Income Calculation Worksheet Hud

Calculation results do not constitute approval for affordable housing income calculation employees earning a fixed rate applicant resident income source type employer name rate x period number of times paid per year estimated annual income x.

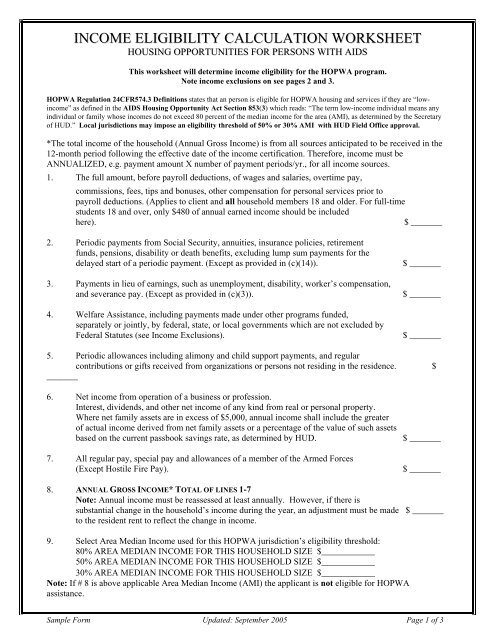

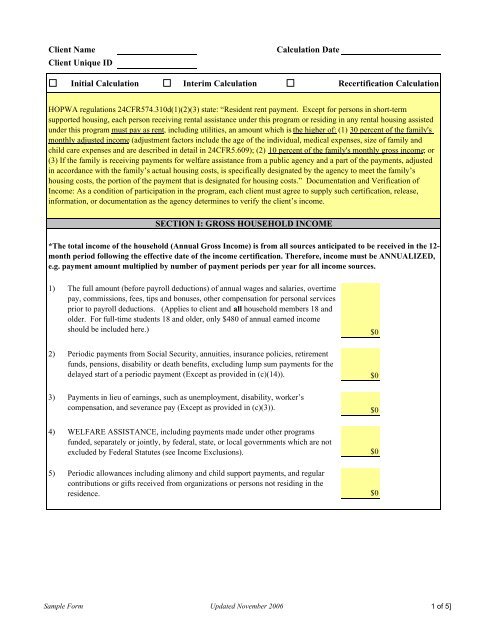

Income calculation worksheet hud. Calculate annual income based on current income. 30 monthly adjusted income line b 10 monthly gross income line a welfare rent welfare recipients in as paid localities only or 25 minimum rent. A copy of this worksheet should be kept in the hprp participant case file. 7 interest dividends and other net income of any kind from real or personal property.

This worksheet will determine the household rent payment based on the greatest of 10 of monthly gross income or 30 of monthly adjusted income. Use the worksheet below to determine and document whether an applicant household meets hprp income eligibility requirements. As of july 1 2020 hud updated the income eligibility calculator to incorporate the fy 2020 income limits for all programs. To be eligible for hprp households must be at or below 50 of the area median income ami and meet other hprp eligibility requirements.

Income calculation worksheet is intended for information purposes only. 15 600 1 300 x 12 months. All calculations that were in a user s dashboard on july 1 2020 as well as calculations completed going forward will use the fy 2020 income limits for the purposes of determining eligibility. Action types included in the income discrepancy report.

Of such assets based on the current passbook savings rate as determined by hud. O if the cash value of the family s total assets is more than 5000 asset income is the greater of. Total tenant payment ttp. For section 8 ttp is the greater of.

O if the cash value of the family s total assets is 5000 or less asset income is the actual income to be derived from these assets. This form provides a format that can be used to assess assets and anticipated income and calculate part 5 annual income in a home program. Fy 2020 income limits. For income exclusions see cpd notice 96 03.

Form hud 50059 records in tracs with an effective date that falls within the specified 3 to 15 months timeline and includes an action type of mi ar ir or ic is included in the income discrepancy report calculations. Greater of actual income derived from net family assets or a percentage of the value. Income from assets is calculated in one of two ways. Shp regulation 24 cfr 583 315 states resident rent.

The owner may calculate the family s income using either of the following two methods. Sample format for calculating part 5 annual income doc.