Income Analysis Worksheet Mgic

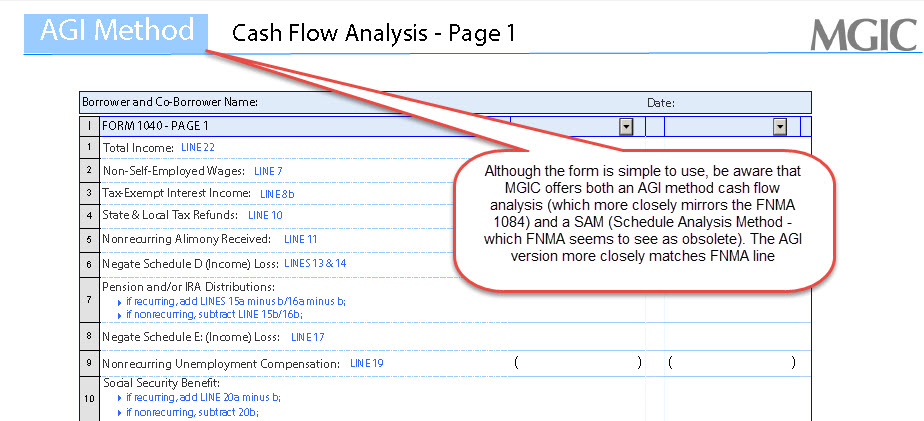

Keep your career on the right track our income analysis tools are designed to help you evaluate qualifying income quickly and easily.

