Yearly Income Calculator Canada

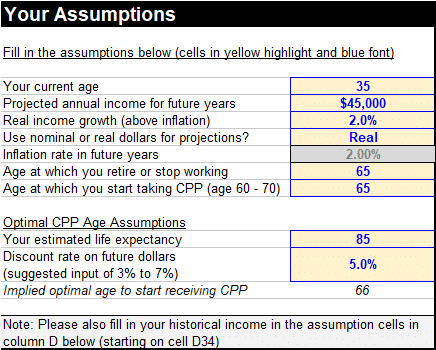

Tax assessment year the tax assessment year is defaulted to 2020 you can change the tax year as required to calculate your salary after tax for a specific year.

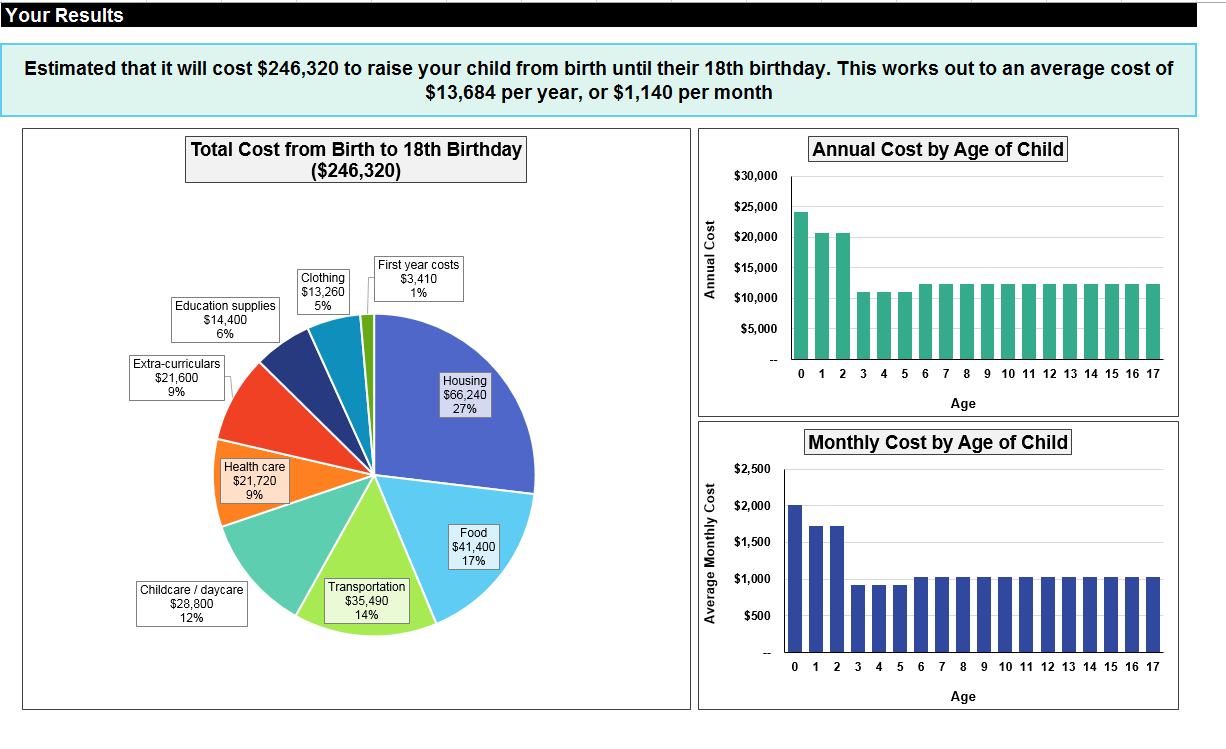

Yearly income calculator canada. Plus since you can adjust the weekly hours and number of work weeks per year the calculator will work for part time and seasonal work as well. Your age you age is used to calculate specific age related tax credits and allowances in canada. Hours per week x 52 weeks per year holiday statutory weeks x hourly wages annual salary. Yearly income hourly wage 40 hrs 52 weeks hourly wage yearly salary 40 hrs 52 weeks daily salary hourly wage 8 hrs weekly salary daily income 5 days biweekly income yearly salary 26 biweeks.

35 hours per week 25 hour 3 weeks and 5 vacations holidays for a total of 4 holiday weeks. The average monthly net salary in canada is around 2 997 cad with a minimum income of 1 012 cad per month. Your average tax rate is 23 00 and your marginal tax rate is 35 26 this marginal tax rate means that your immediate additional income will be taxed at this rate. This places canada on the 12th place in the international labour organisation statistics for 2012 after france but before germany.

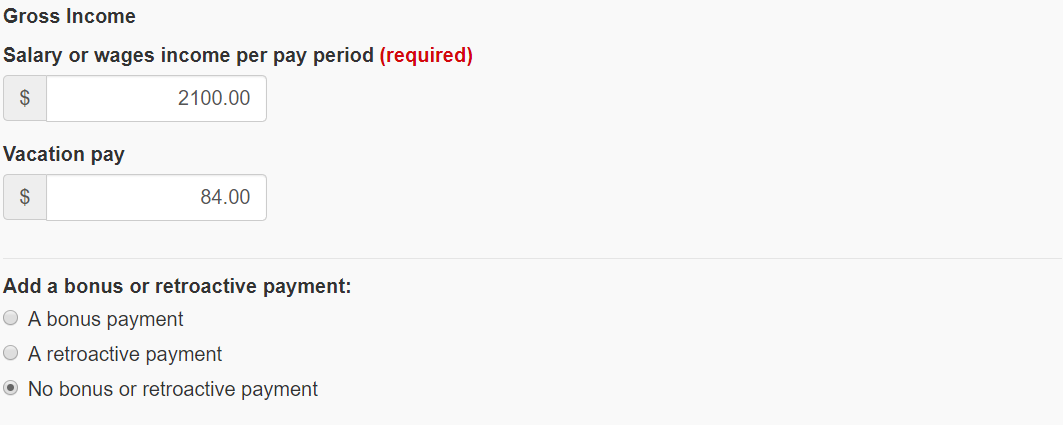

These calculations are approximate and include the following non refundable tax credits. Formula for calculating the annual salary. The annual salary calculator will translate your hourly pay into its yearly monthly biweekly weekly and daily equivalents including any weekly time and a half overtime wages. The basic personal tax amount cpp qpp qpip and ei premiums and the canada employment amount.

The formula of calculating yearly income and hourly salary is as follow. Advanced features of the canada income tax calculator. Rates are up to date as of april 28 2020. Number of children and number of children who qualify for dependents allowance.