Income Withholding Order Iowa

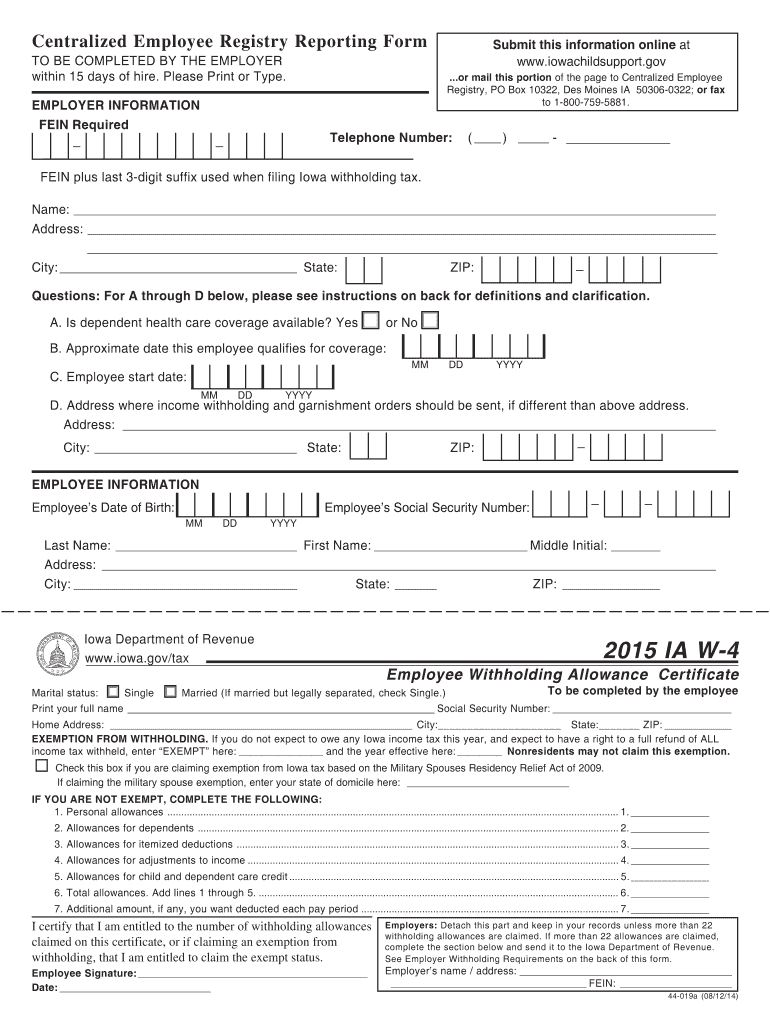

The iwo is the omb approved form used for income withholding in tribal intrastate and interstate cases as well as all child support orders that were initially issued in the state on or after january 1 1994 and all child support orders that were initially issued or modified in the state before january 1 1994 if arrearages occur.

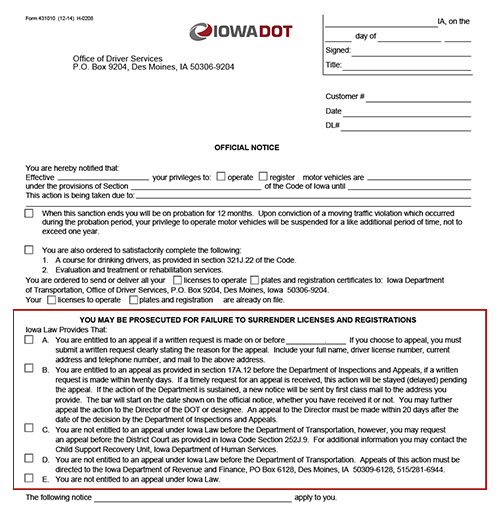

Income withholding order iowa. To terminate child support in iowa the noncustodial parent must submit a motion to terminate the income withholding order the noncustodial parent will receive a hearing date from the iowa court and must personally serve the motion on the custodial parent through a process server or sheriff. Since 1988 all court orders for child support include an automatic income withholding order. When you receive an income withholding order notice iwo from another state see article five of chapter 252k for specific instructions. To learn about income withholding orders and other ways child support can be collected see child support enforcement obligations.

In a support order issued or modified on or after november 1 1990 for which services are being provided by the child support recovery unit and in any support orders issued or modified after january 1 1994 for which services are not provided by the child support recovery unit the income of a support obligor is subject to withholding on the effective date of the order regardless of. How do i start a motion to terminate income withholding for child support in iowa. If support payments are ordered under this chapter chapter 232 234 252a 252c 252e 252f 252h 598 600b or any other applicable chapter or under a comparable statute of another state or foreign country and if income withholding relative to such support payments is allowed under this chapter the child support recovery unit may enter an ex parte order notifying the person whose income. The unit enters an income withholding order iwo to meet these legal requirements.

