Investment Income Yield Formula

Current yield formula current.

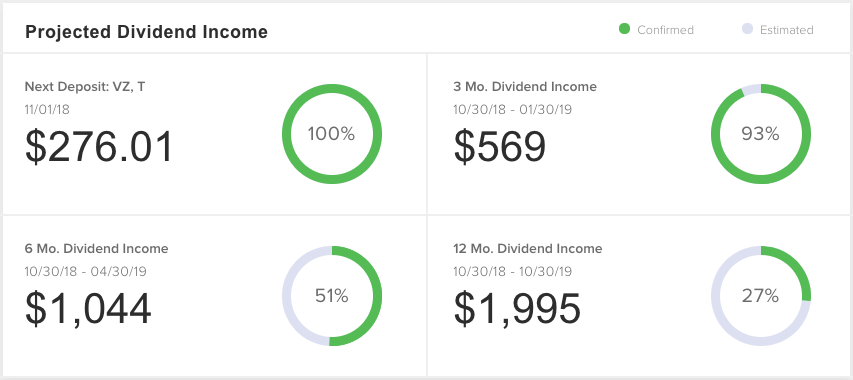

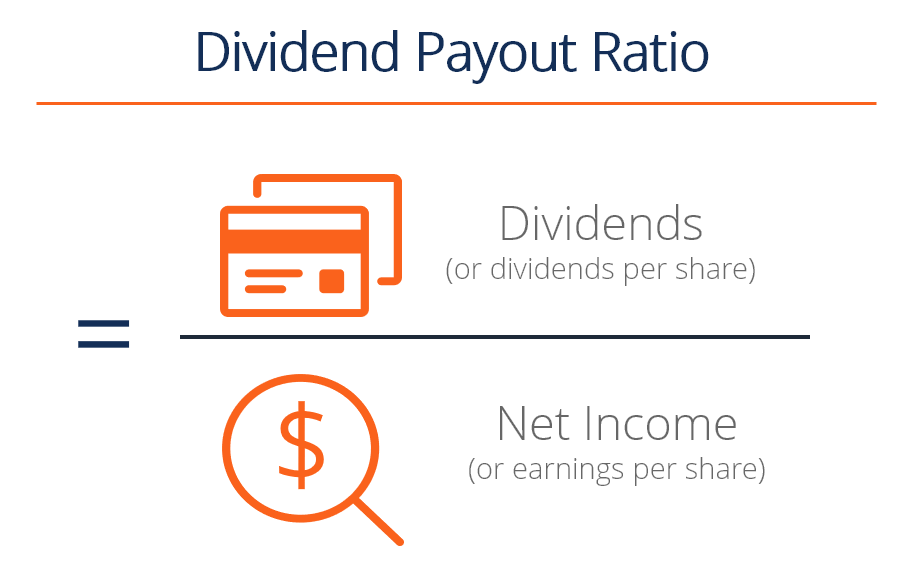

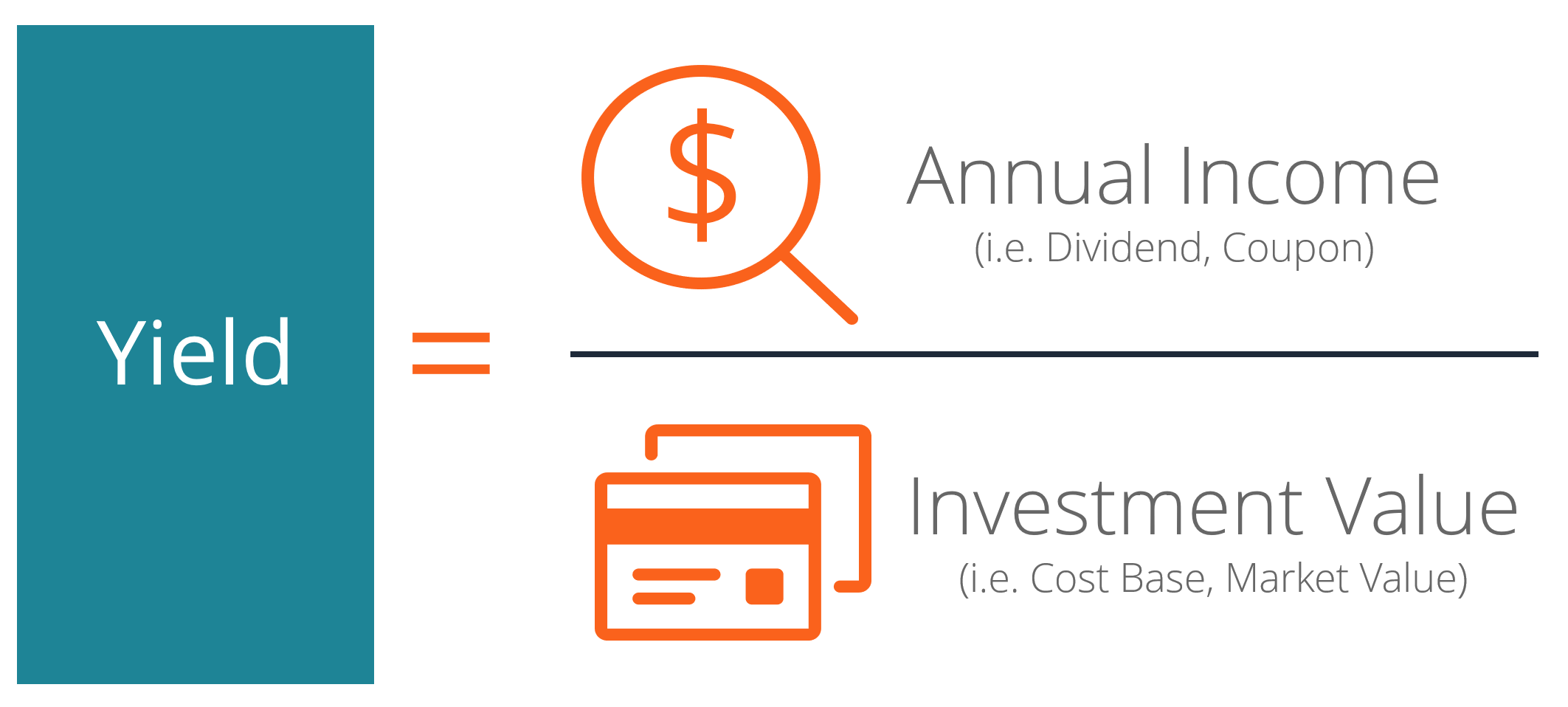

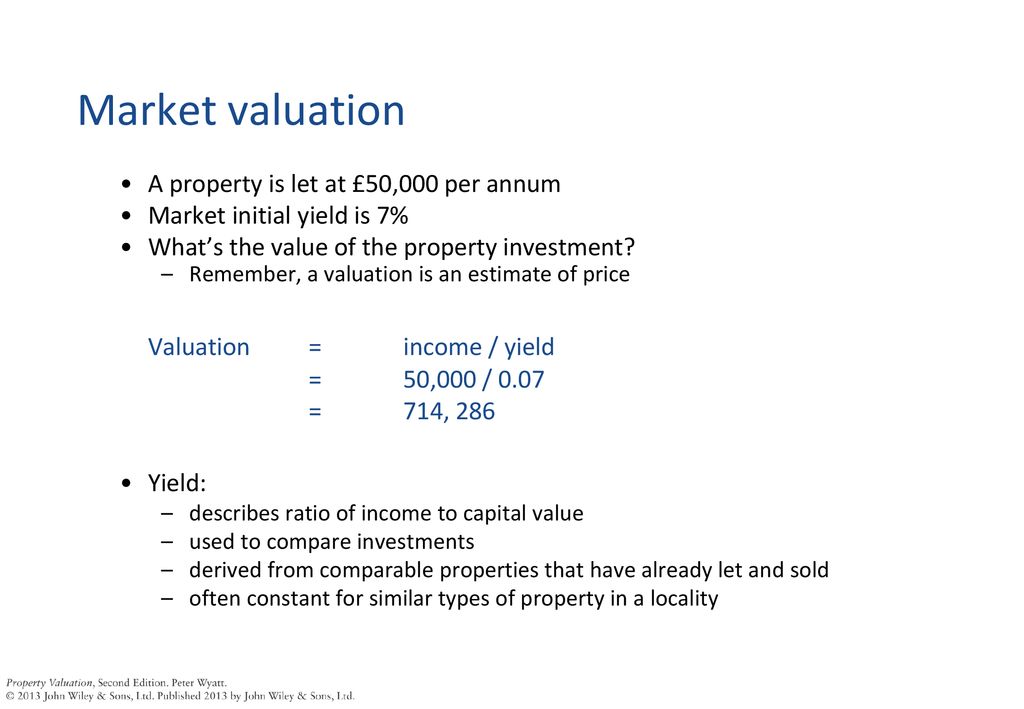

Investment income yield formula. Investment income ratio is the ratio of an insurance company s net investment income to its earned premiums used to determine profitability. The percent yield formula is a way of calculating the annual income only return on an investment return on investment roi return on investment roi is a performance measure used to evaluate the returns of an investment or compare efficiency of different investments. The term yield is simply the earnings from an investment that are generated over a period of time. Using the formula the insurance company s.

