How Are The Income Statement And Balance Sheet Linked When Closing Accounts

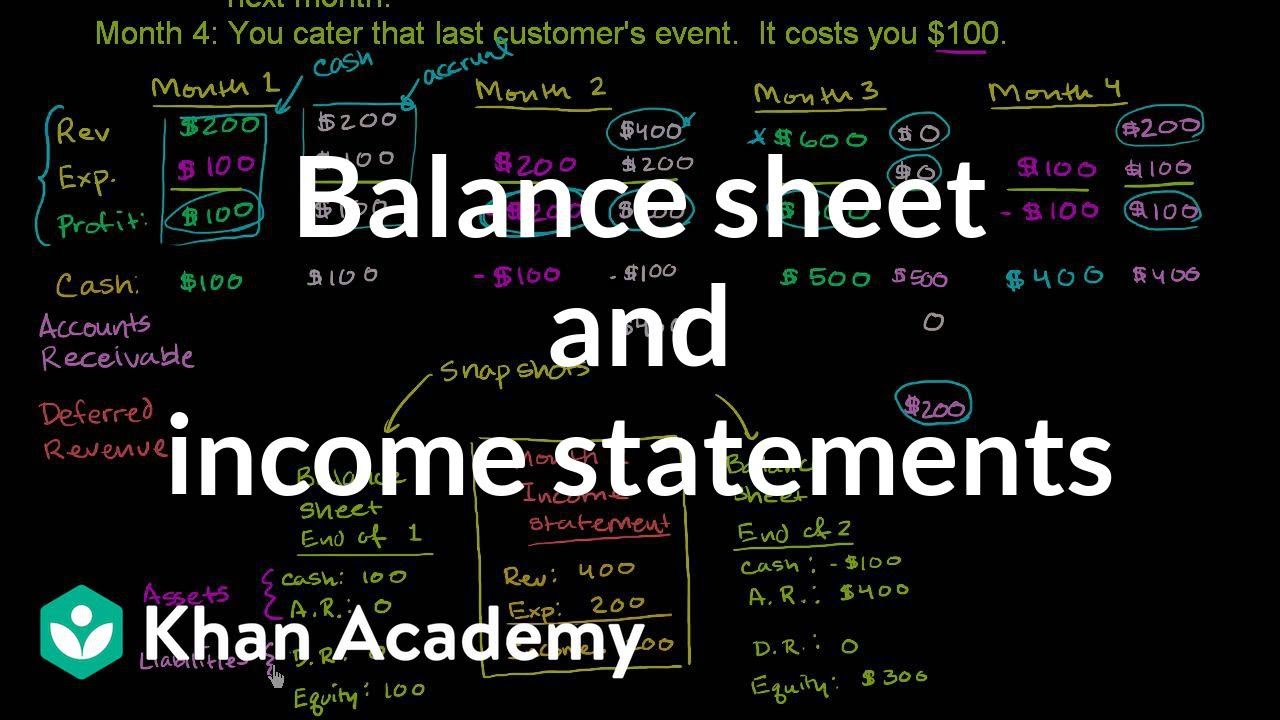

It doesn t show day to day transactions or the current profitability of the business.

