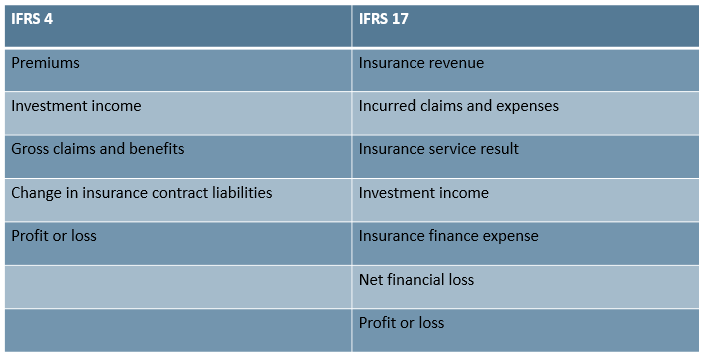

Ifrs 17 Income Statement Presentation

Financial highlights 15 consolidated statement of profit or loss 16 consolidated statement of profit or loss and.

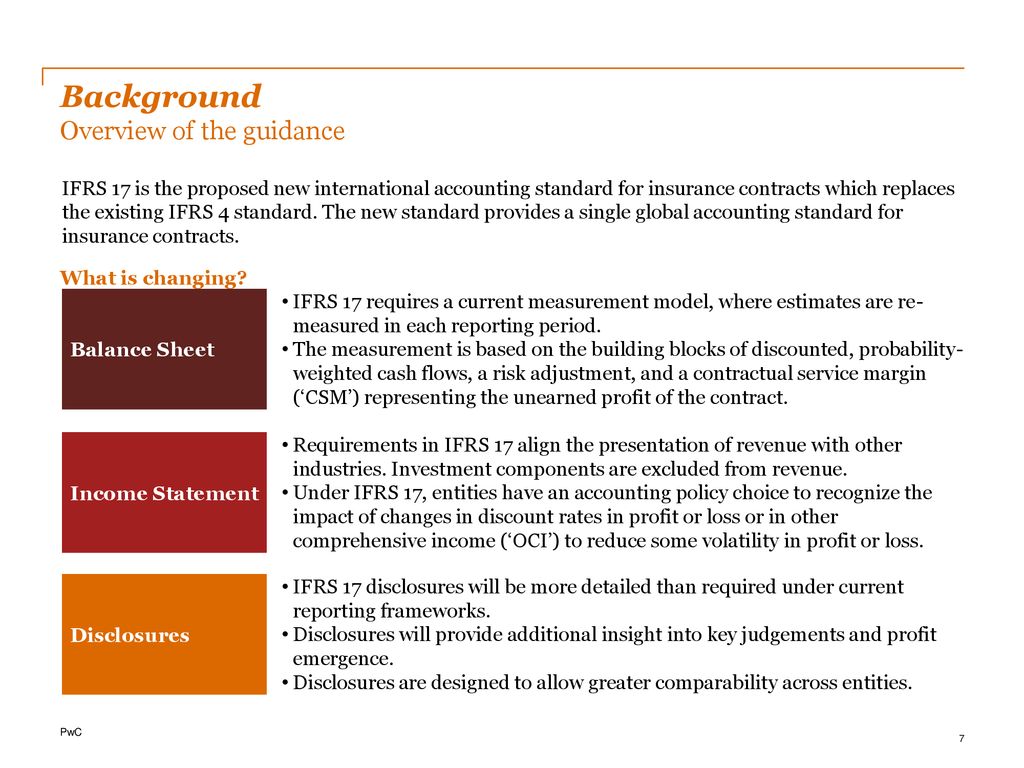

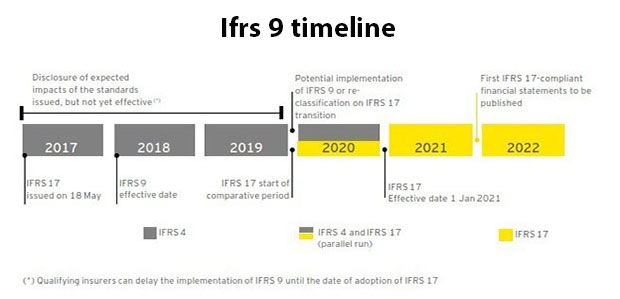

Ifrs 17 income statement presentation. In this article we highlight key considerations affecting preparers when choosing the structure format and contents of the income statement and other presentation matters. Other comprehensive income 17 consolidated statement of financial position 18 consolidated statement of changes in equity 20. Reporting of investment components separately from insurance contract. The standard requires a complete set of financial statements to comprise a statement of financial position a statement of profit or loss and other comprehensive income a statement of changes in equity and a statement of cash flows.

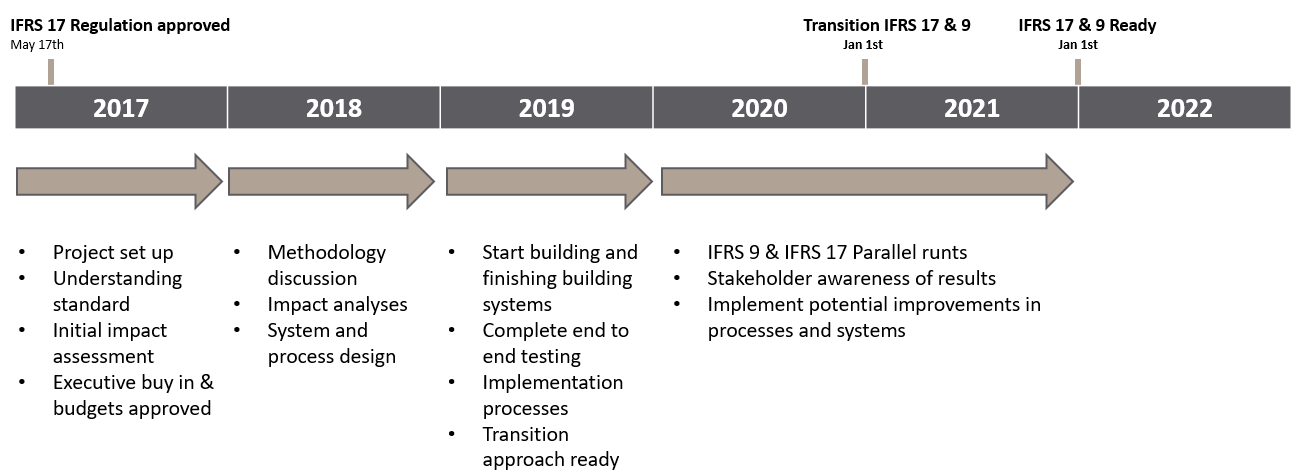

Ifrs 17 establishes the principles for the recognition measurement presentation and disclosure of insurance contracts within the scope of the standard. The objective of ifrs 17 is to ensure that an entity provides relevant information that faithfully represents those contracts. About ifrs 17 5 about the group 9 independent auditors report 10 consolidated financial statements 14. Example 3 ifrs based income statement.

Ifrs 17 has impact on all parts here we will focus on the balance sheet income statement and changes in equity balance sheet the presentation of the consolidated balance sheet will often only have minor changes. This information gives a basis for users of financial statements to assess the effect that insurance contracts have. Ifrs preparers have some flexibility in selecting their income statement format and which line items headings and subtotals are to be presented on the face of the statement. Presentation of financial statements 231 v example disclosures for entities that early adopt ifrs 9.

Employee benefits 2011 255 vii example disclosures for entities that. Suppose pqr is a uk based company that follows ifrs for reporting. The insurance assets and insurance liabilities need to be splits right now they can be aggregated same holds for the reinsurance. In the above example we can see that apart from normal entities all the activities that are unusual and continuous are also taken into count.

Detailed analyses of movements in insurance liabilities in the period. Financial instruments 2010 233 vi example disclosures for entities that early adopt ias 19. Presentation and disclosure ifrs 17 will transform the presentation ofinsurers income statements and bring disclosure requirements which will be new to many including. Ias 1 was reissued in september 2007 and applies to annual periods beginning on or after 1 january 2009.