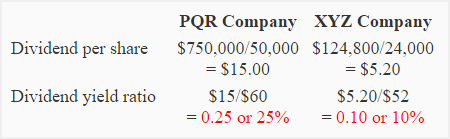

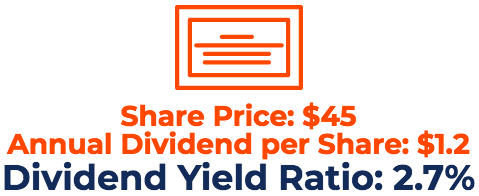

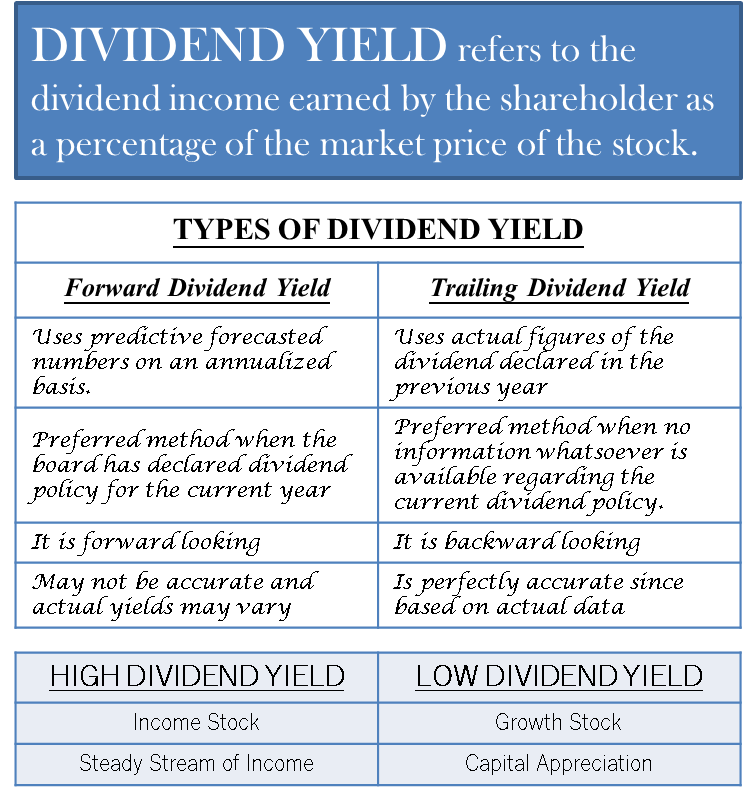

Dividend yield dividend income stock investment. The percentage of return you make from each investment vehicle is called a yield. Securities for which yield is calculated using a 365 day year treasury notes and bonds nc capital management trust cds sometimes others occasionally iii. The yield to call yield to maturity and the current yield.

Tip in order to calculate the average yield on investments you must take the investment s net income for the year and divide. Investment income can come from a number of sources such as dividends capital gains interest payments and any other return made from an investment. The dividend yield in the financial pages is always calculated as if you bought the stock on that given day. By placing income in the numerator and cost or market value in the.

A yield is calculated by dividing income by the amount of the investment. When you see a stock listed in the financial pages the dividend yield is provided along with the stock s price and annual dividend. For a bond there are three types of yields. To re state the yield of a security quoted on a 360 day basis to a yield on a 365 day basis multiply the 360 day yield by the ratio of 365 360.

/dividendyield-5c67fc5946e0fb00011a0c31.jpg)