The Income Statement Shows The Balance Of Permanent Accounts As Of A Certain Date

Retained earnings however isn t closed at the end of a period because it is a permanent account.

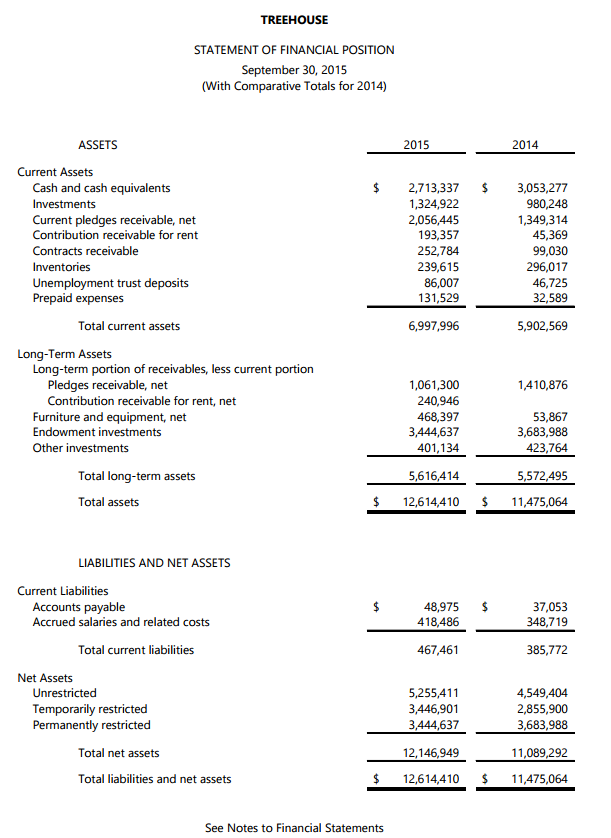

The income statement shows the balance of permanent accounts as of a certain date. The financial statement that reflects a company s profitability is the income statement. For example if the balance sheet is presented as of may 1 2018 you would see the bank account balances from that date in the balance sheet s line item called cash in the current assets section. A balance sheet lists assets and liabilities of the organization as of a specific moment in time i e. Nominal account income statement revenue expense current assets o use in the business within one year of the balance sheet date.

D owner capital is a permanent account but owner withdrawals is a temporary account. The balance of all permanent accounts as of a specific date are reported on the balance sheet. What are income statement accounts. C temporary accounts have a balance for only one period only.

A permanent accounts are reported on the balance sheet. The balance sheet reflects a company s solvency and financial position. As of a certain date. F most temporary accounts are reported on the income statement.