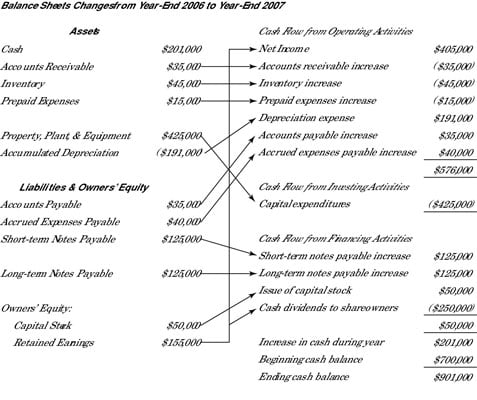

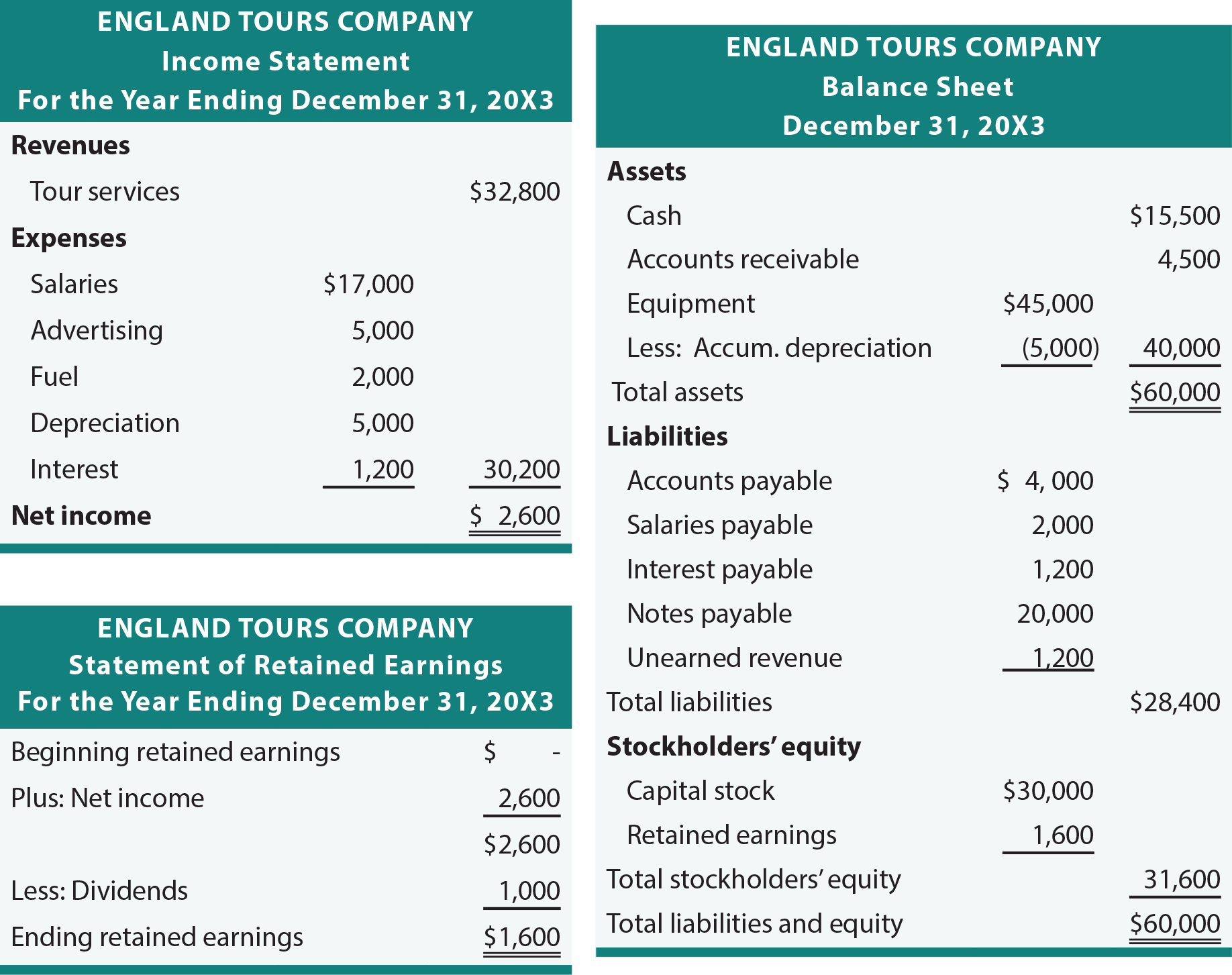

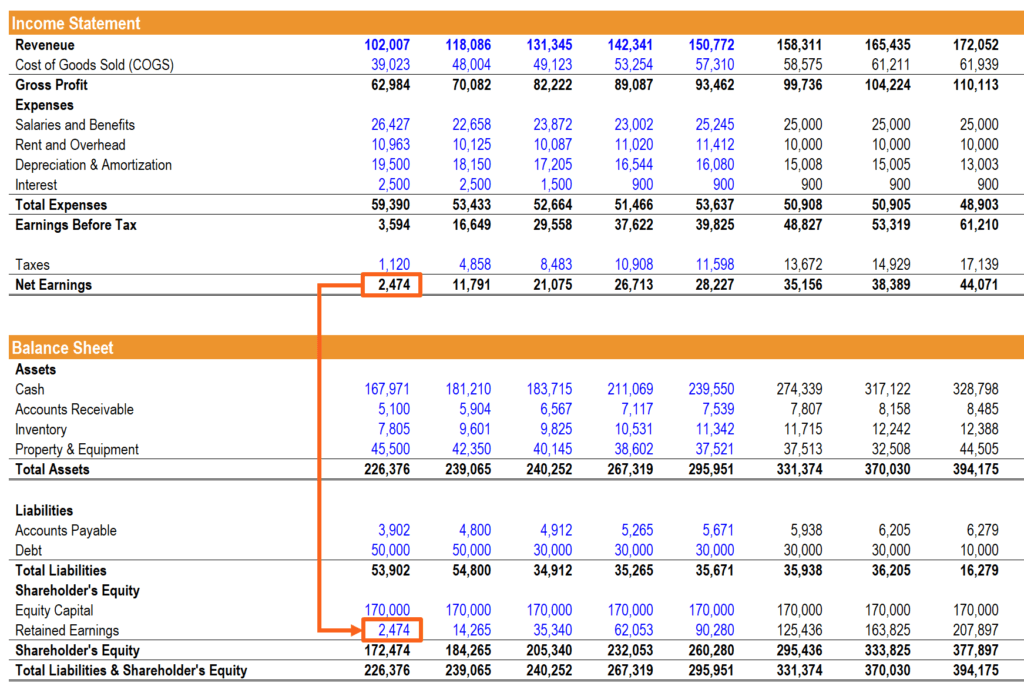

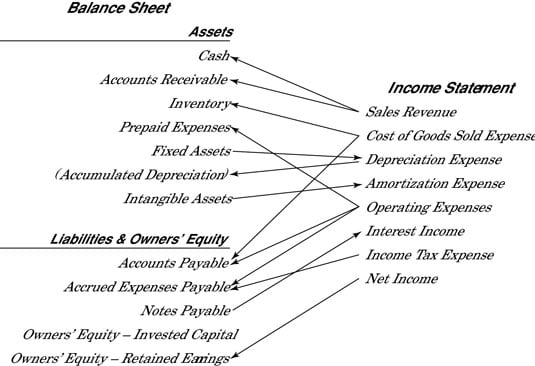

How are the income statement and balance sheet linked when closing accounts. It buys goods costing 500 for cash and sells them on credit to customers for 800. The balance sheet by comparison provides a financial snapshot at a given moment. Here s a quick summary explaining the lines of connection in the figure starting from the top and working down to the bottom. It should income summary should match net income from the income statement.

