Ohio Income Tax Quarterly Payments

Cat q quarterly.

Ohio income tax quarterly payments. Several options are available for paying your ohio and or school district income tax. 2020 payment due dates. Below are the helpful webpages that can assist you with any additional questions you may have. For general payment questions call us toll free at 1 800 282 1780 1 800 750 0750 for persons who use text telephones ttys or adaptive telephone equipment.

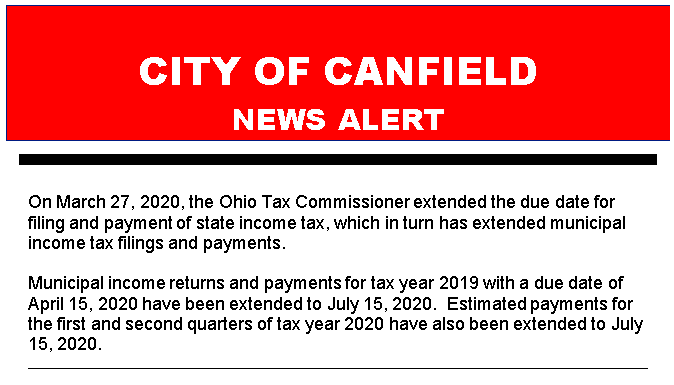

Ohio estimated tax payments. 1st quarter july 15 2020 2nd quarter july 15 2020 3rd quarter sept. Use the ohio it 1040es vouchers to make estimated ohio income tax payments. Also you have the ability to view payments made within the past 61 months.

If you earn income not subject to withholding while living in ohio or from ohio resources you may need to make estimated tax payments to the ohio department of taxation. Cat 12 annual. Ohio extends income tax filing and estimated payment deadline. The ohio department of taxation has an estimated tax payment system similar to the irs with payments due around april 15 june 15 september 15.

Due may 10 1st quarter due august 10 2nd quarter due november 10 3rd quarter due february 10 4th quarter. Ohio epayment allows you to make your ohio individual income and school district income payments electronically. 15 2020 4th quarter jan.