In An Income Statement Subtracting The Cost Of Goods Sold From The Net Sales Provides The

The two most important numbers on this statement are the total manufacturing cost and the cost of goods manufactured.

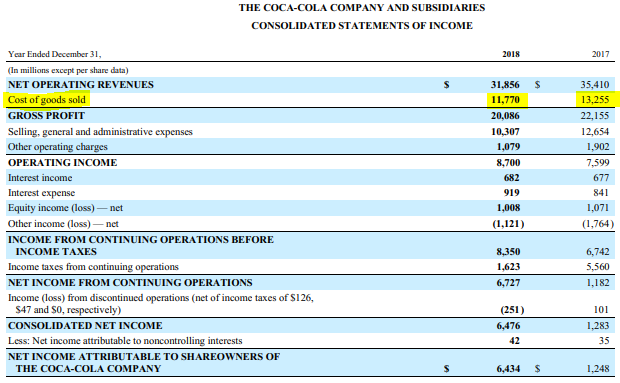

In an income statement subtracting the cost of goods sold from the net sales provides the. Deduct operating expenses from gross profit to determine income from operations. Unlike the balance sheet the income statement calculates net income or loss over a range of time. The terms can be handwritten on the blank side of. The statement of cost of goods manufactured supports the cost of goods sold figure on the income statement.

Gross income is referred to as gross profit when preparing financial statements for companies and it equals the revenues from the sale of goods or services less the cost of goods sold cost of goods sold cogs cost of goods sold cogs measures the direct cost incurred in the production of any goods or services. Steps to calculate gross profit. It is the income earned from operating. A profit and loss statement p l or income statement income statement the income statement is one of a company s core financial statements that shows their profit and loss over a period of time.

On most income statements cost of goods sold appears beneath sales revenue and before gross profits. Find out the net sales or net revenue that takes a total of gross sales and reduce the same by sales return. Add or subtract the results of activities not related to operations to determine net income. Print this pdf file and cut out the flashcards below.

Note that companies report income tax expense in a separate section of the income statement before net income. The sections of a multi step income statement include. It includes material cost. Apart from material costs cogs also consists of labor costs and direct factory overhead.

These are the expenses that are directly related to operations of the company like selling general and administrative expenses. This is the result of subtracting the cost of goods sold from net sales. This section includes total sales the cost of goods sold and the difference between the two which is gross profit. This results when net income is divided by net sales.

Or delivering the services. O10 o12 o14 o16 instructions. Gross profit is calculated by subtracting cost of goods sold from net sales. To calculate gross profit one needs to follow the below steps.

The profit or loss is determined by taking all revenues and subtracting all expenses from both operating and non operating activities this statement. Cost of goods sold cogs is the total value of direct costs related to producing goods sold by a business. However some companies with inventory may use a multi step income statement. For example annual statements use revenues and expenses over a 12 month period.

You can determine net income by subtracting expenses including cogs from revenues. Secondly the cost of sales include all the variable cost that the company incurs while making the product. Direct factory overhead refers to the direct expenses in the manufacturing process that includes energy costs water a portion of equipment depreciation and some others.

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

/TeslaQ2-19IncomeStatementInvestopedia-1466e66b056d48e6b1340bd5cae64602.jpg)

:max_bytes(150000):strip_icc()/JCPIncomestatementMay2019Investopedia-ef93846733094d2cbd1fdfe97126b3bc.jpg)