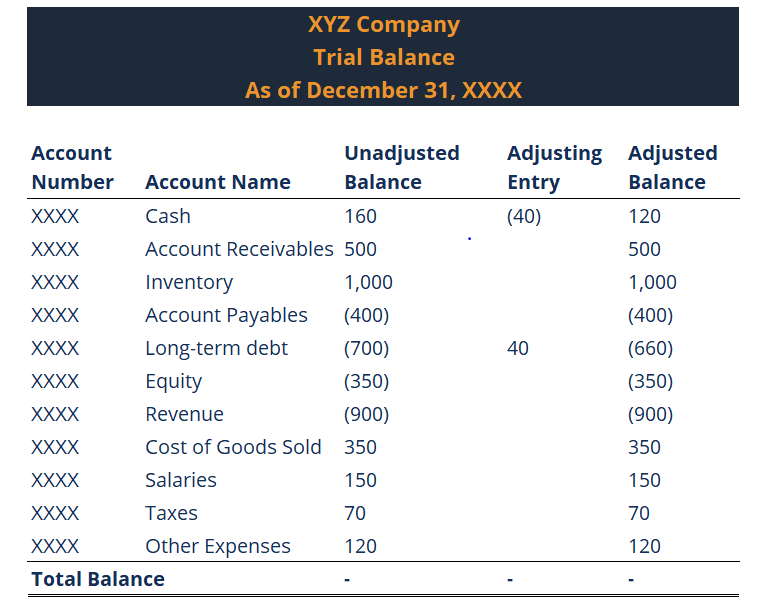

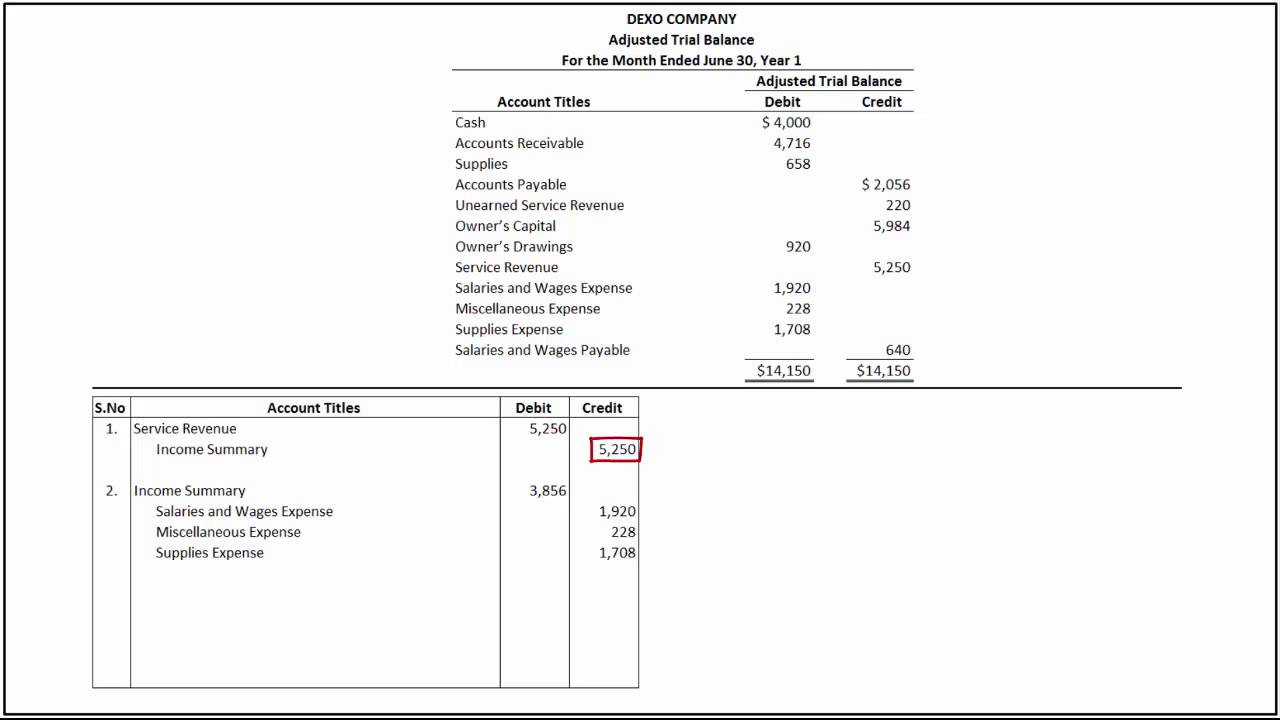

B permanent accounts will appear on a post closing trial balance. Cash accounts receivable. The income statement totals the debits and credits to determine net income before taxes the income statement can be run at any time during the fiscal year to show a company s profitability. At the end of the accounting cycle the income summary account is closed to the retained earning account.

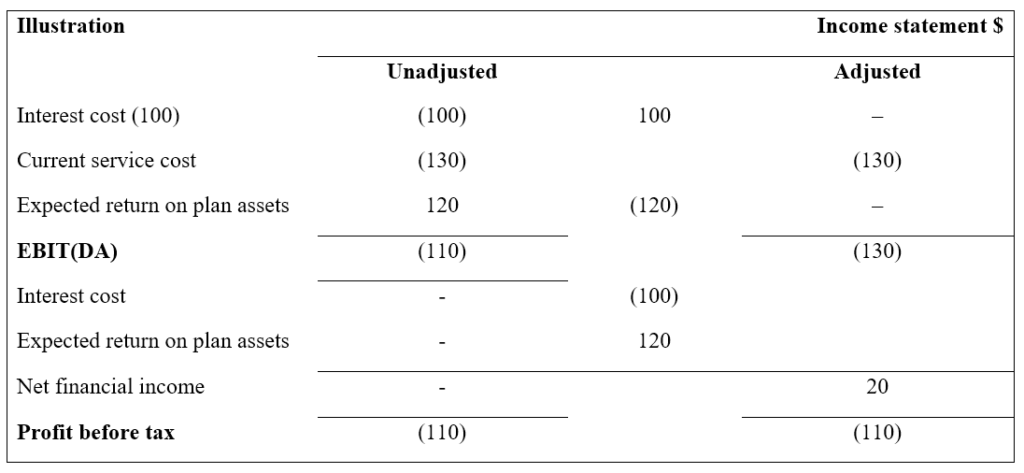

The income statement format above is a basic one what is known as a single step income statement meaning just one category of income and one category of expenses and prepared specifically for a service business. The statement of retained earnings also called statement of owners equity shows the change in retained earnings between the beginning and end of a period e g. Income statement accounts are those accounts in the general ledger that are used in a firm s profit and loss statement. In financial accounting the balance sheet and income statement are the two most important types of financial statements others being cash flow statement and the statement of retained earnings.

The statement of retained earnings consists of only the balance of the retained earnings account at the beginning of the period plus net income before taxes true t f. An income statement also called a profit and loss account or p l. Examples of service businesses are medical accounting or legal practices or a business that provides services such as plumbing cleaning consulting design etc. The income statement or profit and loss report is the easiest to understand it lists only the income and expense accounts and their balances.

A month or a year. These accounts are usually positioned in the general ledger after the accounts used to compile the balance sheet a larger organization may have hundreds or even thousands of income statement accounts in order to track the revenues and. Income statement and balance sheet overview.