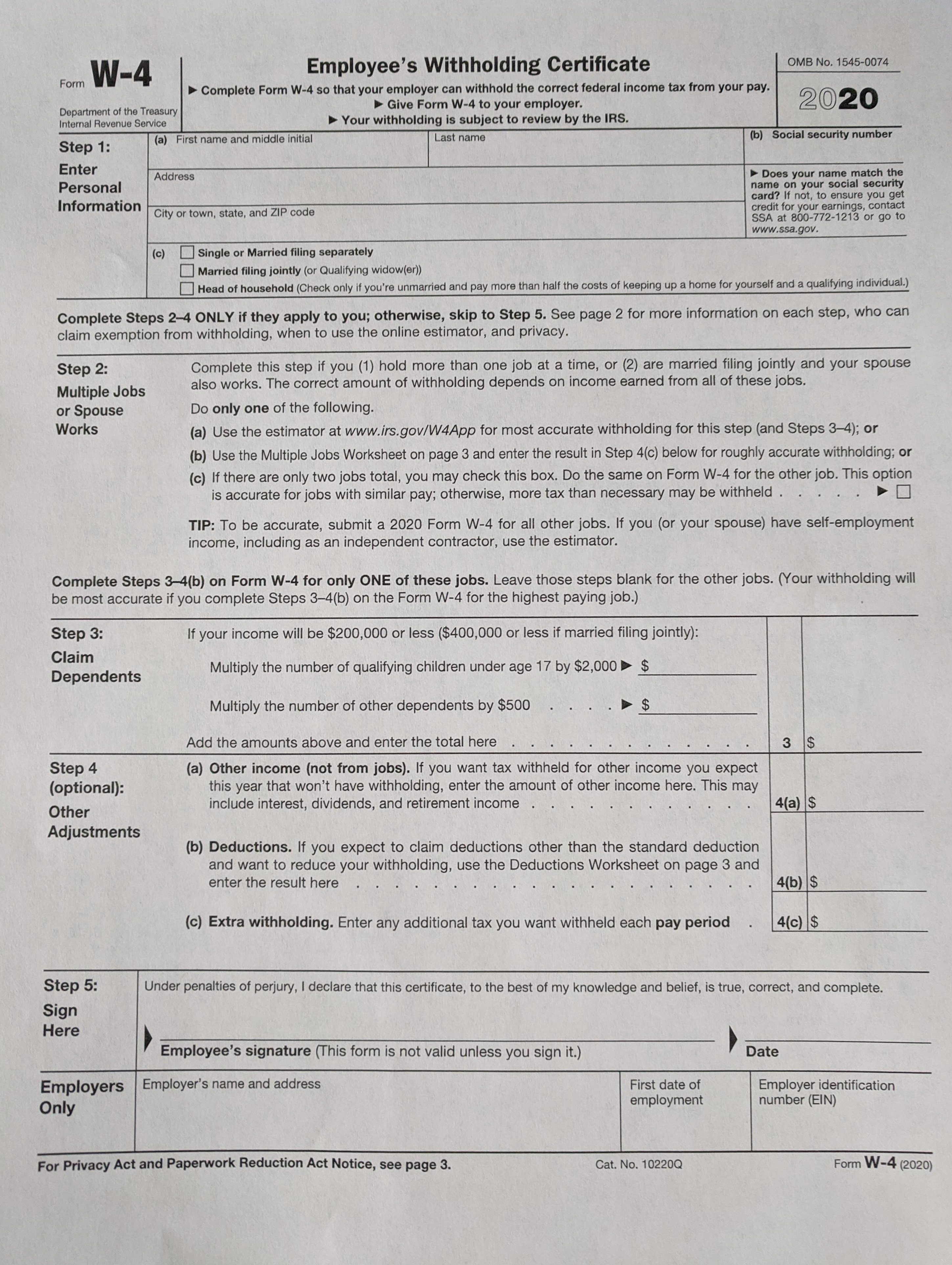

Pursuant to order 2020 03 corporations or financial institutions who filed a 2018 iowa income tax return that covered a period of 12 months and showed an iowa tax liability will not be subject to penalties for underpayment of estimated tax for tax year 2020 quarterly estimated payments with a due date on or after april 30 2020 and before. Entered an income withholding order or changed an income withholding amount. The payor of income shall comply with iowa code chapter 252k when receiving a notice of income withholding from another state. Sent an income withholding for support notice form 470 3272 to your employer or income provider.

Income withholding for support iwo order notice. You will need to file a petition for termination of child support order in the district court where the original child support order was entered. Iowa code sections 252e 6a and 252d 31 direct the clerk to schedule a hearing on the motion for a.