Income Statement Presentation Of Impairment Loss

Presentation in financial statement.

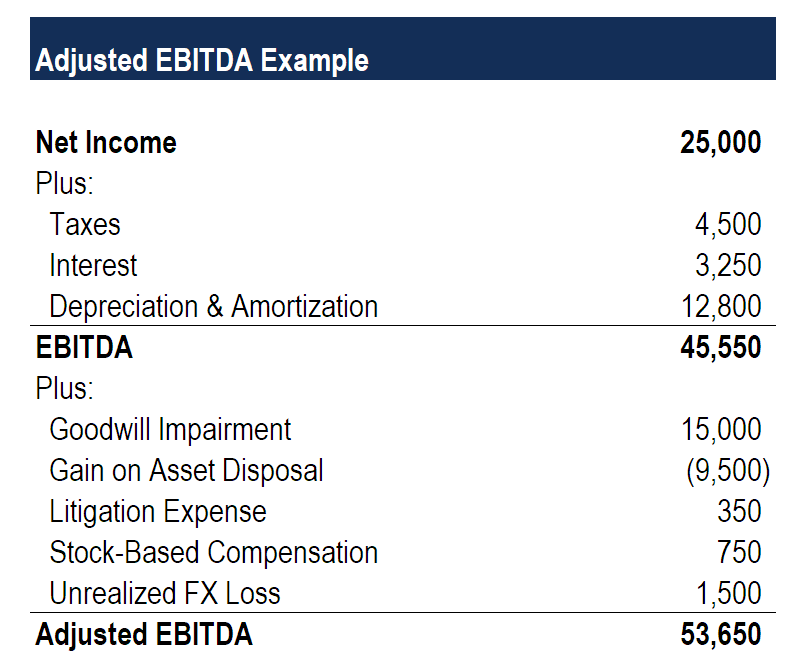

Income statement presentation of impairment loss. The technical definition of impairment loss is a. Depreciation is charged on value of property plant and equipment after charging impairment loss le. The remainder 30 000 will have to be written off as an expense in the period and the asset s carrying amount will now be its recoverable amount 120 000. The amount of the impairment loss reduces the carrying amount of the asset on the balance sheet and reduces net income on the income statement.

We will look here how the impairment asset is disclosed in the financial statements as. Finally the depreciation schedule must be adjusted to the amount of impairment loss recognized. The amount that should be recorded as a loss is the difference between the current fair market value of the asset and its carrying value or amount i e the amount equal to the asset s recorded cost. The disclosures required by u s.

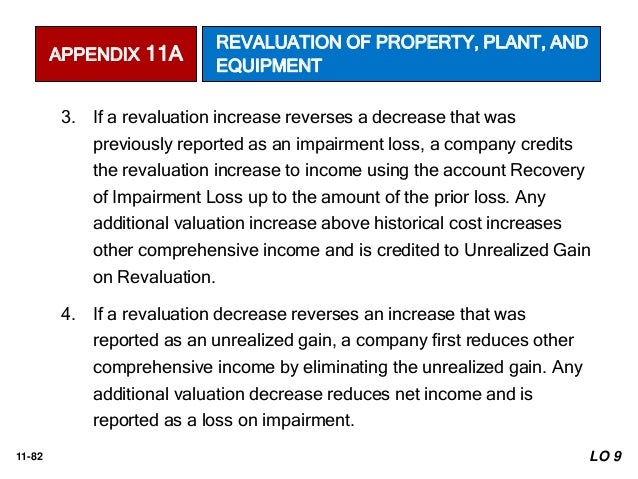

An impairment is recognized as a loss on the income statement and as a reduction in the goodwill account. Asset impairment accounting affects asset reduction in the balance sheet and impairment loss recognition in the income statement. Recoverable amount higher of the fair value less costs to sale and value in use i e. A loss on impairment is recognized as a debit to loss on impairment the difference between the new fair market value and current book value of the asset and a credit to the asset the loss will reduce income in the income statement and reduce total assets on the balance sheet.

Also known as an impairment charge an impairment loss happens when a company writes off products or assets that it considers damaged unusable or less worthy operationally and financially speaking. New value of asset 28 000 x 10 2800. As the office building has no residual value the. If an asset is impaired the impairment loss is recognized in the income statement just like any other operating expense.

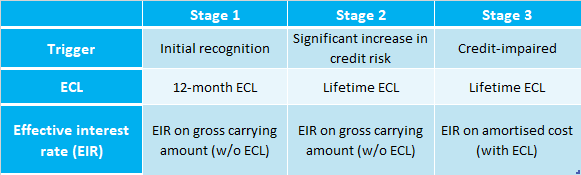

Gaap and ifrs are similar. The impairment loss is a non cash item and doesn t affect cash from operations. Of this impairment loss 10 000 may be offset against the revaluation surplus for the asset and reported as a negative figure in other comprehensive income for the year. Impairment of intangibles with indefinite lives intangible assets with indefinite lives are not amortized.

Impairment loss 8 610 000 7 270 000 1 340 000. With impairment loss being recognized the net profit is impacted negatively. The impairment of an asset reduces its value on the balance sheet. An impairment loss makes it into the total operating expenses section of an income statement and thus decreases corporate net income.