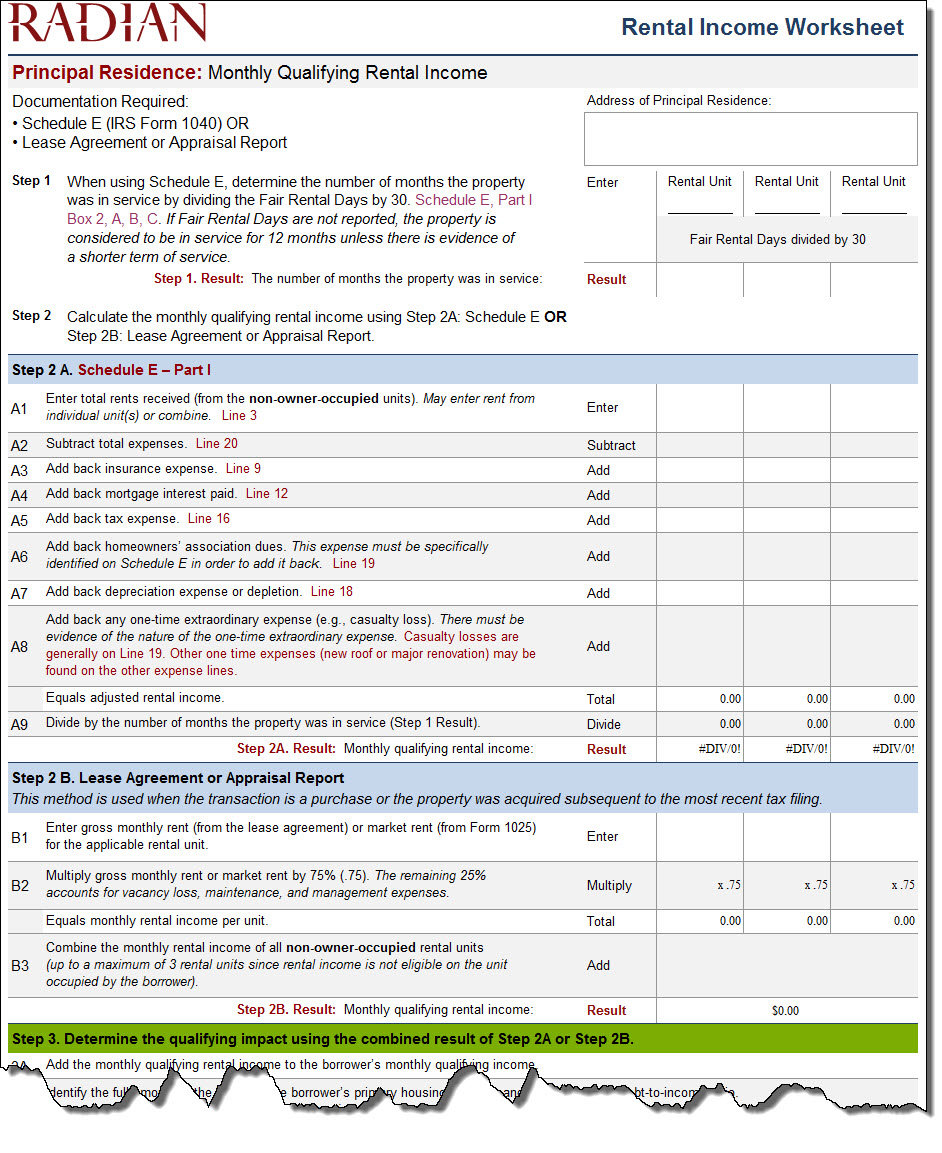

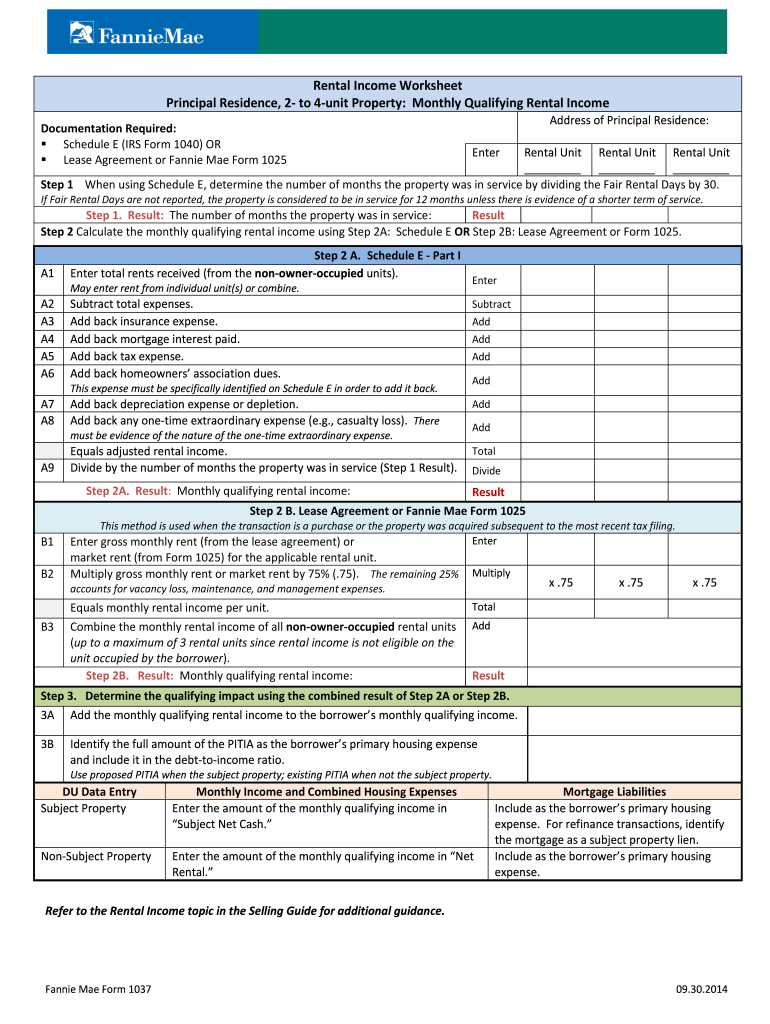

Income analysis worksheet mgic. X schedule k 1 22 23 24. Schedule f profit or loss from farming. Based on the usage of the property ies complete your rental analysis using schedule e lease agreement or alternate or form 8825 as required by your investor. Mortgage guaranty insurance corporation mgic last modified by.

Open it up with online editor and start adjusting. Net profit or loss line 34 2. Involved parties names addresses and numbers etc. Our editable auto calculating worksheets help you with.

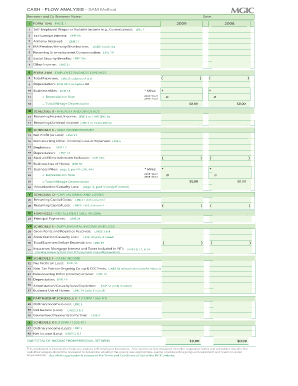

W2 income monthly income ytd 1 year ytd 2 year income from 1099 monthly check or direct deposit income calculation worksheet ytd salary paytsub past year ot breakout use lowest income average date w2 for tax year. Comparative income analysis worksheet annual of expenses compared to gross income annual of taxable income compared to gross income business name. Customize the blanks with smart fillable areas. Cash flow analysis summary.

Evaluate business income as required by your investor. Cash flow analysis worksheets tax year 2019 available now. For schedule e traditional method complete rows 14 16 20. Find the rental income worksheet mgic you require.

Line 4c 2019 line 4 2018 and 2017. This is also a named range. Variable explanation virgin wbk leftmost year drop down. Line 18dep letion vi.

Using mgic worksheets to calculate the appropriate income of self employed borrowers is an efficient compliant part of making a borrower s dream a reality. Non tax portion ongoing coop ccc. Underwriter comments base used to qualify total income. Click done following double checking everything.

Fill out the empty areas. Use our pdf worksheets to total numbers by hand or let our excel calculators do the work for you. Our cash flow analysis worksheets promote ease and accuracy in determining self employed borrowers income. Comments notes for a new line hold alt and press enter.

Line 4 applicable columns 2. Schedule e roy alties use separate worksheet for rental income analysis 1. Most popular articles with biden win. Ytd avg using net income ytd 1 year using net income w2 for year.

Include the date and place your electronic signature. Cash flow and ytd profit and loss p l new. Gross royalties received.