Us Income Tax Rate Kansas

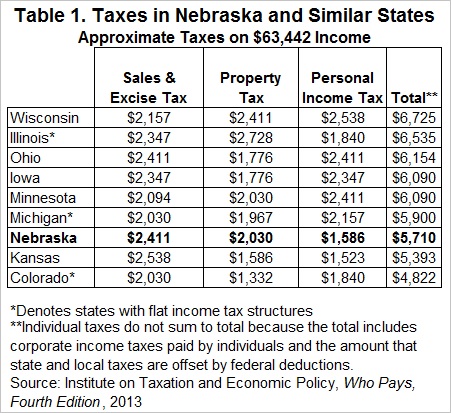

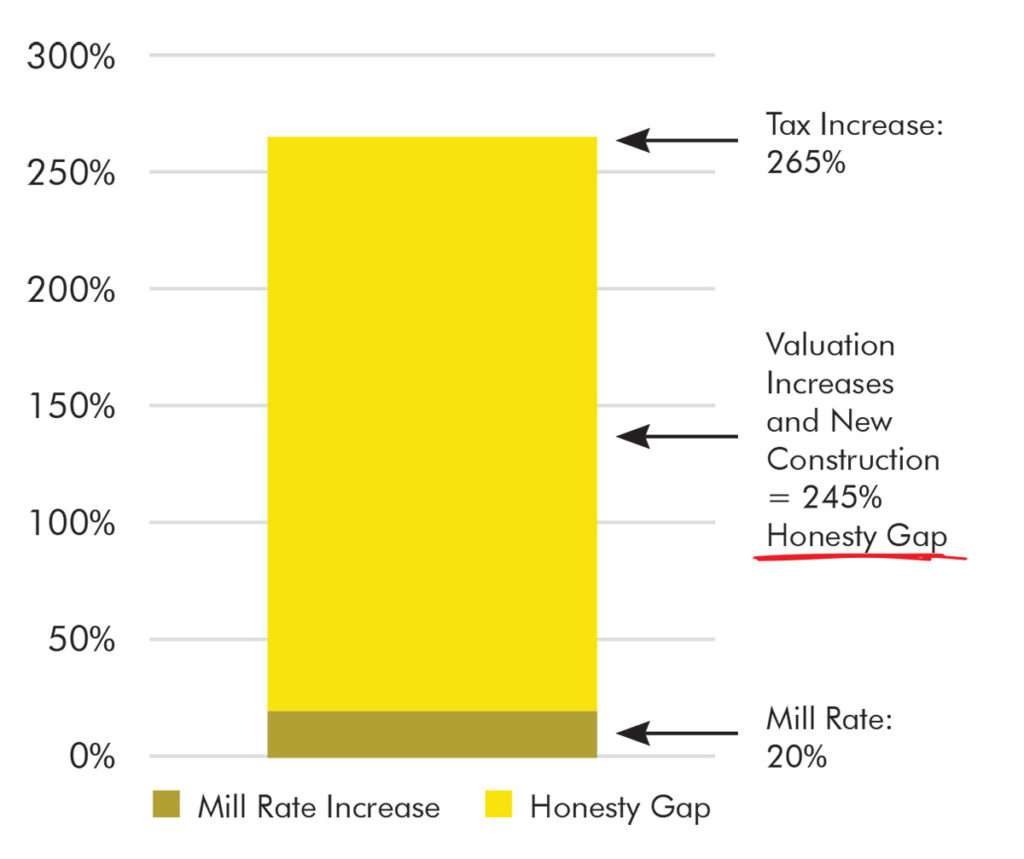

Below we have highlighted a number of tax rates ranks and measures detailing kansas s income tax business tax sales tax and property tax systems.

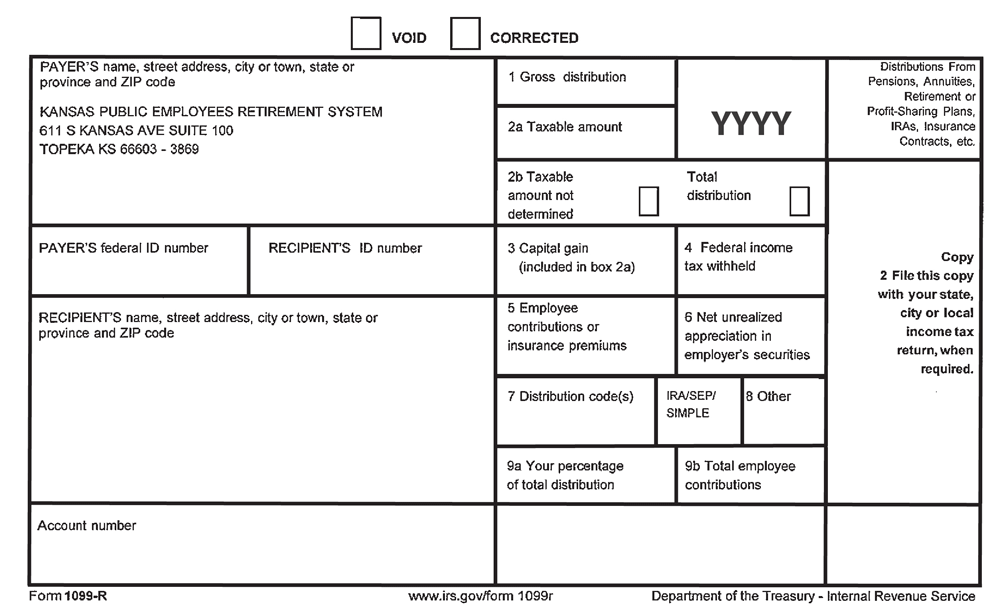

Us income tax rate kansas. Like the federal income tax kansas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. Retirement income from a 401 k pension or ira is fully taxable at the regular kansas income tax rates of 3 1 to 5 7. Each marginal rate only applies to earnings within the applicable marginal tax bracket. The highest kansas tax rate increased from 5 2 to 5 7 last year up from 4 6 for the 2016 income tax year.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. One exception is public pension income whether from federal state or local government pension. In kansas different tax brackets are. The kansas tax calculator is designed to provide a simple illlustration of the state income tax due in kansas to view a comprehensive tax illustration which includes federal tax medicare state tax standard itemised deductions and more please use the main 2020 21 tax reform calculator.

79 32 110 taxable income over 30 000 but not over 60 000. 2020 kansas tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Tax year 2018 and all tax years thereafter taxable income not over 30 000. Our calculator has recently been updated in order to include both the latest federal tax rates along with the latest state tax rates.

The first step towards understanding kansas s tax code is knowing the basics. Each state s tax code is a multifaceted system with many moving parts and kansas is no exception. Kansas state income tax rate table for the 2019 2020 filing season has three income tax brackets with ks tax rates of 3 1 5 25 and 5 7 for single married filing jointly married filing separately and head of household statuses. Individual income tax tax rates resident married joint.

You are able to use our kansas state tax calculator in to calculate your total tax costs in the tax year 2020 21. Kansas has three marginal tax brackets ranging from 3 1 the lowest kansas tax bracket to 5 7 the highest kansas tax bracket. 930 plus 5 25 of excess over 30 000 k s a. Kansas income tax brackets were last changed two years ago for tax year 2018 and the tax rates were previously changed in 2016.

Kansas collects a state income tax at a maximum marginal tax rate of spread across tax brackets.