Income Tax Rates Zurich

Switzerland has one of the lowest income taxes in the world charging a maximum income tax of 13 20.

Income tax rates zurich. Tax holidays may apply. For zurich cantonal taxes the above rates can be applied directly. These include social security or pension fund payments expenses related to the gain of income such as employment expenses and. Your average tax rate is 13 7 and your marginal tax rate is 22 9 this marginal tax rate means that your immediate additional income will be taxed at this rate.

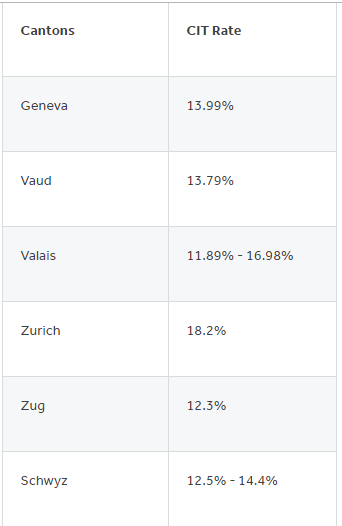

Countries with similar tax brackets include czech republic with a maximum tax bracket of 15 00 denmark with a maximum tax bracket of 18 67 and slovak republic with a maximum tax bracket of 19 00. Individual income tax rates 2019. Taking into account both the federal and the cantonal communal income tax the combined. The cantonal tax administration websites also have an online tax calculator for calculating different types of tax income tax wealth tax property gains tax profit tax.

The federal tax rate of 8 5 is levied on net income since income and capital taxes are deductible in determining taxable income the effective tax rate is 7 8. V calculation of effective taxes. This means that the tax laws and tax rates vary widely from canton to canton. Certain expenses are deductible.

The cantons are free to decide on their own tax rates. 1 6 2 income tax rates for individuals the rate of income tax is progressively graduated in accordance with the level of income. Tax rates may vary in different communities within a canton and are subject to changes in future tax years. They have the power to charge any tax that the confederation does not claim exclusive rights over.

In the canton of zurich the highest marginal income tax rates for federal cantonal and municipal taxes amount to 40 percent of the taxable income in the city of zurich. Tax is imposed at both the federal and cantonal communal levels. The tax withheld from salary is credited interest free against the assessed tax. For married persons the basic rate for cantonal taxes is an average percentage of 6 981 at a taxable income of chf 200 000.

Individual income tax rates of the capitals of the cantons for tax year 2019 for a married tax payer including federal cantonal and communal inco me taxes excluding church tax. The somewhat steeper tax rate curve for singles is at. For the additional municipal taxes the above rate has to be multiplied by the respective municipal tax factor which varies between 0 75 and 1 34 city of zurich.