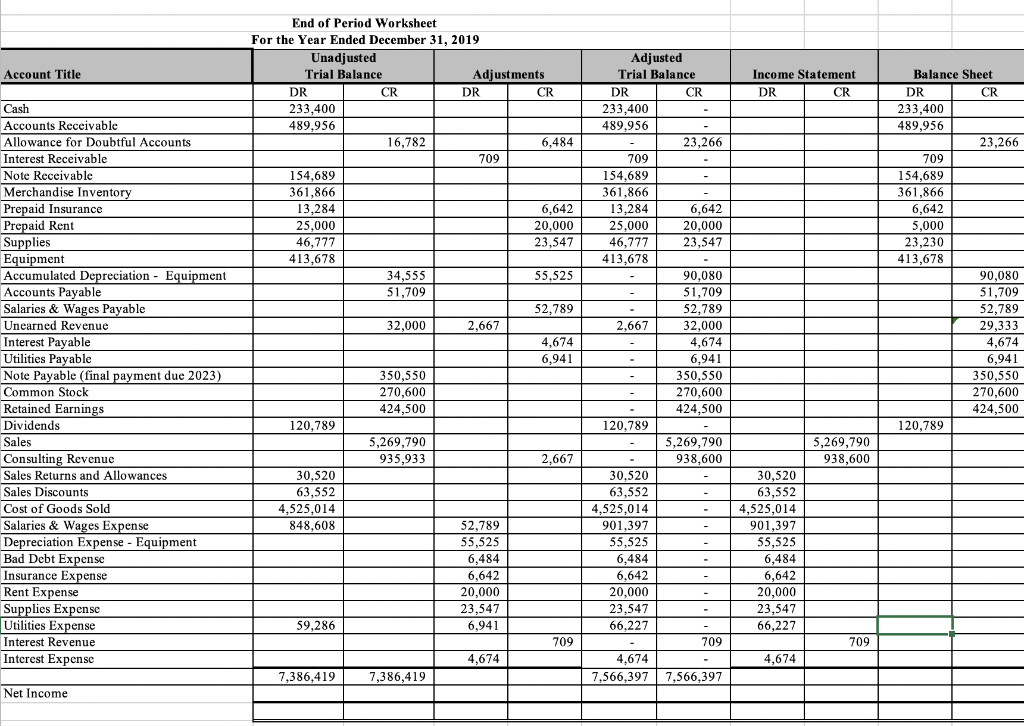

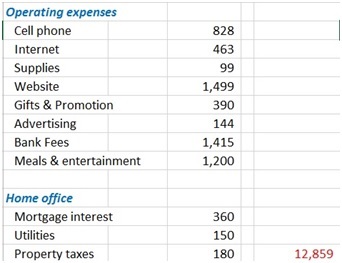

If you verify the ending balances in the relatively few balance sheet accounts you can have confidence that the income statement has the proper. The link between the balance sheet and income statement is helpful for bookkeepers and accountants who want some assurance that the amount of net income appearing on the income statement is correct. The process of closing out temporary accounts means that you re looking at how much you made or lost during the accounting period and adding it to your business running total of profits. Connections between income statement and balance sheet accounts.

