The Income Statement Helps Users Of Financial Statements Predict Future Cash Flows By

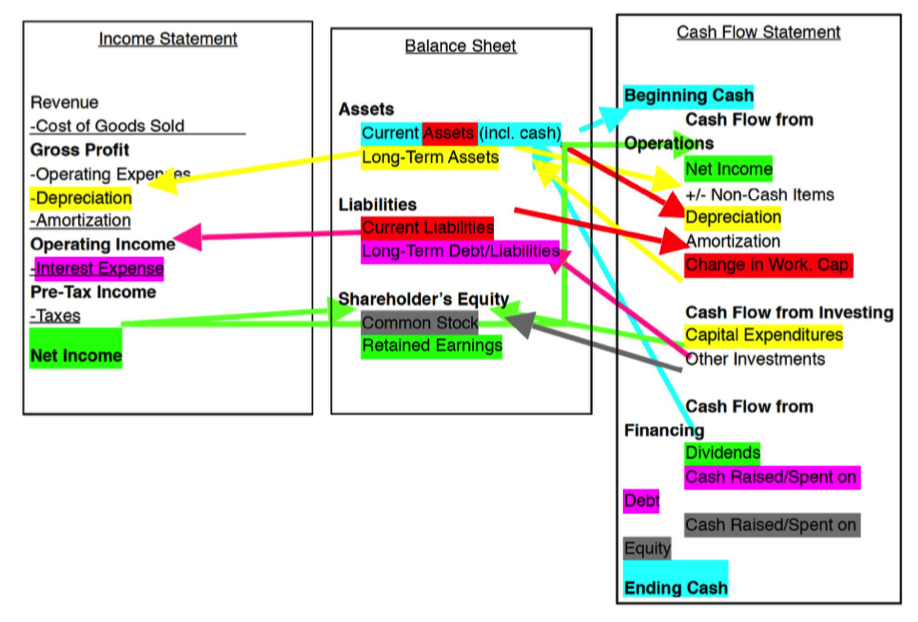

By summarizing key changes in financial position during a period cash flow statement serves to highlight priorities of management.

