Income Tax Group Definition

A person includes i an individual.

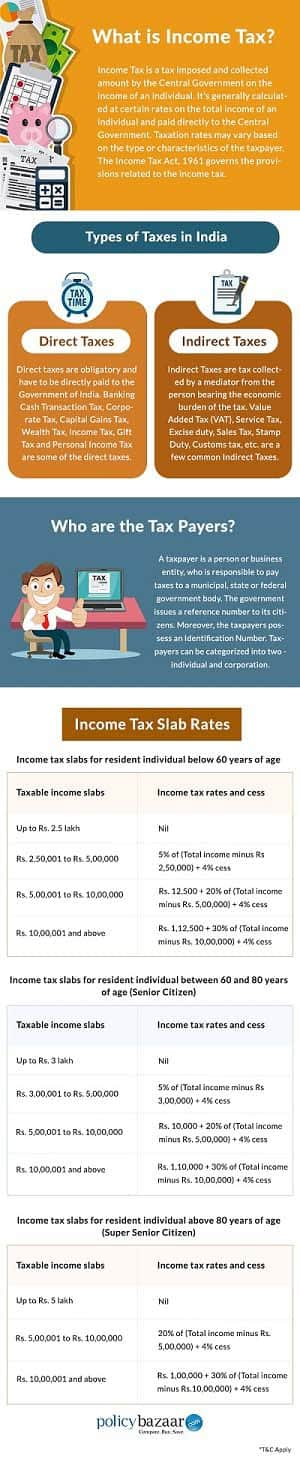

Income tax group definition. The act contains a global definition of group of companies in section 1 1 and a narrower definition of the same term in section 41 1. However a narrower definition of the term group of companies is contained in section 41 of the act which applies to certain corporate tax roll over rules and other provisions contained in the act. The definition of assessee leads us to the definition of person as the former is closely connected with the latter. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction.

The narrower definition generally. An affiliated group is two or more corporations that are related through common ownership but are treated as one for federal income tax purposes. Income tax is a certain percentage of your income that you have to pay regularly to the. Meaning pronunciation translations and examples.

What is an affiliated group. Intra group transfers of capital assets between uk companies including uk pes and non uk companies in respect of uk immovable property are normally tax free though the definition of group for these purposes is slightly different than the definition of group relief for losses. Income tax on income and capital gains until the asset is disposed of to a third party or until a degrouping occurs. The definition is inclusive i e.

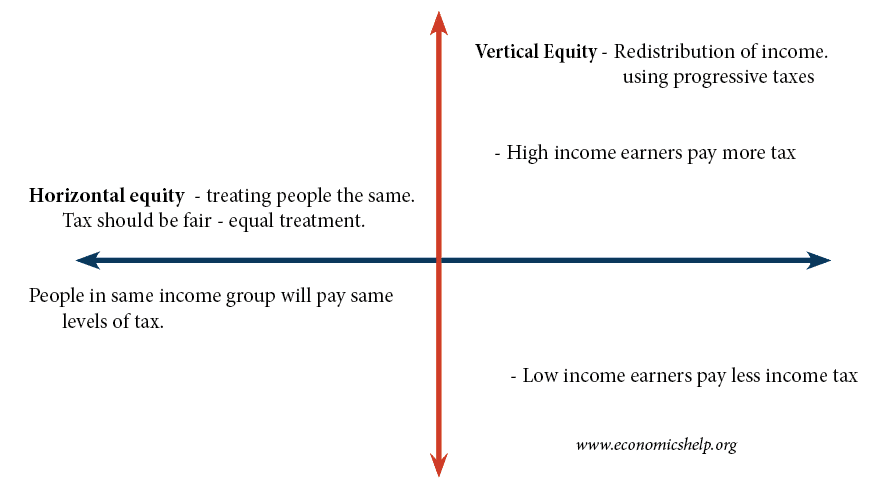

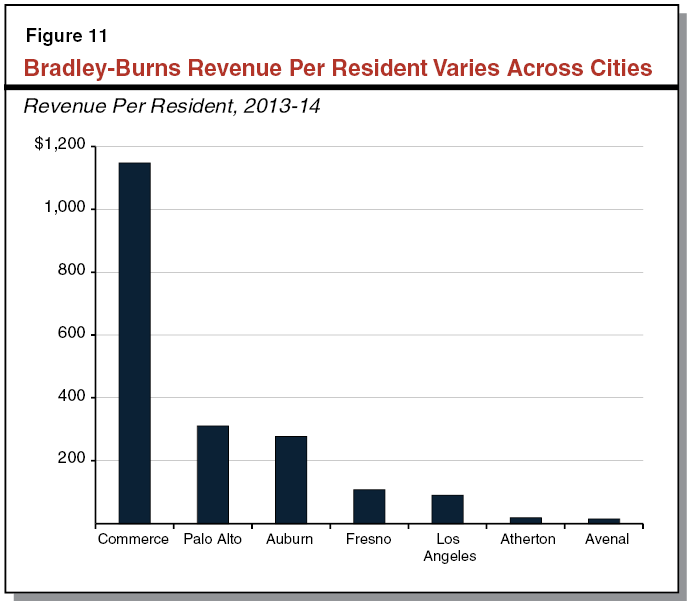

The following figure shows average federal tax rates total federal taxes divided by total income before transfers and taxes by income group in 2015. Data from the congressional budget office cbo illustrates the progressivity of the federal tax code and the impact of transfers from high income to low income americans. A tax consolidation regime applies for income tax and cgt purposes for companies partnerships and trusts ultimately 100 owned by a single head company or certain entities taxed like a company resident in australia. Corporate group taxation.

By law taxpayers must file an income tax return annually to. The term person is important from another point of view also viz the charge of income tax is on every person. Tax consolidation or combined reporting is a regime adopted in the tax or revenue legislation of a number of countries which treats a group of wholly owned or majority owned companies and other entities such as trusts and partnerships as a single entity for tax purposes this generally means that the head entity of the group is responsible for all or most of the group s tax obligations.