What Is The Max Income While On Social Security

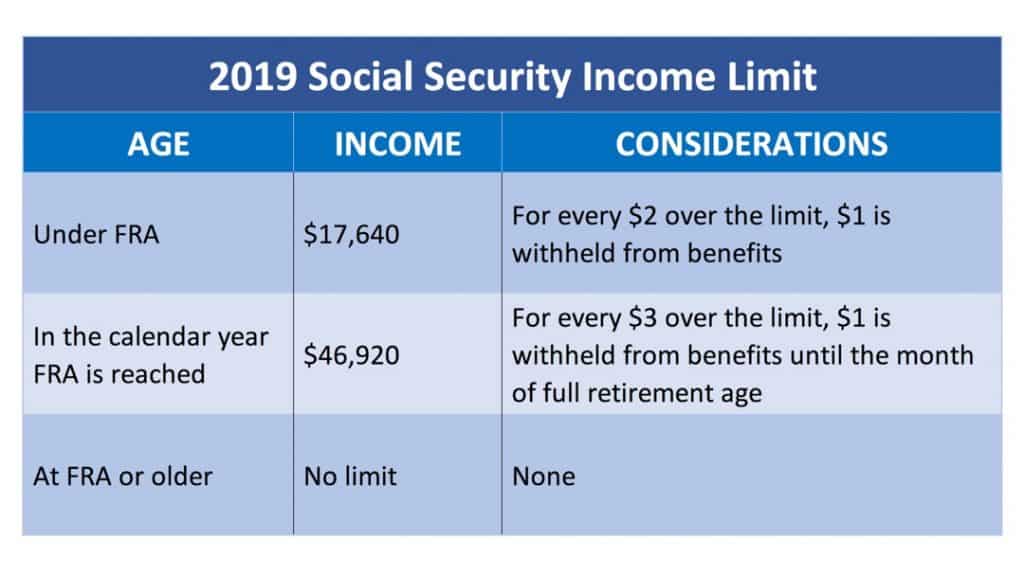

For every 3 you earn over the income limit social security will withhold 1 in benefits.

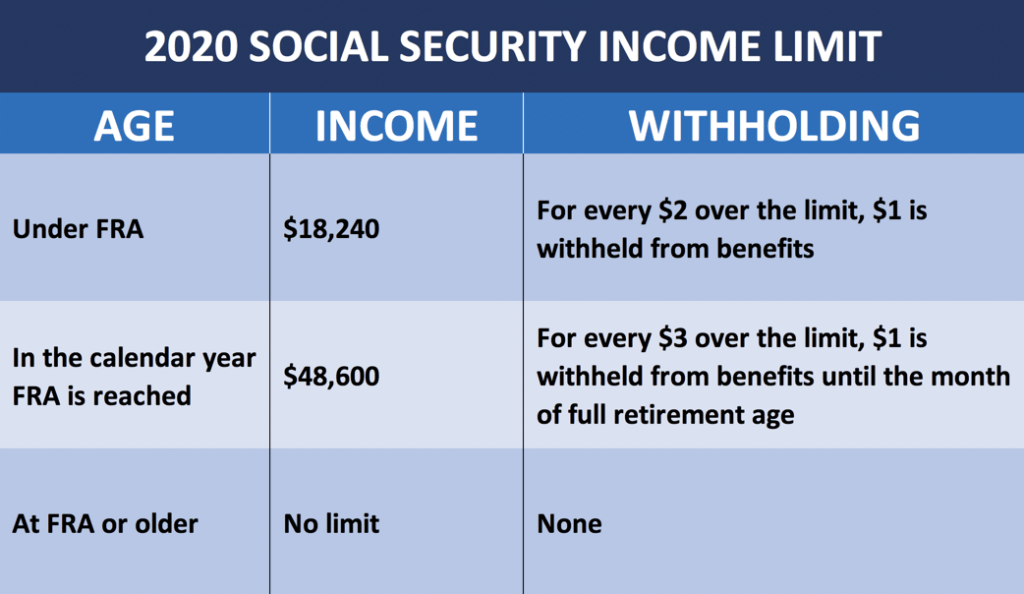

What is the max income while on social security. The 17 640 amount is the number for 2019 but the dollar amount of on the income limit will increase on an annual basis going forward. 28 240 total wages the social security income limit of 18 240 10 000 income in excess of limit because this is a full calendar year during which rosie is receiving benefits but is not yet full retirement age the benefits reduction amount is 1 reduction for every 2 in excess wages. If you are collecting social security benefits and earn more than the annual earnings limit in a year in which you will not be reaching your full retirement age social security will take back 1 of social security for every 2 you earn over the limit. Supplemental security income ssi is a federal program managed by the social security administration that pays monthly cash benefits to disabled blind or elderly people and even some children with little income and few assets.

Furthermore if you ll be reaching fra in 2021 that limit increases to 50 520 up from. Social security s annual earnings limit the maximum people who claim social security early can make from work without triggering a benefit reduction no longer applies as of the month you attain full retirement age which is currently 66 and is gradually rising to 67 over the next several years. En español no. Of that number 1 1 million recipients were children.

The maximum monthly social security benefit that an individual can receive per month in 2021 is 3 895 for. The cap only applies if you are under full retirement age which is 66 and will gradually increase to 67 over the next several years the special rule generally applies in the calendar. Once your income exceeds that point you ll have 1 in social security withheld for every 2 you earn. If you re collecting social security but haven t yet reached fra and won t be.

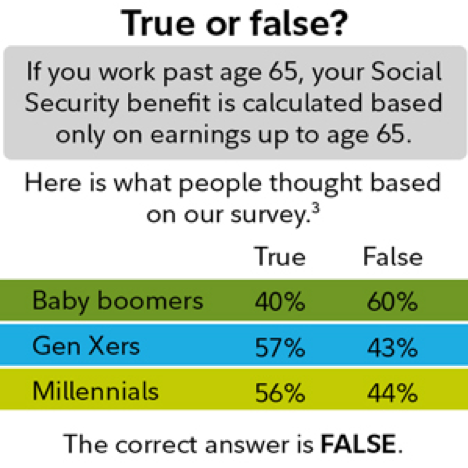

Qualifying for social security at age 62 requires 10 years of work or 40 work credits. At your full retirement age there is no income limit. 2020 s earnings test limits. The amount of money you can earn before losing benefits will depend on how old you are.

In other words if your income exceeds the cap on yearly earnings which in 2020 is 18 240 for people who claim benefits before full retirement age social. Even if you file taxes jointly social security does not count both spouses incomes against one spouse s earnings limit it s only interested in how much you make from work while receiving benefits.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-42e418fa494247adb22cf86e98cd3537.jpg)