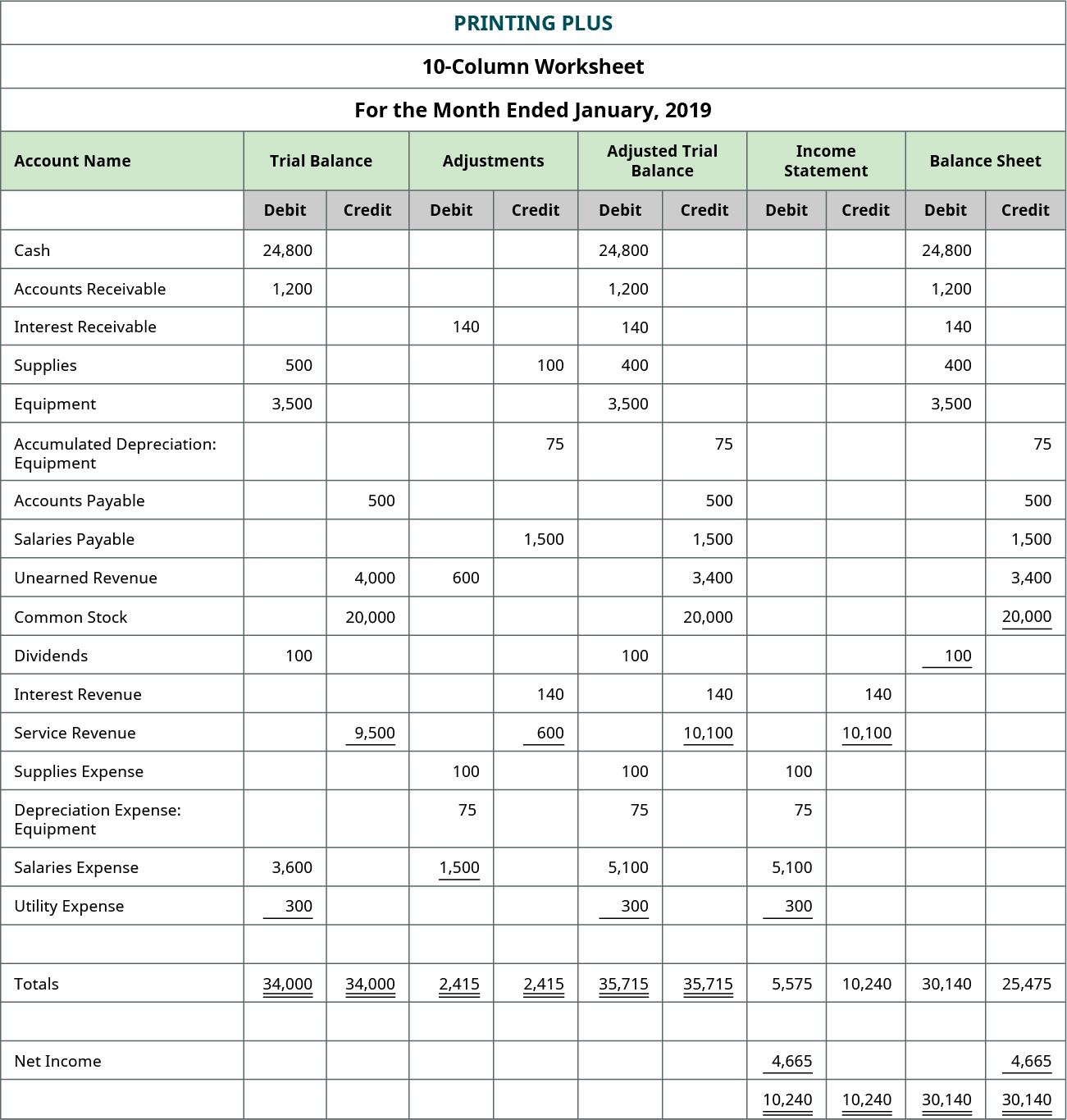

This is commonly referred to as closing the books. For example the revenues account records the amount of revenues earned during an. Create a closing journal entry to transfer the balance from the income summary account to the company s equity account. This is where your permanent accounts like retained earnings live.

The profit and loss p l account summarises a business trading transactions income sales and expenditure and the resulting profit or loss for a given period. Example of how the balance sheet and income statement are connected to illustrate the connection between the balance sheet and income statement let s assume that a company s owner s equity was 40 000 at the beginning of the year and it was 65 000 at the end of the year. Temporary accounts are income statement accounts that are used to track accounting activity during an accounting period. At this point you have closed the revenue and expense accounts into income summary.

The sum of the last period s closing cash balance plus this periods cash from operations investing and financing is the closing cash balance on the balance sheet if you want to see a video based example watch cfi s webinar on linking the 3 statements cfi webinar link the 3 financial statements this cfi quarterly webinar provides a live. The balance in income summary now represents 37 100 credit 28 010 debit or 9 090 credit balance does that number seem familiar. In other words the temporary accounts are closed or reset at the end of the year. For example if a corporation s net income for the year is 45 000 the closing entry will be a debit of 45 000 to the income summary account and a credit of 45 000 to retained earnings.

Making sales and incurring expenses for making sales requires a business to maintain a working cash balance. The accounts on the balance sheet are like running totals for your business. However many of its figures relate to or are affected by.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)