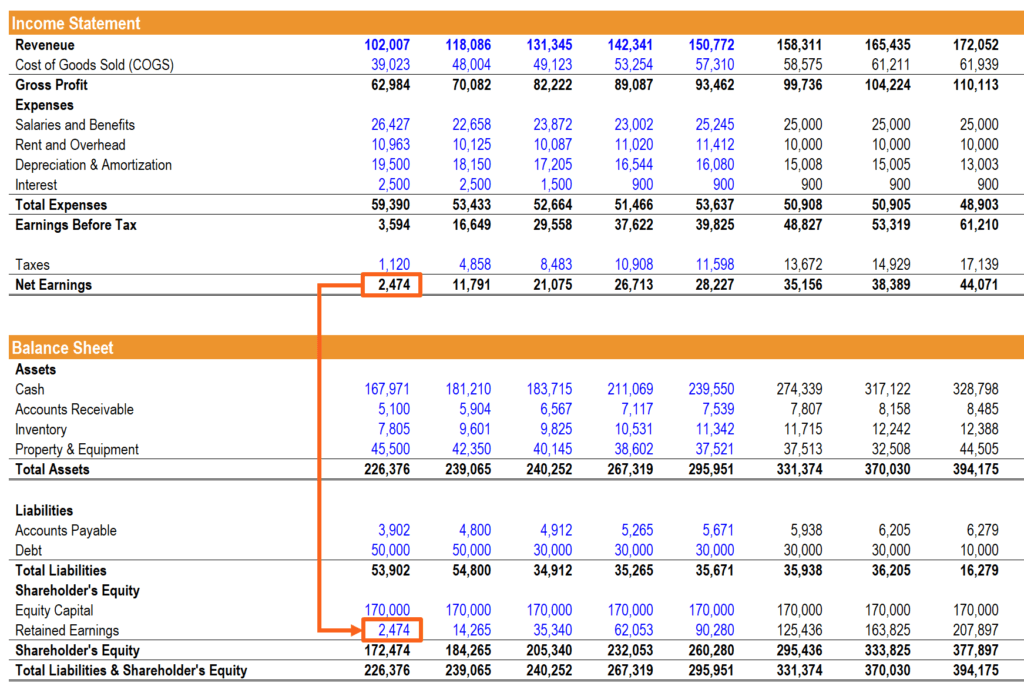

An income statement shows the totals of a company s revenues and expenses.

Income statement shows profitability. Gross margin is the difference between. What financial statements show profitability of a company. A company s financial statements are its performance scorecard. C total assets and current assets.

Many income items are also cash inflows. The income statement can either be prepared in report format or account format. Taken together they show the financial health of company and provide clues as to its future prospects. The sale of crops and livestock are usually both income and cash inflows.

For example suppose your company had a net income of 4 500 and sales of 18 875. An income statement shows profitability while a cash flow statement shows liquidity. Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income profit relative to revenue balance sheet assets operating costs and shareholders equity during a specific period of time. Using the information on your income statement you can measure how much profit your company produced per dollar of sales and how much extra cash you brought in per sale.

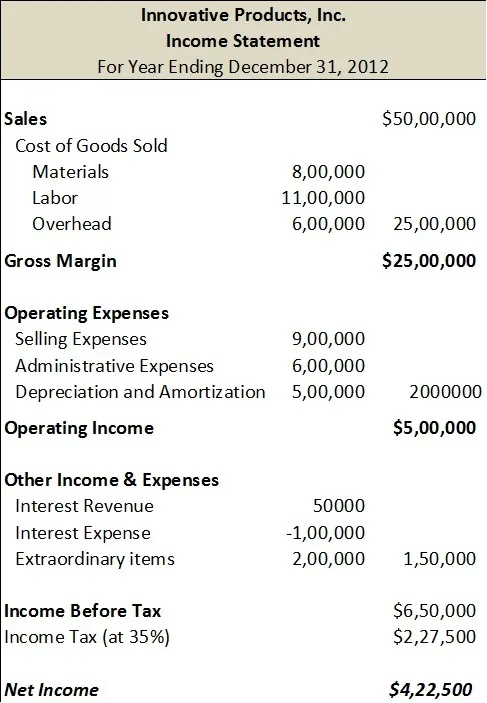

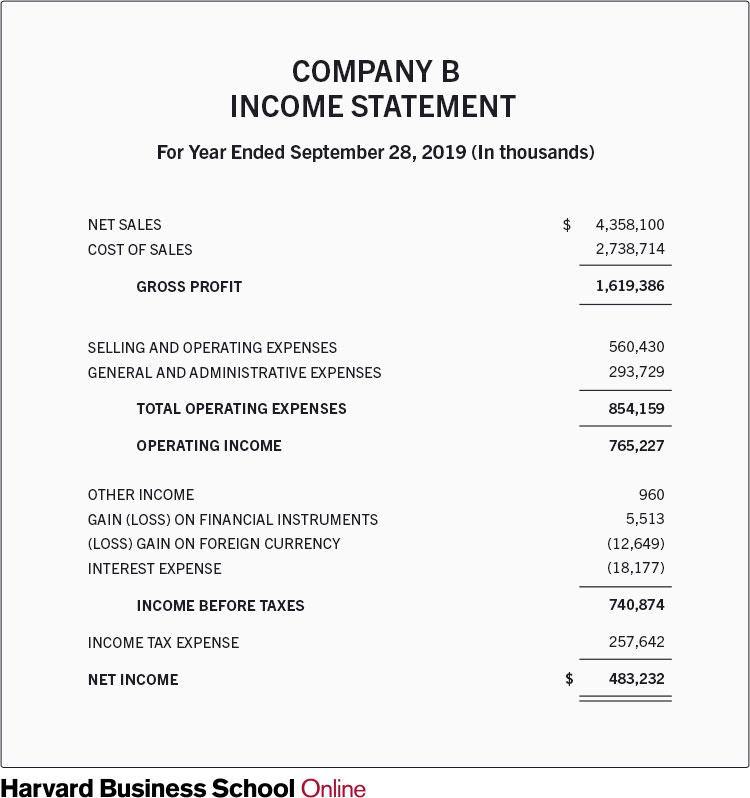

The income statement also called the profit and loss statement is a report that shows the income expenses and resulting profits or losses of a company during a specific time period. Profitability ratios focus on a company s return on investment in inventory and other assets. It matches all revenues from selling goods and services against all expenses including interest depreciation and. A revenue and net income.

They show how well a company utilizes its assets to produce profit. The income statement balance sheet and cash flow statement are primary financial. The income statement is one of a company s core financial statements that shows their profit and loss over a period of time. The timing is also usually the same cash method of accounting as long as a check is received and deposited in your account at the time of the.

These ratios basically show how well companies can achieve profits from their operations. An income statement is one of the three major financial statements that reports a company s financial performance over a specific accounting period. The net profit margin shows how much of. You calculate ros by dividing net income before taxes by sales.

The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement is one of three statements used in both corporate finance including financial modeling and accounting.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/Apple10KIS-00e74dfe3f34479180ac7ede7b982292.jpg)