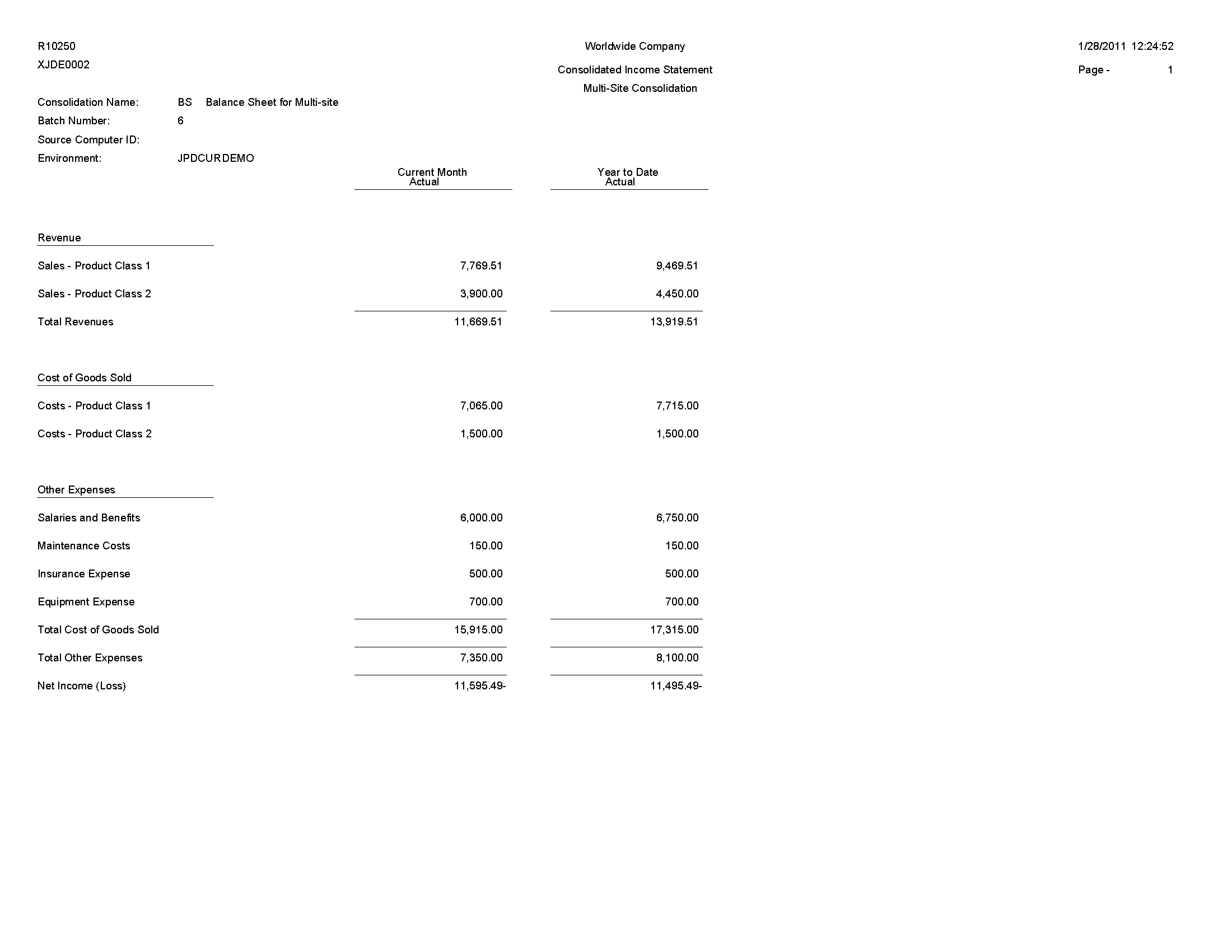

The income statement helps users of financial statements predict future cash flows by. Evaluate the past performance of the company. In npv analysis on which to base their economic decisions. Evaluate a firm s economic resources and obligations. The income statement helps users of financial statements predict future cash flows in a number of ways.

Evaluate the past performance of the company 2. Determine whether insiders have sold or purchased the firm s stock. Not all of the answers will be discovered in the annual report or form 10 k filing. A projected cash flow statement can be prepared in order to know the future cash position of a concern so as to enable a firm to plan and coordinate its financial operations properly.

For example investors and creditors use the income statement information to. Predict future cash flows. A cash flow statement tells you how much cash is entering and leaving your business. The statement of cash flow helps users do the following.

The statement of cash flows or the cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company. Determine a firm s components of income from operations. A loss on disposal of long term assets would be removed from the net income on the statement of cash flows by adding it back in the operating section. For example investors and creditors use the income statement information to.

Projecting future earnings is especially complex due to several other factors. Therefore a statement of cash flows should be presented alongside the statement of financial position income statement and statement of changes in equity. According to kieso weygandt and warfield 2011 a cash flow statement is a useful reporting tool that is used by investors creditors managers and tax authority to measure different. Provide a basis for predicting future performance.

First not all of the relevant financial information on a company can be found by analyzing the income statement balance sheet or cash flow statement. Since a cash flow statement is based on the cash basis of accounting it is very useful in the evaluation of cash position of a firm. First let s take a closer look at what cash flow statements do for your business and why they. Evaluate a firm s liquidity solvency and financial flexibility.

Help assess the risk or uncertainty of achieving future. A statement of cash flows is intended to help users of financial statements. Usefulness of the income statement the income statement helps users of financial statements predict future cash flows in a number of ways. Along with balance sheets and income statements it s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating.

It also enables analysts to use the information about historic cash flows to form projections of future cash flows of an entity e g.