Prepare An Income Statement For Lonyear Inc For The Year Ended December 31 2017

Prepare a statement of owner s equity for the year ended december 31.

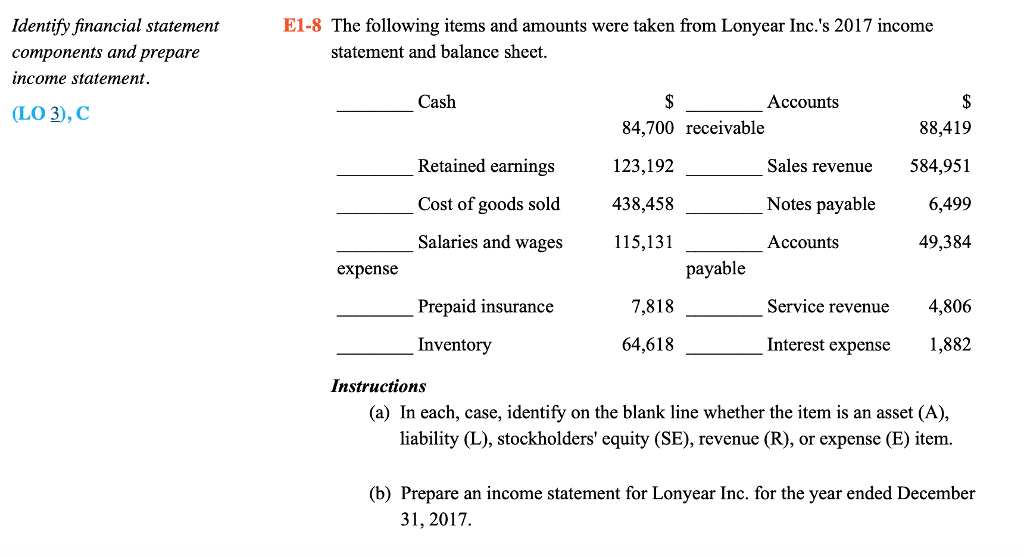

Prepare an income statement for lonyear inc for the year ended december 31 2017. For example an annual income statement issued by paul s guitar shop inc. Instructions a in each case identify on the blank line whether the item is an asset a liability l stockholders equity se revenue r or expense e item. No additional investments were made during the year. Would have the following heading.

Prepare a balance sheet as of december 31. Xyz company income statement for the year ending dec. Paul s guitar shop inc. Adjusted trial balance if you want you may take a look at how an income statement looks like here before we proceed.

View homework help e18b xlsx from acc 240 at grand canyon university. When you re ready let s begin. Your answer is correct. Prepare a post closing trial.

Income statement for the year ended december 31 2017 revenues sales revenue 584 951 service revenue 4 806 total revenues 589 757 expenses cost of goods sold 438 458 salaries and wages expense 115 131 interest expense 1 882 total expenses 555 471. After analyzing the data prepare a retained earnings statement for the year ending december 31 2017. After analyzing the data prepare an income statement for the year ending december 31 2017. For the ended december 31 2017.

This statement should serve to give you the basic layout and an idea of how a profit loss statement or income statement works. E1 8b prepare an income statement for lonyear inc. B prepare an income state for lonyear inc. In this tutorial we will prepare an income statement of a sole proprietorship service type business using information from previous lessons.

We will be using the adjusted trial balance from this lesson. Income statement for the year ended december 31 2014 sales revenue 50 500 cost of goods sold 27 000 gross profit 23 500 operating expenses. All income statements have a heading that display s the company name title of the statement and the time period of the report. Prepare an income statement and a retained earnings statement for the year ended december 31 2014 and a classified balance sheet as of december 31 2014.

For the year ended december 31 2015. List items that increase retained earnings first for the year ended december 31 2017. Based upon the end of period spreadsheet journalize the closing entries.